Bitcoin (BTC) has skilled an roughly 19% tumble since hitting its all-time high (ATH) on March 14, 2024. This situation raises considerations in regards to the most up-to-date bull market’s longevity.

Then again, despite the most up-to-date correction, many analysts mediate this represents a wholesome consolidation at some point of the continuing bull market, no longer its quit.

Bitcoin Correction Indicators Market Neatly being, No longer End of Bull Rush

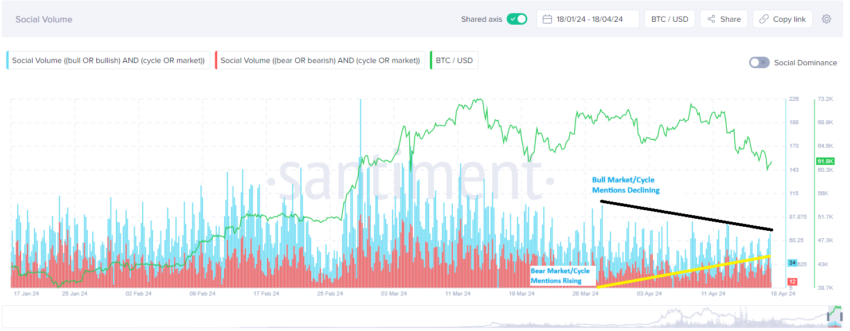

On-chain data platform Santiment experiences a shift in market sentiment. Per Santiment data, the “bull market/cycle” mentions dangle risen since listless March. Moreover, Santiment observes a decline in FOMO (dread of missing out) sentiment and a upward thrust in FUD (dread, uncertainty, and doubt).

Santiment extra suggests that costs dangle historically moved contrary to the existing sentiment of the hundreds. Attributable to this truth, there’s a ability for a recovery sooner than or quickly after the imminent Bitcoin halving.

The lengthen within the “bull market/cycle” mentions aligned with Bitcoin’s most modern ticket performance. Bitcoin is trading at $61,988 at the time of writing.

Apparently, Bitcoin’s ticket decline contradicts the usual story surrounding Bitcoin halving. The quadrennial occasion has a history of being associated with BTC ticket surges. The upcoming near Bitcoin halving is scheduled for a block height 840,000, roughly on April 20, 2024.

Many consultants mediate this yr’s Bitcoin halving could well well well doubtlessly alter BTC’s conventional ticket surge. This prediction is notably as a consequence of the most up-to-date approval of the US say Bitcoin ETFs.

Then again, analysts look the most up-to-date correction as a wholesome motion. Crypto analyst CryptoCon emphasized the need for corrections, even within a bull market. He identifies the 20-week EMA at $55,600 as a key enhance degree for Bitcoin.

“As lengthy as Bitcoin continues to retest this intriguing sensible, we can look a very good smooth curve love 2017 to the quit,” he explained.

Famed analyst PlanB furthermore maintains a bullish lengthy-length of time outlook for Bitcoin.

“[In my opinion], this Bitcoin halving is potentially no longer various … BTC high will most definitely be above $300,000 in 2025,” PlanB mentioned.

Echoing Notion B and CryptoCon, Hannah Phung, Lead Recordsdata Analyst at Achieve On Chain, mentioned that ticket will enhance have a tendency to happen around 6 to 300 and sixty five days submit-halving.

The consultants’ opinion aligns with Bitcoin’s historical data. After the first halving in November 2012, the price rose from around $12 to over $1,000 by listless 2013. Equally, the 2d halving in July 2016 saw the price of Bitcoin surging from around $650 to almost about $20,000 by December 2017. The third halving in Would possibly perchance perhaps also 2020 resulted in a ticket lengthen from around $8,000 to $69,000 by November 2021.

Despite the particular outlook for Bitcoin’s ticket within the lengthy length of time, Bitcoin halving could well well well remain a say for miners. This yr’s halving cuts the reward for mining a Bitcoin block from 6.25 to some.125 BTC, greatly impacting miner profitability. Which ability that, miners face stress to innovate and procure ways to diminish charges while striking forward or rising their Bitcoin output.

Whereas this occasion can doubtlessly impact miner profitability, a January 2024 gape by CoinShares unearths that some miners can stay to yelp the story. CoinShares notes that miners with immense Bitcoin holdings and higher capitalization have a tendency to fare higher in bullish markets.

Then again, these with restricted cash reserves and high operational charges per BTC are more at probability of Bitcoin’s ticket declines.

The latest correction, the imminent halving, and the newly licensed US say ETFs develop a advanced surroundings for Bitcoin ticket predictions. But general, lengthy-length of time bullish sentiment remains sturdy among most substitute consultants.