Tezos is making predominant strides in growing its DeFi ecosystem with the start of the DeFi Catalyst Accelerator (DCA) in Singapore.

This six-week program nurtures early-stage startups building innovative decentralized finance (DeFi) functions on the Tezos blockchain and its Etherlink Layer-2 rollup.

Tezos Launches DCA as Venture Capitalist Pastime in DeFi Is Abet

Tezos and Etherlink grunt they offer positive advantages for DeFi pattern, i.e., hunch, security, low charges, and compatibility with Ethereum-basically based tools. Etherlink’s emphasis on decentralization and MEV protection additional enhances its appeal for DeFi builders.

The inaugural DCA cohort contains 5 groups, i.e., Plend, Hanji, SaveX, Hashleap, and Rivo. These startups aim to contend with diverse challenges for the duration of the DeFi sector. They focal point on stablecoin type, on-chain exchanges, harmful-border remittances, fee solutions, and simplified DeFi investing.

Be taught extra: How To Fund Innovation: A E book to Web3 Grants

Moreover, DCA participants have the help of the abilities of StableTech contributors, who have in depth abilities building core ingredients for the duration of the Tezos DeFi toolkit. StableTech itself is a consortium of contributors to the Tezos ecosystem.

The start of the DCA coincides with renewed enterprise capitalist hobby within the DeFi sector. On April 12, 2024, Berachain, an EVM-equal L1 constructed on the Cosmos SDK and powered by Proof of Liquidity, secured $100 million in Assortment B funding. This funding became co-led by Brevan Howard (BH) Digital Sources and Framework Ventures.

Moreover, Galaxy Digital, a critical player within the crypto sector, has also not too prolonged within the past declared its plans to expand its investment horizon. The firm plans to broaden its investment focal point by launching a brand fresh Galaxy Ventures Fund I, LP fund. This $100 million fund objectives to develop make stronger and resources to promising startups.

Be taught extra: Crypto Hedge Funds: What Are They and How Attain They Work?

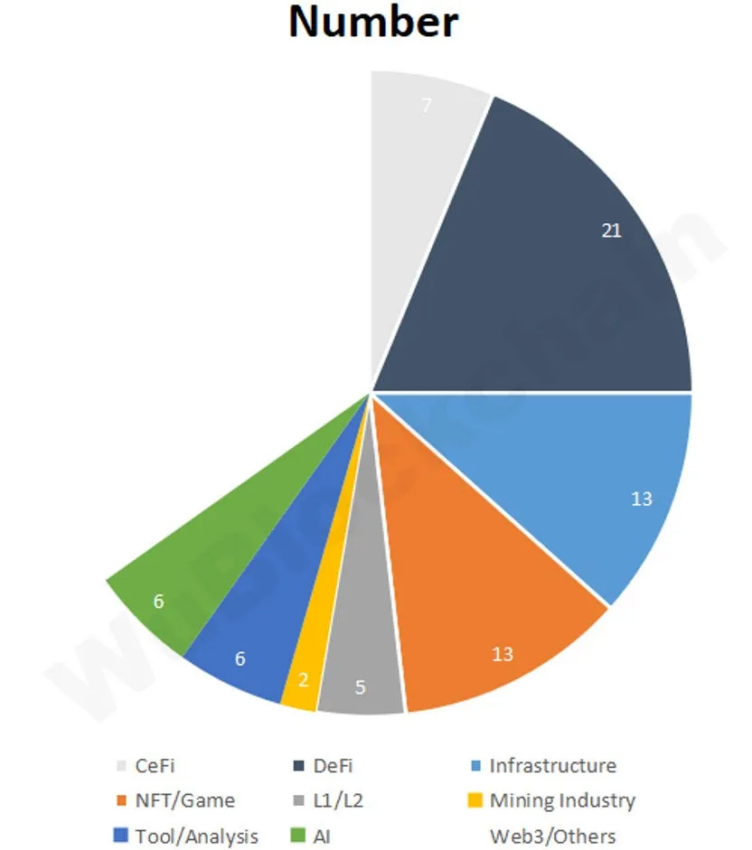

This renewed hobby builds upon a convincing January 2024. Using RootData’s statistics, journalist Colin Wu accepted 113 publicly disclosed investment projects within the crypto enterprise capital space in January. This represents a month-on-month prolong of 10.8% from 102 projects in December 2023.

“Among the many many industries within the crypto market in January, the financing share of infrastructure projects became approximately 12%, DeFi approximately 19%, CeFi approximately 6%, NFT/GameFi approximately 12%, and L1/L2 approximately 4%,” accepted journalist Colin Wu in his suppose.