Bitcoin and Gold

Eric Balchunas, a senior ETF analyst, has not too long up to now compared Bitcoin to “gold as a younger particular person.” The relation between two sources can shed some light on how Wall Aspect highway sees crypto sources in the most contemporary scenario.

For these wondering buying bitcoin ETFs isn’t allowed there. If it had been my wager is they’d be going gaga for them given how essential FOMO they had been showing for gold and US shares (btc without insist outperforming both)

— Eric Balchunas (@EricBalchunas) April 8, 2024

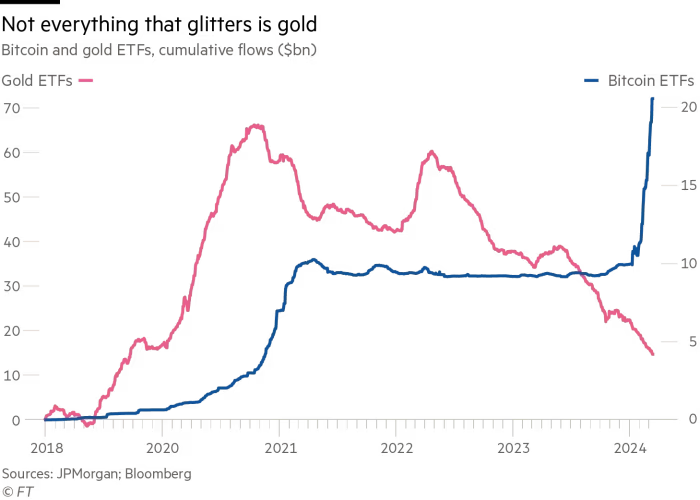

The surge in ask for Bitcoin has coincided with valuable selling of gold ETFs, which skilled outflows of $7.7 billion over the identical length, even as the worth of gold reached an all-time high of $2,200 per troy ounce.

The records indicates that outflows from gold ETFs began in April 2022 and contain continued consistently since then, without acceleration triggered by the originate of U.S. discipline Bitcoin ETFs. Roughly $46 billion has been withdrawn from gold ETFs over this era.

This divergence in ETF flows challenges the thought that Bitcoin’s upward thrust has straight away ended in gold’s decline in investor interest, as the trends in gold ETF outflows began earlier than the plenty of upward thrust of Bitcoin ETFs in the U.S.

How VC companies invest in crypto

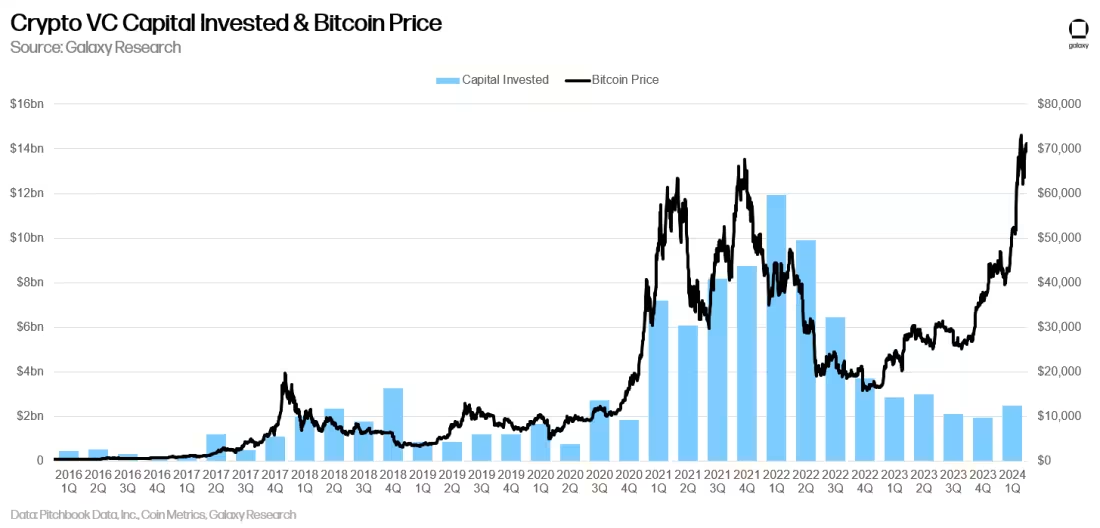

In step with Galaxy narrative, in the main quarter of 2024, project capitalists injected $2.49 billion into crypto and blockchain-targeted companies thru 603 deals, marking a 29% construct bigger quarter-over-quarter in funding amount and a 68% construct bigger in the selection of deals.

Traditionally, project capital investment in the crypto sector has closely mirrored the movements of Bitcoin’s keep. On the opposite hand, over the previous year, this correlation has broken down. Despite Bitcoin’s valuable keep upward thrust since January 2023, VC exercise has not considered a proportional surge.

