Gold has made consecutive contemporary all-time highs year-to-date, drawing investors’ attention and fueling what changed into as soon as already a vastly increased request. Finbold selected two tokenized gold cryptocurrencies to put money into and be triumphant in exposure to the leading commodity

As of writing, the TradingView index for gold marks an all-time excessive of $2,431 per ounce. Furthermore, gold contracts closed the week – on April 12, Friday – at a valuation of $2,343 per ounce. Having a request ahead, Bloomberg Intelligence‘s commodity expert forecasts gold would perchance maybe attain $3,000 per ounce.

Then again, investing in gold can infrequently be expensive and limiting, in step with varied geographic locations, or funding budgets.

Gold funding alternatives

As an instance, young Chinese language investors beget started searching for to derive bodily gold beans to be triumphant in more accessible exposure to the dear metal. Right here is because these gold tokens beget a lower minimum entry price. Additionally, they are more straightforward to retailer and pass than the real looking gold bars and other bodily variants of the world’s leading asset.

Then again, rep admission to to gold derivatives similar to substitute-traded funds (ETFs) or diverse contracts face a the same scheme back of serious entry limitations for the favored inhabitants. As a result, the price of gold in varied markets would perchance vary from underlying indexes like TradingView‘s.

Severely, some cryptocurrency projects deal with this request, offering more accessible versions of synthetic gold tokens. Hence, allowing a more diverse exposure to the dominating commodity, besides more straightforward storage, portability, and arbitrage alternatives.

2 gold tokens that anyone ought to aquire

On this context, Finbold selected two of the most common gold-backed cryptocurrencies or gold tokens. These resources are a synthetic version of the commodity, with mechanisms constructed to retain a peg to gold’s label.

Tether Gold (XAUt)

First, Tether has its non-public gold token under the ticker XAUt, the utilization of gold’s nomination as a supranational forex. The firm is the leading stablecoin issuer in the cryptocurrency industry, controlling USDT, with over $105 billion market cap.

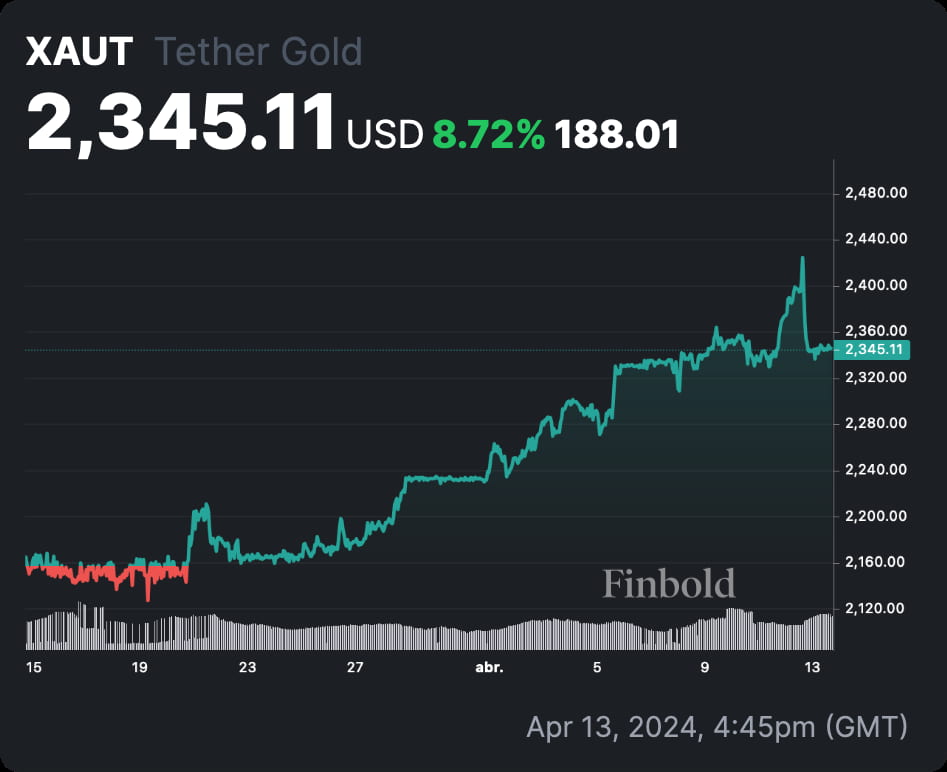

Particularly, Tether’s tokenized gold trades moderately of above TradingView‘s index, at $2,345 per ounce. XAUt is a $577.75 million market cap cryptocurrency, indicating a low-cap mission in step with the industry parameters.

PAX Gold (PAXG)

Pax Gold (PAXG) is a gold-backed cryptocurrency issued by Paxos, a regulated blockchain infrastructure. The firm is largely known for serving as Binance‘s buck-stablecoin (BUSD) controller, despite having its non-public synthetic buck, the USDP.

Curiously, PAXG trades with a near to 2% top class in opposition to the index, priced at $2,385 with ongoing volatility. Paxos’s gold token has a $435 million capitalization, ranked in the 159th space in step with the CoinMarketCap index.

The HSBC moreover has its synthetic gold asset, though most attention-grabbing accessible for the monetary institution’s clients.

In conclusion, Tether and Paxos tokenized gold cryptocurrencies are basically the most solid tokens to accessibly put money into and be triumphant in exposure to the dear metal by blockchain infrastructure in a permissionless system.

Then again, the tokenized versions of the commodity beget essential risks to take notice of and are at threat of these entities’ honesty and correctly being. Investors ought to enact their due diligence and bother these risks sooner than making monetary choices.

Disclaimer: The yell material on this effect of residing would perchance aloof no longer be conception to be funding advice. Investing is speculative. When investing, your capital is in threat.