Ethereum (ETH) has fair now not too prolonged ago skilled famous volatility amid market mark fluctuations. No topic this unsure ambiance, Ethereum objectives to protect up its mark above the well-known $3,000 toughen zone.

Share of the volatility will also be attributed to increased whale exercise appealing ETH, to boot-known quantities of the token are being transferred to exchanges. As an instance, Whale Alert info on April 20 indicated that 10,911 ETH, valued at roughly $33.52 million, modified into transferred to Coinbase.

Such substantial actions to essential exchanges delight in Coinbase elevate issues about sustained volatility in Ethereum’s mark, especially brooding about the decentralized finance (DeFi) asset’s susceptibility to total market bearish sentiments.

For the time being, ETH is trading at $3,062.73, having corrected by practically 1% within the final 24 hours. On the day-to-day chart, Ethereum dipped to a low of $2,900 earlier than experiencing a rapid uptick.

In the meantime, on the weekly chart, ETH is down over 6%. Amidst this volatility, the essential center of attention is on how Ethereum’s valuation will evolve within the approaching days.

Ethereum mark AI prediction

Ethereum is teetering factual above the $3,000 zone, an well-known juncture, as losing this degree would possibly well maybe build of dwelling off a extra downward trajectory. Searching for insights into Ethereum’s doable future actions, Finbold modified into to predictions from synthetic intelligence (AI) machine algorithm gadgets at CoinCodex.

In step with info retrieved on April 20, Ethereum is projected to alternate at $3,117.08 on Might presumably 1, representing an amplify of roughly 1.7% from its most up-to-date valuation.

It’s payment noting that Might presumably has well-known regulatory implications for Ethereum. The Securities and Exchange Commission (SEC) is seemingly to settle approving a topic Ethereum trade-traded fund (ETF).

Might presumably quiet this product receive approval, its doable influence on Ethereum’s market dynamics remains unsure. This will seemingly be well-known to discover whether this can echo the precedent build of dwelling by identical ETFs for Bitcoin (BTC).

ETH’s key toughen zone to peek

Amid ongoing uncertainty surrounding Ethereum’s mark, crypto analyst Ali Martinez cautioned on April 16 that must quiet ETH proceed a downward type, investors must quiet carefully discover the well-known toughen zone between $2,000 and $2,430.

Internal this differ, roughly 9.37 million addresses help practically fifty three million ETH. A breach of this toughen zone would possibly well maybe presumably intensify selling rigidity and exacerbate the downturn.

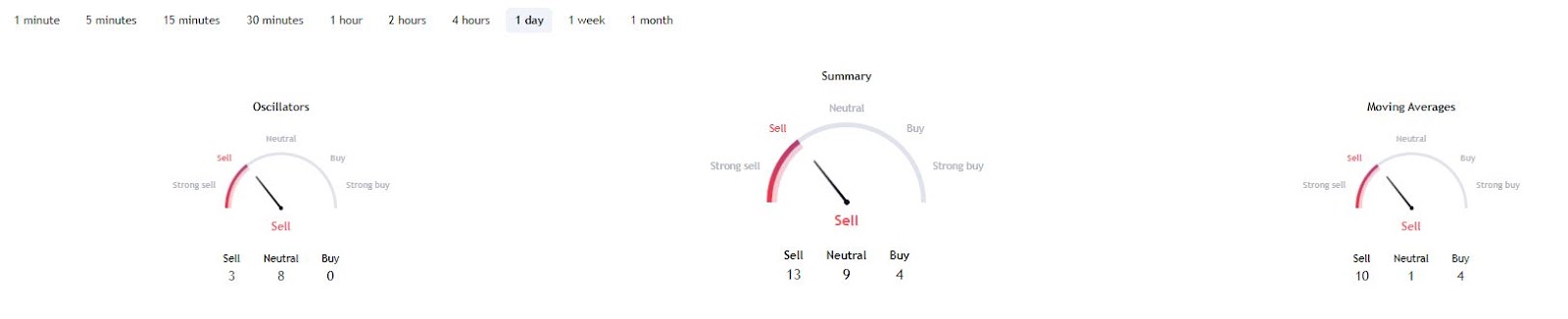

Moreover, Ethereum’s technical indicators remain predominantly bearish. A abstract of the one-day gauges retrieved from TradingView indicates a ‘sell’ sentiment at 13, with identical sentiments reflected in transferring averages and oscillators at 10 and 3, respectively.

In conclusion, in spite of prevailing bearish sentiments surrounding Ethereum, the asset stands to rating the income of any bullish resurgence within the broader market, seemingly driven by the aftermath of the Bitcoin halving match.

Disclaimer: The relate material on this dwelling must quiet now not be regarded as funding advice. Investing is speculative. When investing, your capital is at risk.