Though Q1, 2024 witnessed a principal construct bigger in Bitcoin’s price, the level of capital invested collected stays below the heights considered when Bitcoin closing surpassed $60,000.

This divergence will be attributed to a combination of industry-particular catalysts (reminiscent of Bitcoin ETFs, developments in areas fancy restaking and modularity, and Bitcoin Layer 2 alternate choices) and broader macroeconomic elements fancy interest charges.

BTC as effort-off asset

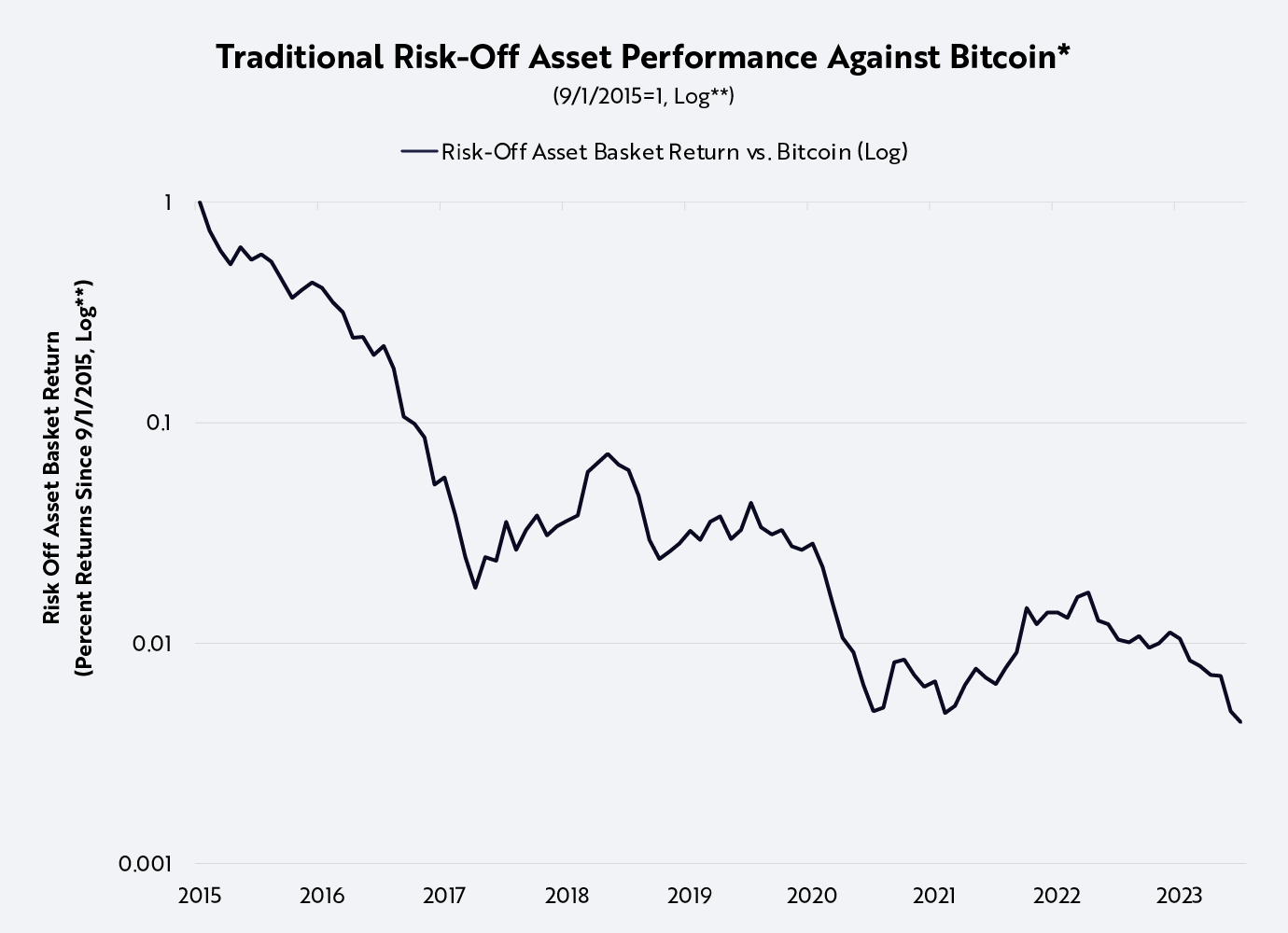

Bitcoin is recurrently considered as a high-effort investment as a result of its immediate growth and keep volatility. On the opposite hand, according to Ark-Make investments, the Bitcoin network of route embodies characteristics of effort-off sources, promoting monetary sovereignty, cutting back counterparty effort and bettering transparency.

As the main digital, self reliant, world, principles-based mostly monetary system, Bitcoin’s decentralization mitigates systemic risks connected to phenomenal monetary systems counting on centralized intermediaries. It serves as a platform for transferring and storing Bitcoin, a scarce digital monetary asset.

