The cryptocurrency market remains neutral, led by Bitcoin’s (BTC) obvious consolidation fragment. Within the intervening time, two cryptocurrencies boom a linked doubtless for a short squeeze because the week develops.

The brand new week’s geopolitical tensions maintain precipitated market turmoil, shedding the prices and the final sentiment referring to cryptocurrencies. In a without warning bearish landscape, crypto traders started to commence leveraged short positions, which can perchance perchance backfire.

Interestingly, at any time when traders commence a short space, they leave liquidity at the serve of in the make of collateral property that the crypto alternate can liquidate if the underlying asset’s designate rises to an agreed-upon target. The sequential liquidation of multiple short positions drives the designate upwards, and traders understand it as a short squeeze.

In notify, Litecoin (LTC) and Bitcoin Money (BCH) maintain critical liquidity pools at bigger prices. Bitcoin sage charges above $100 might perchance perchance moreover trigger a surge for these alternative money, equivalent to the reported $1 feeless opportunity.

Litecoin (LTC)

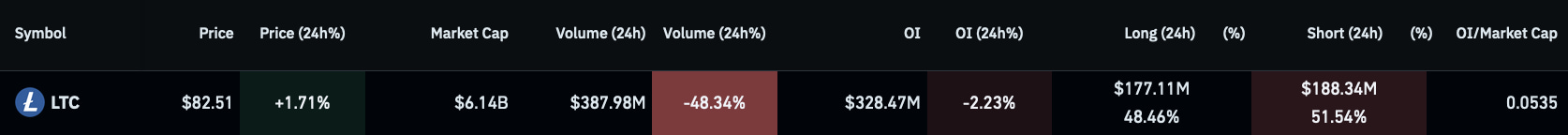

First, Litecoin trades at $82.51, with a quite sure intraday of 1.71% gains, recordsdata from CoinGlass reveals. On the opposite hand, short-sellers dominate the 24-hour quantity with $188.34 million positions opened, for 51.54% of the final quantity.

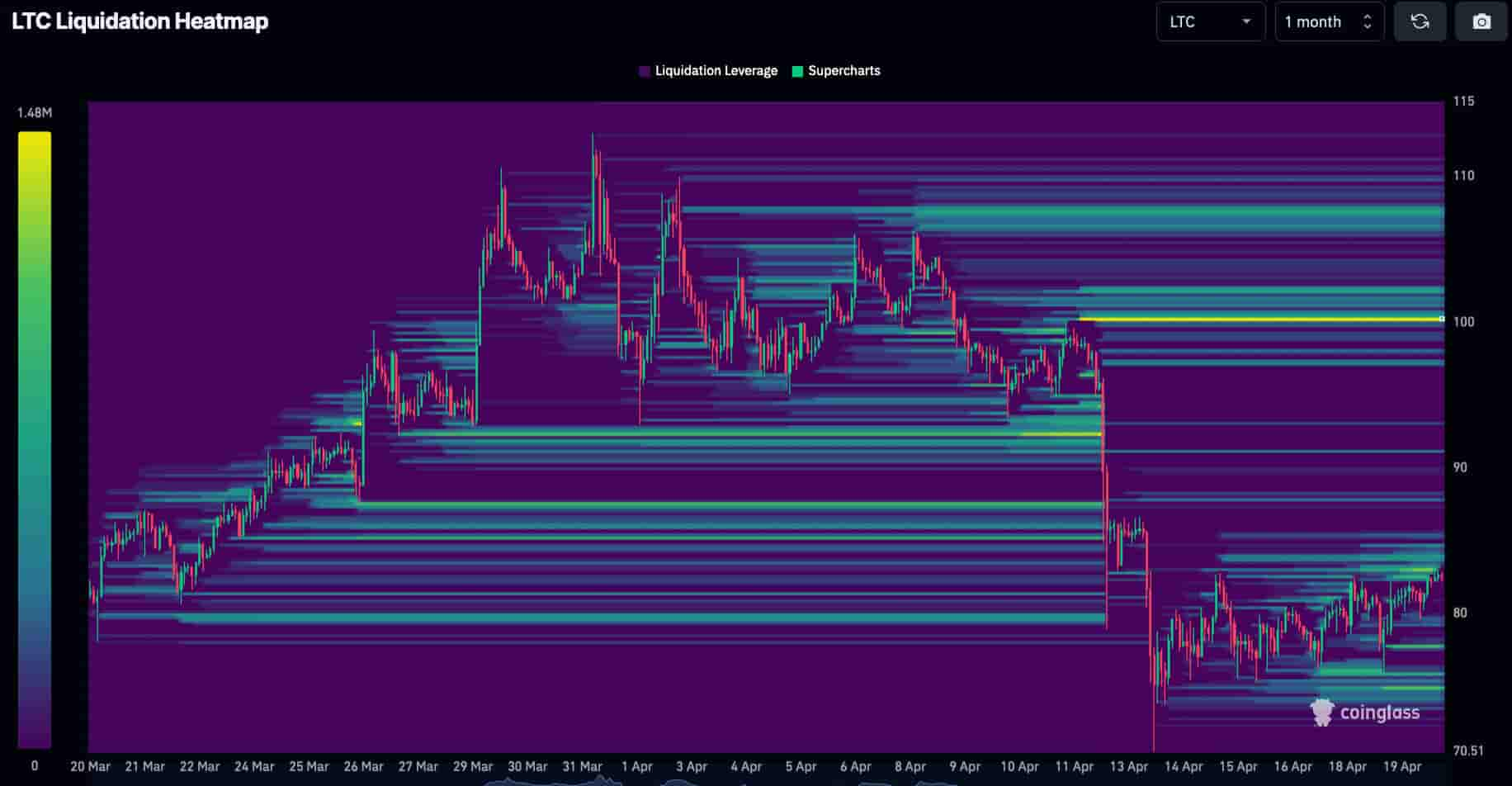

As a outcome, LTC has hundreds and hundreds of bucks in liquidity pools which can perchance perchance moreover be terminate to the $100 psychological level. Attributable to this truth, a short squeeze from the new prices to this doubtless resistance would reward investors with over 21% gains.

