As Bitcoin (BTC) continues to alternate in a consolidation phase beneath $65,000, technical indicators and ancient performances imply that the maiden cryptocurrency will more than doubtless be on the level of great capitulation within the upcoming months.

In explicit, crypto trading expert Alan Santana’s diagnosis in a TradingView post on April 27 steered that Bitcoin would possibly possibly moreover tumble over 50% from its present label to $30,000.

The analyst warned patrons to note out for the upcoming “capitulation tumble,” which he steered marks a most well-known match that happens completely once each and each loads of years. Santana’s calculations are per Bitcoin’s common trading vary over the final month and a half of, which sits around $66,600.

The expert pointed to loads of indicators, including declining volume and a weakening Relative Energy Index (RSI), as signs of impending bearish momentum. The diagnosis outlined a probably scenario where Bitcoin experiences a pointy tumble, followed by a stabilization.

“This is the final warning and a friendly reminder; what we’re about to concept is a “capitulation tumble!”. <…> the 50% capitulation tumble, we receive a amount within the vary of $33,300. <…> The motion can maintain to hotfoot one thing love this: The initial tumble rapidly and solid; be aware that the initial transfer is bearish marketwide, length. Then this transfer stabilizes and the ALTSBTC and smaller Altcoins will receive better first. Mid-dimension 2d and the supreme one final,” the expert stated.

Key levels to gaze

Santana added that Bitcoin’s failure to interrupt above key resistance levels, such because the EMA50, extra confirms the market’s non eternal bearish bias. In step with Santana:

“Bitcoin moved assist beneath EMA50 24-April and has been trading beneath. As lengthy because the trading happens beneath this level, right here method at $64,560; the non eternal bearish bias is grand solid and confirmed.”

On the same time, Santana identified that the functionality for correction would possibly possibly moreover be derived from ancient Bitcoin performance. As an instance, the trading expert renowned that Could also simply historically tends to be a remarkable month for cryptocurrencies, basically when prices are coming down from multi-yr highs.

Nevertheless, the analyst encouraged patrons no longer to apprehension, because the capitulation tumble represents the muse of a brand current bullish phase for Bitcoin, with most well-known opportunities anticipated to emerge in unhurried 2024 and for the length of 2025.

Despite the anticipated tumble to around $30,000, Santana predicted that Bitcoin would within the fracture rebound by 30-50% forward of slowly climbing. This slack ascent would possibly possibly moreover uncover about Bitcoin trip a most well-known bullish momentum anticipated to kick in for the length of the principle six months of 2025, a yr when a brand current all-time high is anticipated.

Bitcoin label diagnosis

As of press time, Bitcoin used to be trading at $63,519, reflecting beneficial properties of approximately 0.6% over the final 24 hours. Nevertheless, within the weekly timeframe, Bitcoin declined by almost 3%.

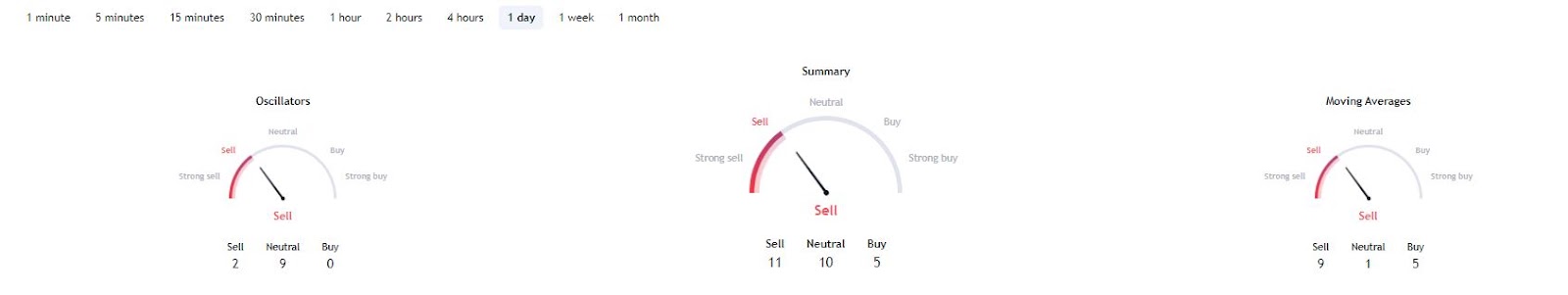

Some build else, a assessment of Bitcoin’s one-day technical diagnosis sourced from TradingView echoes bearish sentiments. A abstract of the indicators signifies a ‘promote’ sentiment at 11, whereas transferring averages moreover signal ‘promote’ at 9. The same bearish sentiment is mirrored in oscillators, with a gauge studying of 2.

Total, the diagnosis looks to align with the ancient constructing identified because the post-halving retrace, where Bitcoin undergoes a correction forward of resuming its upward rally. Breaching beneath the $60,000 brand would possibly possibly moreover extra validate the prevailing bearish sentiment.

Disclaimer: The negate on this case shouldn’t be really apt investment advice. Investing is speculative. When investing, your capital is at possibility.