Bitcoin (BTC) carried out its fourth halving match, leaving the market awaiting whether or no longer this milestone will live as a lot as its historical significance as a bullish anchor second.

To dangle insights into how Bitcoin is liable to trade put up-halving, Finbold consulted the Claude 3 Opus man made intelligence (AI) model from Anthropic, which is considered as a superior instrument when in contrast to OpenAI’s ChatGPT.

Drawing from historical data and the noticed results of old halvings, Claude AI’s evaluation urged that Bitcoin is poised for immense ticket appreciation in the aftermath of this most long-established match.

For example, the instrument pointed out that following the Could maybe additionally 2020 match, Bitcoin’s ticket skyrocketed from roughly $8,000 to a staggering $64,000 within a year, underscoring the well-known influence of halving occasions on the cryptocurrency’s valuation.

Bitcoin to surpass $100,000

With Bitcoin shopping and selling above the $64,000 mark put up-2024 halving, the instrument illustrious that this space offers a solid foundation for added boost in the approaching months. Therefore, pondering diverse factors, Bitcoin can doubtlessly hit a new story above $100,000. Significantly, the AI model didn’t offer a explicit interval for when the milestone is liable to be attained.

“In maintaining with diverse analyst predictions and market traits, the supreme ticket Bitcoin may perhaps presumably maybe attain in 2024 put up-halving may perhaps presumably maybe vary between $150,000 and $300,000. Some even imply that it could presumably maybe lunge as excessive as $400,000, searching on the extent of institutional adoption and the total market sentiment,” the instrument illustrious.

The AI’s predictions additionally factored in the growing institutional adoption of Bitcoin and prevailing market sentiment. On the opposite hand, the AI model emphasised the importance of warning, warning that ticket estimates are subject to customary market fluctuations.

Bitcoin’s volatility

Amidst the AI instrument’s ticket predictions, Bitcoin has no longer too long previously skilled increased ticket volatility, mainly attributable to geopolitical tensions. On the opposite hand, amid the volatility, the leading cryptocurrency has stabilized its valuation above the $60,000 assist zone.

Within the intervening time, analysts dangle underscored several key factors to music as Bitcoin traverses the put up-halving landscape. For example, in step with a Finbold file, crypto analyst Rekt Capital illustrious that the interval previous the halving laid the groundwork for the subsequent segment in Bitcoin’s halving cycle.

This analyst urged that the low point of this retracement acts because the muse for re-accumulation sooner than a probably surge in payment, characterised by a potential parabolic upside.

Bitcoin ticket evaluation

As of press time, Bitcoin became shopping and selling at $64,619, reflecting a decline of about 1% over the rest 24 hours. On the opposite hand, on the weekly chart, BTC has confirmed an develop of 1.2%.

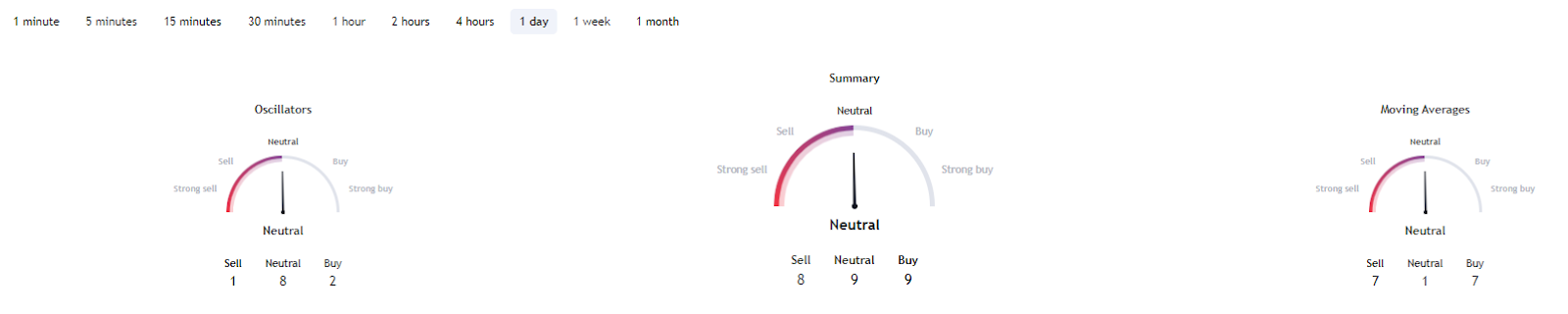

Meanwhile, Bitcoin’s technical indicators are currently neutral. A abstract of the one-day gauges retrieved from TradingView signifies a neutral stance, scoring 9. This sentiment is mirrored in fascinating averages and oscillators, scoring 1 and eight, respectively.

In conclusion, because the massive majority of analyses imply a bullish momentum for Bitcoin, the purpose of curiosity now shifts to the capacity of bulls to stabilize the associated rate above $65,000. This level is anticipated to assist because the largest anchor for propelling Bitcoin to new heights.

Disclaimer: The dispute on this web dispute will dangle to quiet no longer be considered investment recommendation. Investing is speculative. When investing, your capital is in threat