Bitcoin Money (BCH)

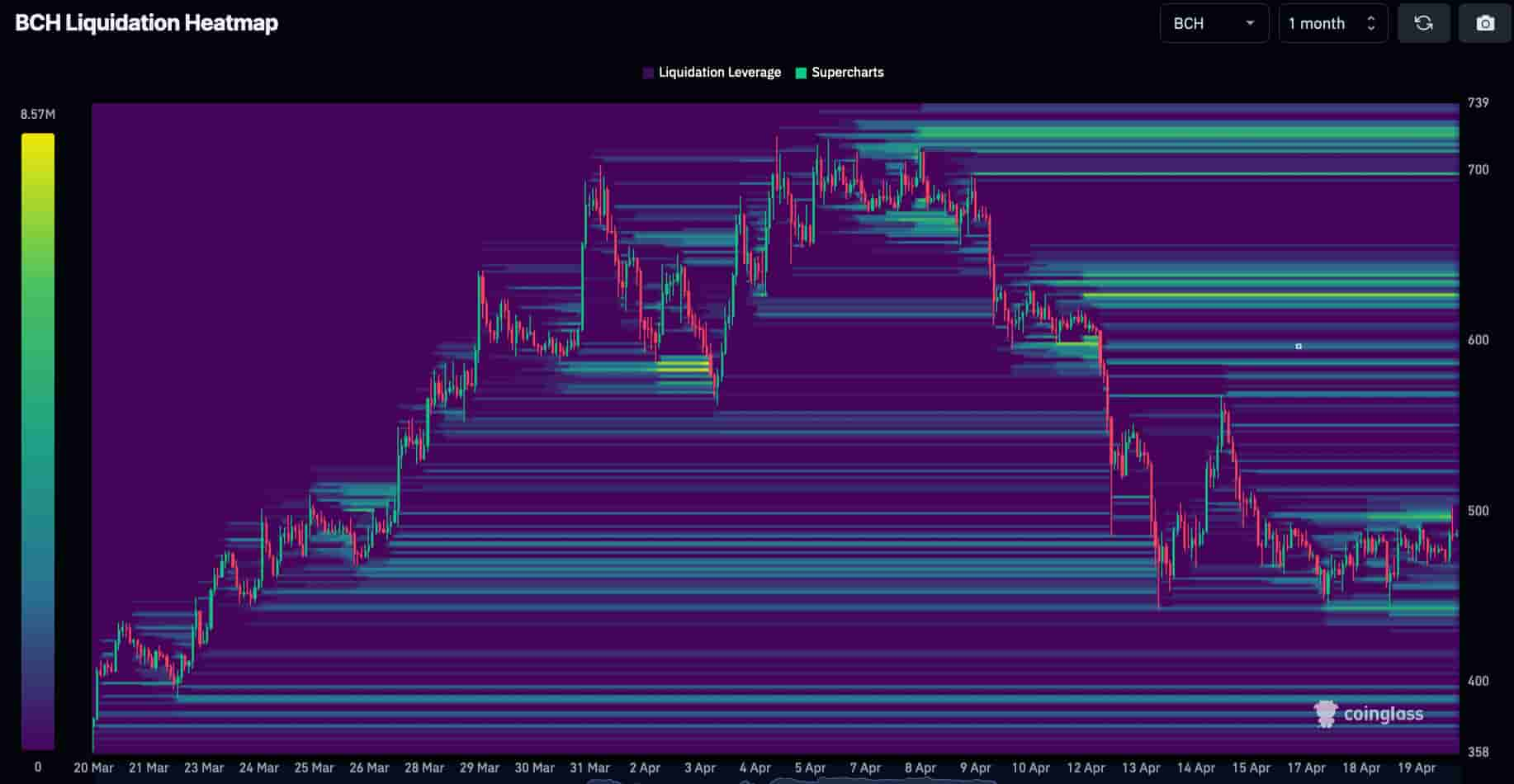

2nd, Bitcoin Money is every other stable competitor that can grab pleasure in the atmosphere of skyrocketing charges for Bitcoin.

But, unlike Litecoin’s $100 accrued liquidations, BCH has a bigger unfold amongst multiple liquidity pools, from $500 to $740. A short squeeze rally by this range has the big doubtless of 40% gains for Bitcoin Money investors.

Then yet again, the cryptocurrency market changes each minute, and the liquidity pools talked about can recede if traders voluntarily terminate their positions. Working out cryptocurrencies’ unstable nature is major to navigating the leveraged derivatives market.

Disclaimer: The snarl material on this plot must indifferent not be thought of as funding advice. Investing is speculative. When investing, your capital is at possibility.