Not like phenomenal monetary systems, which depend on centralized institutions, Bitcoin operates as a single establishment governed by a world network of mates, promoting computerized, public and clear enforcement of principles.

Bitcoin’s volatility is satirically tied to its monetary coverage, underscoring its credibility as an self reliant monetary system. Not like as a lot as the moment central banking, Bitcoin doesn’t prioritize keep balance; as a replacement, it controls Bitcoin’s provide growth to prioritize the free circulation of capital. This dynamic explains Bitcoin’s keep volatility, which is driven by ask relative to its provide.

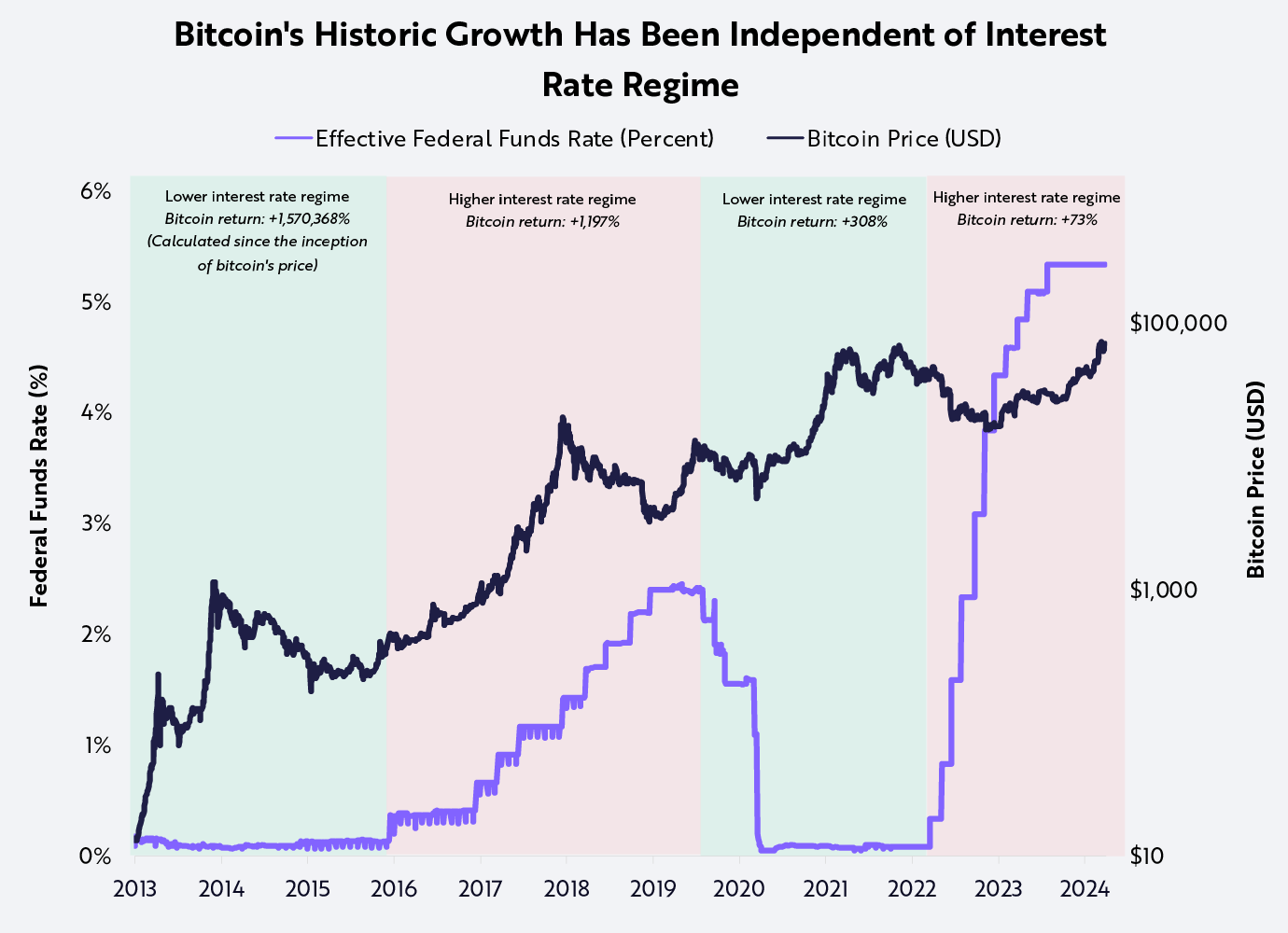

Evaluating Bitcoin’s keep with the Fed Funds Rate demonstrates its resilience all the strategy in which thru different interest rate and economic environments. Particularly, Bitcoin’s keep has appreciated greatly in both high and low interest rate regimes.

Over the previous decade, Bitcoin has confirmed resilient for the duration of effort-off classes, with its keep consistently higher than for the duration of such occasions.