Solana (SOL) is for the time being present process a corrective section, and there are indications that the price could well doubtlessly decline extra.

There’s a possibility that SOL could well reach around $130 as fragment of this correction, BeInCrypto analyzes the price charts.

Solana’s Rate Rebounds from 50-Day EMA

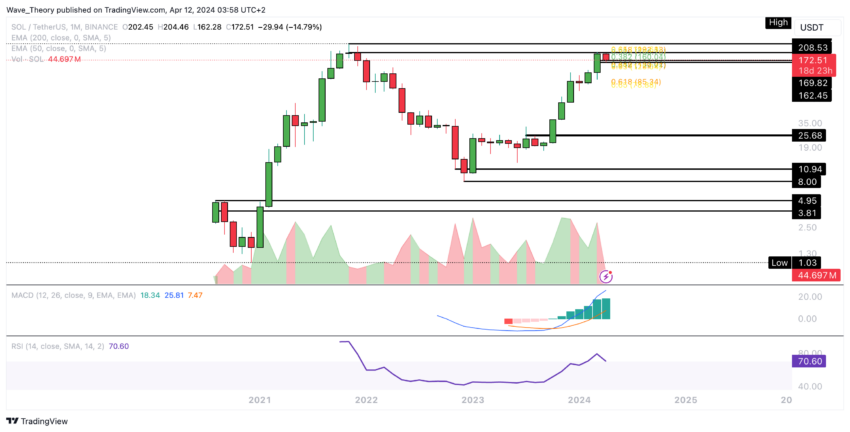

The day before the day prior to this, Solana reached the 50-day EMA toughen at the 0.382 Fib level, approximately at $160, and rebounded strongly. In the imply time, the SOL price faces necessary Fib resistances around $180 and $195.

Furthermore, the Difficult Moderate Convergence Divergence (MACD) histogram has shown bullish momentum over the last three days. Alternatively, the MACD traces are bearishly crossed, and the Relative Power Index (RSI) stays impartial.

Besides, the EMAs shield a golden crossover, indicating a bullish style in the short to medium interval of time. Nonetheless, the corrective section will ideal attain if Solana surpasses the golden ratio of around $195.

Solana’s 4H Chart Alert: Is a Demise Unsuitable on the Horizon?

In the 4-hour chart, the MACD traces are in a bullish crossover, whereas the histogram fluctuates between bullish and bearish movements.

Read Extra: Straightforward strategies to Aquire Solana Meme Cash: A Step-By-Step Data

At the same time, the RSI is hovering in impartial territory, and the EMAs shield a golden crossover. Alternatively, they’re approaching near closely, doubtlessly ensuing in a Demise Unsuitable.

The form of development would deliver a short bearish style.

Solana’s No longer easy Week: Rate Dips Over 20%

Since our cautionary demonstrate on a doable correction in Solana when its price hovered around $190, it has indeed experienced a decline of over 20% from its weekly peak of approximately $205.

In consequence, the MACD histogram has shown a bearish style for the reason that outdated week. No topic this, the MACD traces shield their bullish crossover whereas the RSI progressively transitions from overbought territories to a impartial stance.

In the imply time, unparalleled Fibonacci helps are noticed around $160 and $130. In the match of a severe correction, Solana could well doubtlessly retreat to the golden ratio toughen end to $85.

At this level, the 50-week EMA serves as a extra pillar of toughen. It’s price noting that one of these pronounced correction wouldn’t invalidate the general bullish style, as necessary volatility is attribute of the cryptocurrency realm. As a consequence of this truth, it stays a plausible train.

MACD Histogram Indicators Downturn in Coming Month

The MACD histogram can also demonstrate a bearish style in essentially the most widespread month. In the imply time, the MACD retains its predominantly bullish stance, as evidenced by the bullish crossover of the MACD traces and the upward trajectory of the histogram.

Furthermore, the RSI is progressively transitioning from overbought ranges in direction of impartial territory.

Solana vs. Bitcoin: Looking ahead to a Bullish Leap at Fibonacci Strengthen

A critically particular train has unfolded pertaining to Solana’s efficiency against Bitcoin. Following a bearish divergence noticed in the weekly RSI, the Solana price faced a bearish rejection at the Golden Ratio resistance level of around 0.003 BTC.

Read Extra: Solana (SOL) Rate Prediction 2024/2025/2030

This development suggests a doable bullish rebound for Solana, with the chance of the price bouncing off Fibonacci helps ranging from approximately 0.0021 BTC to 0.0023 BTC, initiating an upward trajectory.

Alternatively, must the price fail to search out toughen at some level of the aforementioned fluctuate, necessary toughen is anticipated around 0.00145 BTC. It’s price noting that the MACD traces are nearing a bearish crossover, accompanied by a bearish downturn in the MACD histogram noticed for the reason that outdated week.