This day’s market session has been dominated by bears as seen in on the present time’s session. The total global market cap stood at $2,27T, representing a 0.68% tumble over the last 24 hour. The buying and selling quantity on the other aspect, stood at $63.74B, representing a 0.63% lift over the last 24 hours.

Bitcoin Place Assessment

Bitcoin (BTC) is having a undergo session on the present time because it falls support beneath $61K. Taking a detect at an in-depth diagnosis, we see that Bitcoin tag charts reveals a bearish pattern with the price buying and selling beneath the 20-interval easy involving moderate (SMA) on the Bollinger Bands (BB). The Bollinger Bands are huge, suggesting high volatility.

Alternatively, the MACD indicator is beneath zero and exhibiting a bearish crossover, which supports the downtrend. The most up-to-date tag motion is bearish with a microscopic restoration are attempting that failed to breach the upper Bollinger Band, indicating likely additional downside. As of press time, the Bitcoin tag stood at $60,951, representing a 3.6% lower from its earlier 24-hour tag.

Ethereum Place Assessment

Ethereum (ETH) shall be having a downtrend on the present time as evidenced by its tag actions. Taking a detect at an in-depth diagnosis, we see that Ethereum’s chart displays a the same bearish pattern, with prices persistently buying and selling beneath the predominant involving averages, indicating real selling stress. The Alligator indicator reveals the jaw, teeth, and lips are aligned downwards, confirming the downtrend.

Alternatively, the Cash Hump Index (MFI) is hovering end to the 50 stage, suggesting a steadiness between buying and selling stress, however the total pattern remains downward. As of press time, the Ethereum tag stood at $2,920, representing a 4.3% lower from its earlier 24-hour tag.

Akash Netwrok Place Assessment

Akash Community (AKT) is a gainer in on the present time’s session as seen from its tag actions. Analysing Akash Community tag charts, we see that Akash Community items a extra neutral to a miniature bit bullish scenario. The price is oscillating spherical the SuperTrend indicator, which lately grew to turn into green, suggesting a capacity bullish reversal. The Bollinger Bands are narrowing, indicating reduced volatility.

Alternatively, we see the Relative Strength Index (RSI) is above the midpoint at spherical 67, which in most cases signals energy. Nonetheless, it’s nearing overbought territory, suggesting caution. As of press time, the Akash Community tag stood at $5.ninety 9, representing a 3.46% lift from its earlier 24-hour tag.

Toncoin Place Assessment

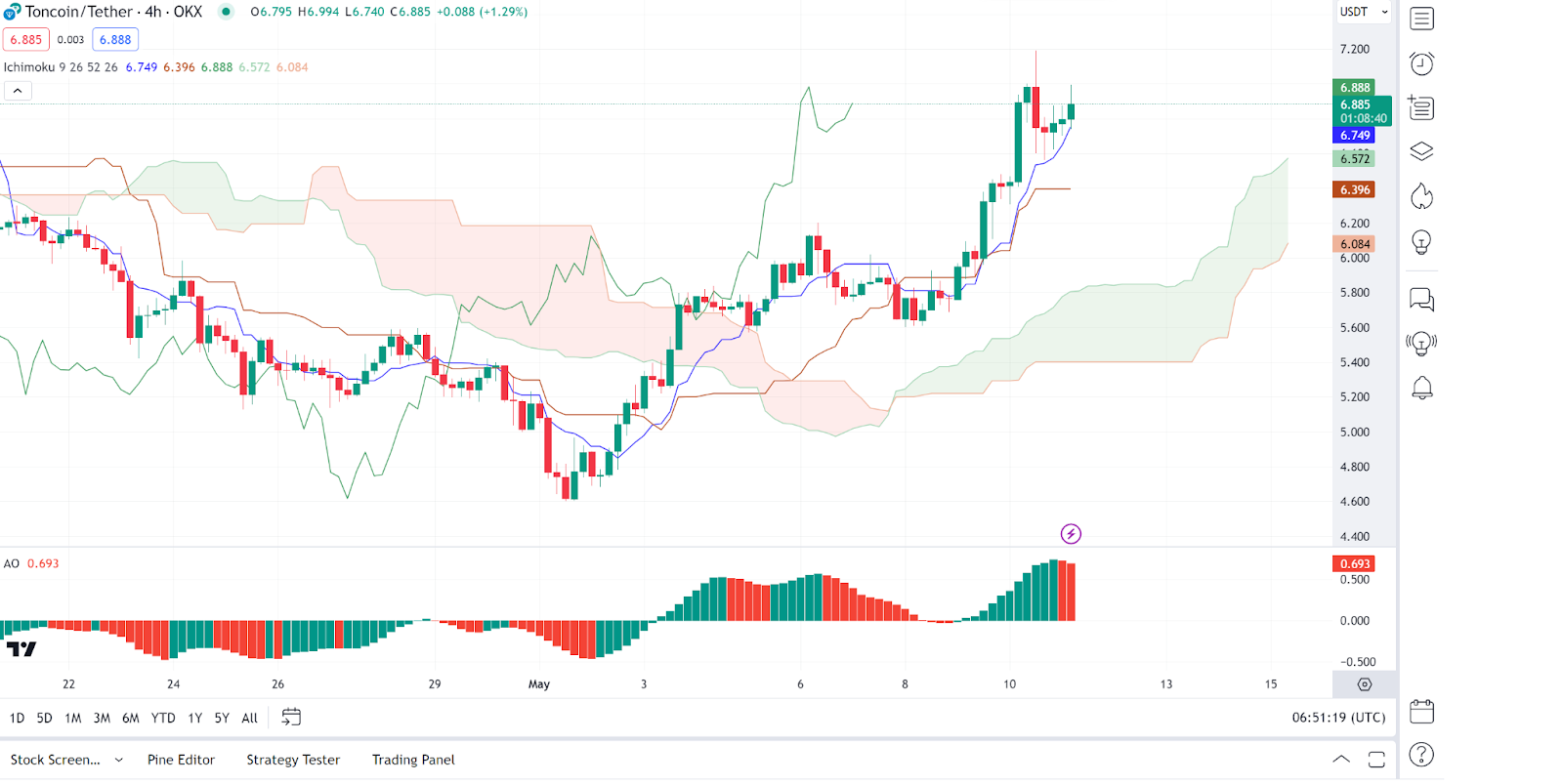

Toncoin (TON) shall be one other gainer in on the present time’s session as evidenced by its tag actions. Taking a detect at an in-depth diagnosis, we see that Toncoin reveals a bullish pattern, with the price motion involving above the Ichimoku cloud, indicating bullish momentum. The most up-to-date green candles verify traders’ dominance.

Alternatively, the Awesome Oscillator (AO) is evident and lengthening, suggesting rising bullish momentum. Nonetheless, its most up-to-date series of crimson bars might perchance perchance well perhaps also counsel fading bull stress. The price has efficiently breached previous resistance levels, potentially environment up for added upside. As of press time, the Toncoin tag stood at $6.88, representing a 1.44% lift from its earlier 24-hour tag.

Injective Place Assessment

Injective (INJ) shall be having a factual session on the present time as seen from its tag actions. Taking a detect at an in-depth diagnosis, we see that Injective Protocol’s chart shows a fluctuating pattern internal a descending channel. The Auto Pitchfork tool reveals the price oscillating between the median line and the lower boundary of the pitchfork, suggesting a capacity for either continuation internal the channel or a breakout.

Alternatively, analysing other indicators, we see that the Woodie’s CCI is end to the zero line, indicating a lack of real momentum in either course. As of press time, the Injective tag stood at $24.78, representing a 0.89% lift from its earlier 24-hour tag.