The broader cryptocurrency market has shed the momentary positive aspects skilled main as a lot as the Bitcoin (BTC) halving match. Following the completion of the bullish match, the markets beget did not react positively, with analysts attributing it to the post-halving retracement.

By distinction backdrop and prevailing market sentiment, Finbold has known three cryptocurrencies price looking out at in the upcoming week despite the predominantly red market.

Bitcoin (BTC)

One of the principle causes for pastime in Bitcoin is its most up-to-date halving match and how the charge will evolve. For the reason that match, Bitcoin has skilled a correction, slipping under the $65,000 designate. Preliminary optimism revolved around Bitcoin’s possible to set positive aspects above $65,000. Nonetheless, the post-halving correction has tempered these expectations and raised questions about the cryptocurrency’s momentary outlook.

It is price noting that Bitcoin originally dropped under the $70,000 zone following heightened geopolitical stress. Certainly, in the upcoming week, patrons shall be drawn to how Bitcoin’s label adapts to the evolving tensions in the Heart East.

Crucially, consideration is on Bitcoin’s capability to sustain its positive aspects above the $60,000 enhance zone. Analysts emphasize the significance of this label level, suggesting that a fall under $60,000 would perhaps maybe spell danger forward for the cryptocurrency, pointing to that you just are going to be in a region to assume of additional downside.

Whether Bitcoin can shake off the most up-to-date downturn, reclaim its momentum, navigate geopolitical headwinds, and sustain above the wanted $60,000 designate remains to be viewed in the upcoming week. Certainly, the trajectory of the crypto will possible have an effect on traditional market sentiment.

By press time, Bitcoin became as soon as shopping and selling at $63,606 with day-to-day losses of practically 2%.

Solana (SOL)

Solana (SOL), a decentralized finance (DeFi) venture, remains a pivotal asset to behold, critically regarding its blockchain activities at threat of have an effect on its label. Seriously, Solana, which has skilled a predominant rally in most up-to-date months, confronted stress amid the most up-to-date traditional market sell-off, with the asset hovering shut to dropping under $130.

Nonetheless, SOL managed to reclaim the $140 designate, showcasing resilience amidst market turbulence.

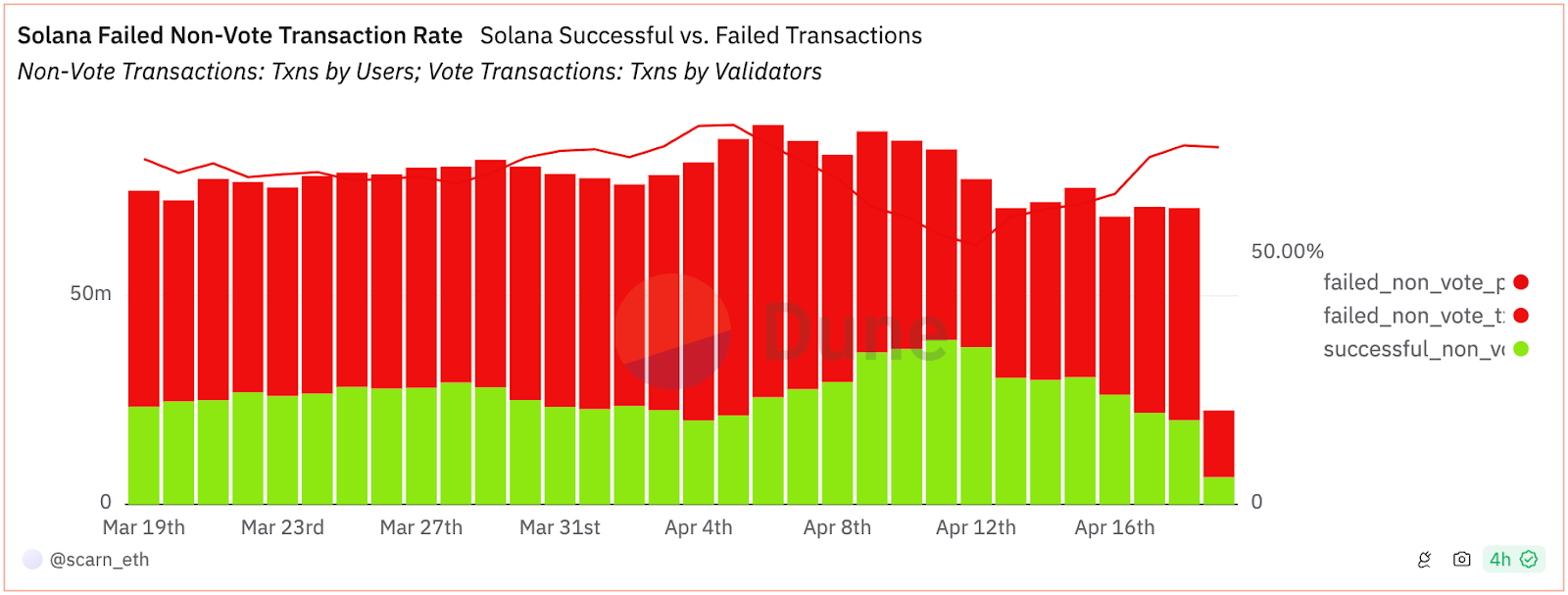

No topic this resilience, numerous community points proceed to persist around Solana. No topic the most up-to-date rollout of a predominant community fix, excessive transaction failure rates persist, with 71% of non-vote casting transactions amassed main to failures as of April 19.

The most up-to-date v1.18.11 update to the devnet by the Solana dev store Anza originally failed but became as soon as efficiently restarted in a second try. This effort targets to alleviate ongoing community congestion, signaling ongoing efforts to tackle technical challenges.

As of press time, SOL became as soon as shopping and selling at $141, having corrected by over 7% in the final seven days.

Celestia (TIA)

Celestia (TIA) cryptocurrency represents a modular community facilitating the easy deployment of particular person blockchains with minimal overhead. The token has been a standout performer in the most up-to-date market rally, critically declaring a particular trajectory amid the general prevailing bearish sentiments.

TIA’s upward momentum started in tiring 2023 following the initiate of Celestia’s mainnet beta, signaling the onset of the modular blockchain expertise. One other contributing aspect to its label surge would be its earlier listing on Binance, underscoring promising scalability solutions.

As we transfer into the novel week, consideration is on whether or no longer TIA can sustain its resilience and trajectory in the inexperienced zone.

By press time, the token became as soon as shopping and selling at $11.29, reflecting day-to-day positive aspects of practically 3%. Over the final seven days, it has increased by over 15%.

It’s crucial to acknowledge that the cryptocurrencies mentioned are amassed field to exterior market forces that lengthen beyond their inherent fundamentals.

Disclaimer: The tell material on this region would perhaps maybe honest amassed no longer be regarded as investment advice. Investing is speculative. When investing, your capital is in threat.