The charge of XRP has been underneath scrutiny for basically final in a consolidated half amid the continuing appropriate fight with the US Securities and Commerce Commission (SEC) and Ripple.

Past the aptitude have an effect on of the pronounce , the XRP community is brooding about assorted most notable components, at the side of the probability of an switch-traded fund (ETF). This comes after Ripple’s CEO, Brad Garlinghouse, expressed openness to an XRP ETF, which would possibly perhaps perchance perhaps well positively impact the asset’s ticket.

Within the meantime, as consideration remains on the next ticket trajectory, important on-chain transactions secure emerged, most likely affecting the XRP’s total trajectory. Particularly, on February 25, Whale Alert recordsdata revealed the unlocking of 400 million XRP (approximately $217.5 million) from escrow at Ripple.

A serious scenario highlighted by the analyst is the rejection at key Exponential Transferring Averages (EMAs) – EMA10, EMA21, and EMA50 – on a weekly basis. Whereas XRP moved above these stages final week, a rejection this week is believed to be a failed signal, with Santana noting that this form of rejection holds twice the importance of a usual signal.

The shopping and selling skilled adopted a bearish point of view, suggesting a likely 35% descend in the XRP ticket. He additionally issued a cautionary display mask, indicating that the scenario would possibly perhaps perchance perhaps well worsen.

XRP ticket diagnosis

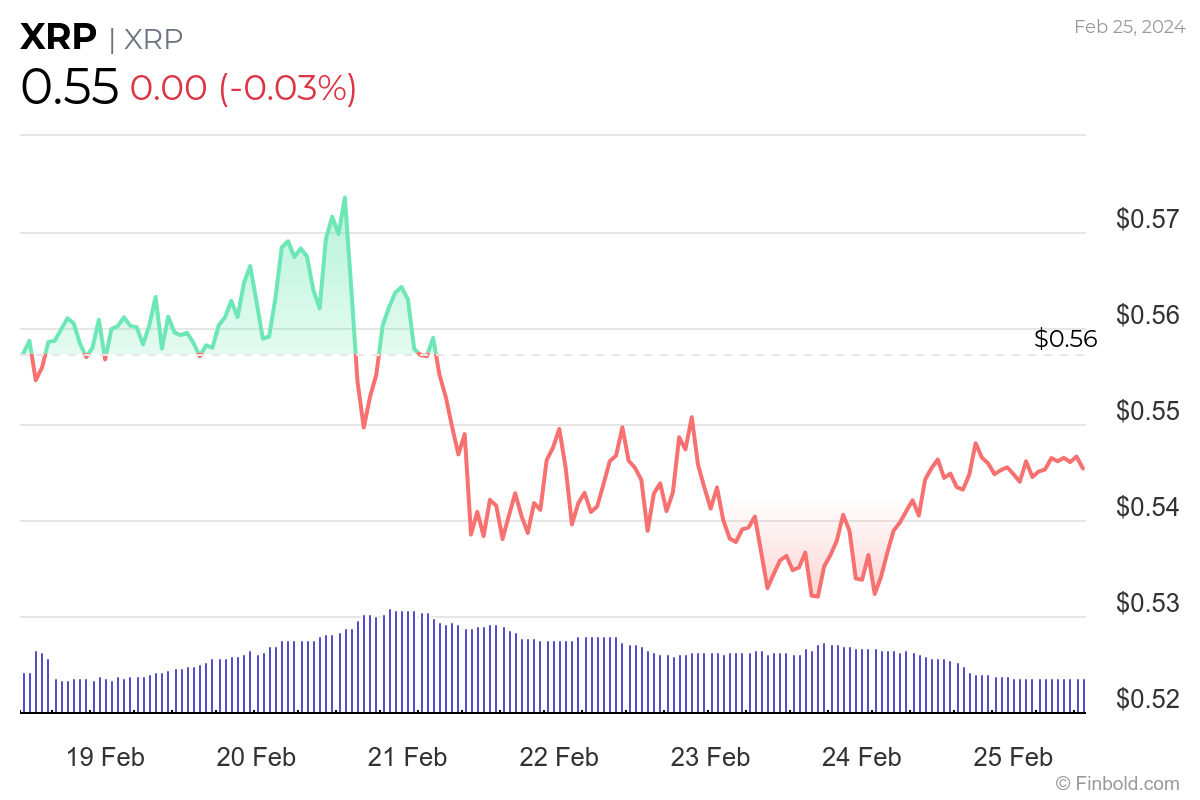

By press time, XRP became shopping and selling at $0.55, experiencing day after day losses of decrease than 0.1%. On the weekly chart, XRP has declined by over 2%.

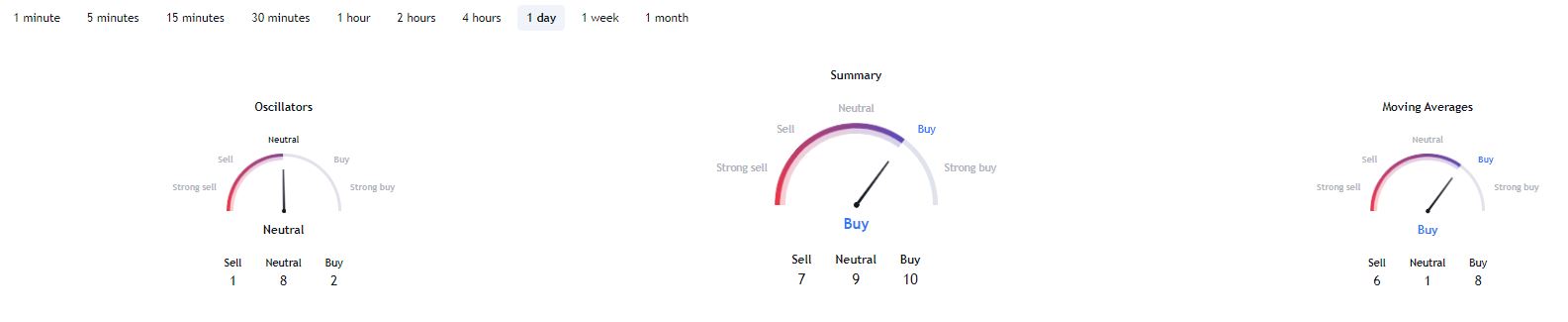

By means of technical indicators, bullish sentiments prevail for XRP. One-day gauges retrieved from TradingView relate a summary aligning with a ‘aquire’ sentiment at 10. This sentiment is mirrored in spirited averages at 8, while oscillators present a ‘neutral’ stance at 8.

Whereas usual market sentiments have an effect on the prospects of XRP, the asset is additionally at possibility of be impacted by the implications of the continuing appropriate case. The particular court docket cases secure improved past the discovery stage, with both events working on their therapies-associated briefs.

Crucial upcoming deadlines encompass March 13, when the SEC is expected to file therapies-associated briefs; April 12, the deadline to post motions opposing therapies proposals; and April 29, the final deadline for therapies submissions.

Disclaimer: The snort on this space mustn’t be thought to be investment advice. Investing is speculative. When investing, your capital is at bother.