Rapidly Take

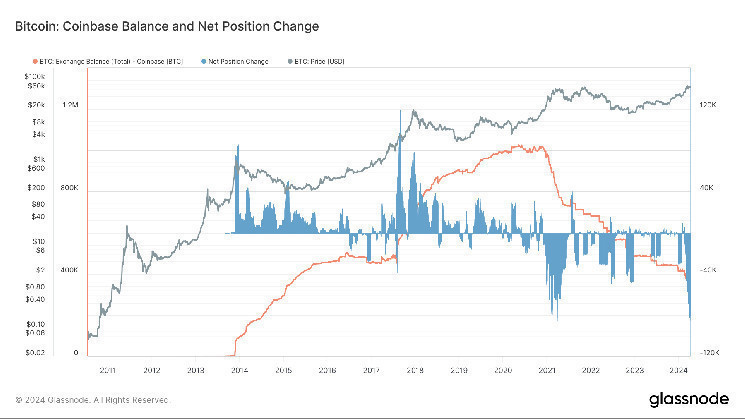

Glassnode records finds a substantial lower in Bitcoin (BTC) holdings on the Coinbase alternate. Over the past 30 days, a critical 85,000 BTC had been withdrawn from the platform, marking the 2d-supreme discover outflow on file for a 30-day duration. This mirrors a the same occurrence in March 2021, when 86,000 BTC left Coinbase.

The alternate’s Bitcoin steadiness has confirmed a consistent decline since March 2020. In December 2020, Coinbase possessed roughly 1 million BTC, but by July 2021, this figure had dwindled to stunning 730,000 BTC – a low cost of 270,000 BTC amidst the value surge from $10,000 to $60,000.

More now not too long in the past, this downward pattern has accelerated. Following the originate of the inaugural Bitcoin ETFs in January 2024, Coinbase held 411,000 BTC. Currently, this figure has plummeted to 294,000 BTC, indicating a decline of roughly 120,000 coins in a mere two months, coinciding with a trace hovering around $72,000. These inclinations counsel both retail and institutional traders are impulsively withdrawing their Bitcoin holdings from the alternate.

All the draw by means of the final two months, CryptoSlate has documented several well-known withdrawals from Coinbase, with the most most modern being roughly $1.1 billion.