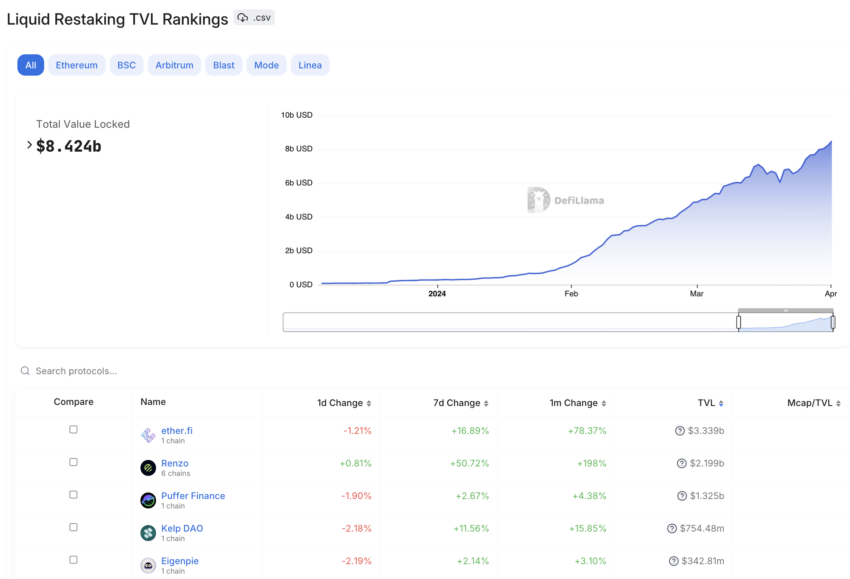

The decentralized finance (DeFi) sector is witnessing a transformative pattern, with liquid restaking tokens (LRTs) reaching a staggering whole value locked (TVL) of virtually $8.5 billion.

This surge highlights a broader legend within the DeFi ecosystem, suggesting a shift in funding dynamics.

Which Liquid Restaking Protocols Are Contributing to TVL Growth?

Main this fee is EtherFi, which by myself commands a TVL exceeding $3.3 billion. Due to this, protocols like Renzo, Kelp, and Puffer are additionally experiencing unprecedented enhance.

Etherfi’s dominance, followed carefully by Renzo with $2.2 billion and Puffer at $1.3 billion, signifies a sturdy market appetite for liquid restaking. Moreover, Kelp and EigenPie make contributions severely, with TVL of over $750 million and $342 million, respectively.

“Liquid restaking protocols now withhold a watch on practically 5% of staked Ethereum, most of which used to be staked in 2024,” pseudonymous DeFi researcher Hildobby stated.

Study more: Ethereum Restaking: What Is It And How Does It Work?

Importantly, the adoption of EigenLayer is central to this pattern. It facilitates restaking, allowing customers to devour salvage admission to to their funds, which boosts the TVL in these protocols.

Moreover, EigenLayer has become a pivotal component on this ecosystem, with its TVL now surpassing $12.4 billion. The protocol’s approach to leverage these funds for boosting network security is noteworthy.

Namely, since February 2024, EigenLayer and varied restaking platforms began attracting personnel consideration. A file by BeInCrypto highlighted a unparalleled 171% develop in EigenLayer’s TVL in precisely one week in February, underscoring the market’s enthusiasm for liquid restaking.

Irrespective of a rapid lived end in restaking deposits on EigenLayer, the ardour in LRTs stays excessive. Protocols like EtherFi, Renzo, and Kelp proceed to scheme ether deposits for restaking, promising additional rewards thru Eigen. This lunge has maintained momentum and bolstered the enhance of liquid restaking.

The allure of an EigenLayer airdrop has additional invigorated the DeFi personnel. Many are depositing staked Ethereum into EigenLayer to toughen their airdrop prospects. This approach is indicative of the evolving tactics within the DeFi sector geared in direction of maximizing returns.

Study more: What Is EigenLayer?

The consistent develop in TVL and strategic restaking practices indeed highlights the rising doubtless of liquid restaking as a pivotal legend within the DeFi home.

“Liquid restaking is the predominant legend for the subsequent decade,” DeFi analyst Chrome stated.