Bitcoin would possibly well merely need posted the deepest correction since the FTX fracture in November 2022, dipping over 20% from its all-time high of spherical $74,000. Alternatively, Glassnode analysts, while sharing their preview on X, dwell cautiously optimistic.

Bitcoin Drops 20% From March High, However Glassnode Is Bullish

Glassnode notes that the Bitcoin “macro uptrend peaceable appears one among the more resilient in ancient previous” and that despite the truth that corrections were made, they’re reasonably shallow. With this put, the blockchain analytics platform confirms that the coin has improved with liquidity rising, lowering volatility.Alternatively, for bulls to gain toughen and prices to rally, triggers would be from elementary components. Despite the truth that trace action structure would possibly well perhaps provide toughen, trace catalysts are, as ancient previous reveals, linked to market events.

As Glassnode observes, the sturdy macro pattern, bullish for Bitcoin, has tapered volatility, serving to withhold the uptrend. The increasingly shallow corrections, as the blockchain analytics platform notes, voice a more aged market backed by more establishments.

Whales Collecting As Institutions Glimpse BTC

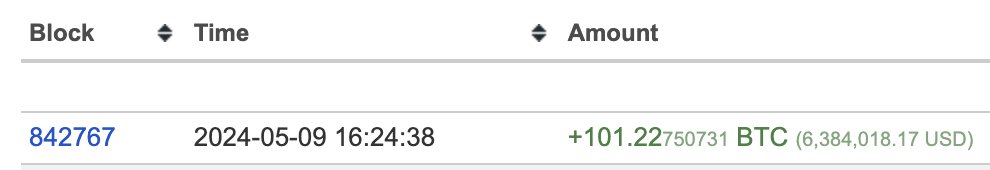

Self assurance stays high. On-chain files reveals that one whale has taken benefit of the reasonably low prices and the correction to stack cash.

In the closing week, the whale sold over 100 BTC, pushing the amount of cash sold this month to over 7,257 BTC. This aggressive accumulation suggests that the whale, even on the original multi-300 and sixty five days high, Bitcoin will most certainly be undervalued.

There’ll most certainly be more Bitcoin tailwinds incoming. For instance, this week, dilapidated United States president Donald Trump started accepting crypto donations in the continuing campaign. This shift of stance has been bullish since Trump pushed aside Bitcoin earlier.

Whereas this occurs, European regulators appear commence to approving Bitcoin as an investable asset within Undertakings for Collective Funding in Transferable Securities (UCITS) funds. If this goes thru, it would also unlock more billions into Bitcoin from European establishments.

This switch is wide, pondering that banking giants fancy Morgan Stanley and BNP Paribas are already exploring strategies for his or her purchasers to make investments in BTC.

Linked Reading: Bitcoin Fast Duration of time NUPL Tag Turns Detrimental, What This Manner For Tag

From a macro level, therising M2 money present in the USA amid concerns from the USA Federal Reserve that inflation is high would possibly well perhaps further buoy Bitcoin attach a query to of. BTC, fancy gold, is belief of as a staunch haven, a hedge in opposition to inflation since its present is designed to be deflationary.