The cryptocurrency panorama may even very successfully be on the brink of welcoming a predominant influx of capital via a fresh mechanism is named “Initial Parts Offering”, in accordance with IntoTheBlock’s On-chain Insights. Traditionally, the evolution of funding units in the crypto sector, equivalent to Initial Coin Offerings (ICOs) post-Ethereum initiating and NFT mints in 2017, has catalyzed bull markets by enabling explain global investment into fresh initiatives.

Lucas Outumuro, Head of Research at IntoTheBlock, believes that the factors machine adopted by protocols at some level of the final six months could act as a trigger merely treasure the ICOs did. At the initiating build popularized by NFT market Blur, these programs signify a more proactive and versatile different to worn airdrops, rewarding customers for contributions treasure liquidity provision and user referrals.

This grew to became a vogue for project bootstrapping and liquidity creation, with EigenLayer’s factors program standing out as a number one instance, collecting over $7.8 billion earlier than its mainnet initiating. Following the buildup of factors, protocols treasure EigenLayer transition to token issuance via Initial Parts Offerings, mirroring the dynamics of ICOs nonetheless with a fresh ability.

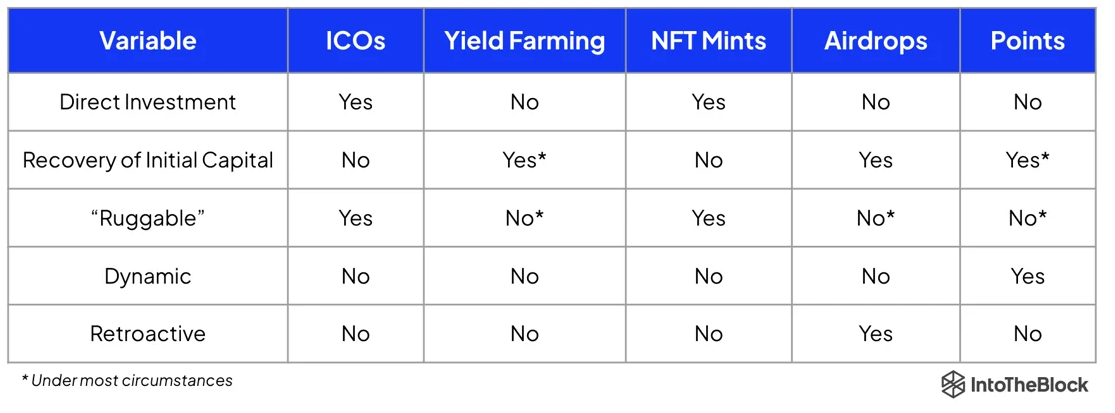

Even supposing factors programs are no longer devoid of flaws, they offer several advantages over outdated units by striking off the need for explain financial investment from customers and reducing the threat of tokens being labeled as securities.

Thus, the factors model is gaining momentum, with initiatives treasure Ethena integrating such mechanisms from their inception, even though the sustainability of the present enthusiasm for factors programs stays dangerous.

On the different hand, Outumuro states that drawing from ancient patterns, this modern bootstrapping mechanism could potentially usher in a brand fresh technology of capital bound alongside with the sail and formation for the length of the crypto market.