The cost of Polygon (MATIC) is witnessing a resurgence, indicated by a recovery in day-to-day active addresses following steep declines. This uptick, supported by the RSI 7D, suggests possible for additional shopping for that will most certainly most certainly boost MATIC’s designate.

On the opposite hand, caution is instructed as EMA traces level in direction of ongoing consolidation, hinting at a much less bullish outlook for MATIC in the advance term. Merchants should always peaceable weigh these contrasting indicators slightly.

Polygon Active Addresses Are Rising All but again

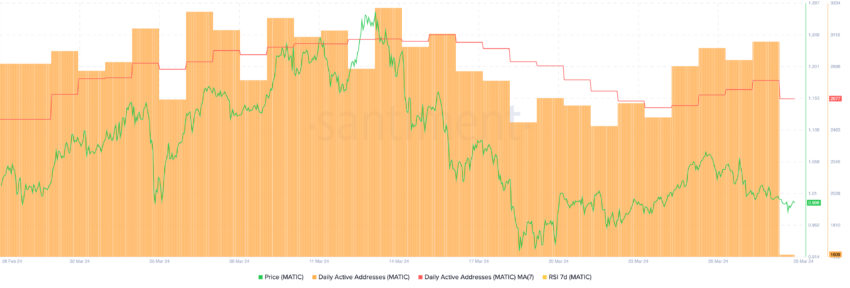

Polygon (MATIC) skilled a vital milestone on March 14, when the collection of day-to-day active addresses soared to three,301, coinciding with a designate surge to $1.27, marking its highest value since February 2023.

This height shows a solid correlation between MATIC’s designate and its active particular person snide, suggesting that greater engagement phases can force up MATIC’s designate.

On the opposite hand, a subsequent decline in day-to-day active addresses to 2,550 by March 24 indicated a cooling length. Remarkably, from March 24 to March 28, the day-to-day active addresses rebounded to three,069, with the Daily Active Addresses 7D Exciting Common indicating an uptrend.

This recovery suggests a renewed passion in MATIC, most certainly signaling an upcoming designate amplify. The relationship between active addresses and MATIC’s designate is principal, as rising particular person engagement typically precedes sure designate actions, providing a bullish outlook for investors and highlighting the platform’s rising adoption and utility.

Study Extra: 14 Absolute best Polygon (MATIC) Wallets in 2024

RSI Shows Room For Boom

The Relative Energy Index (RSI) for MATIC has seen a distinguished shift, currently positioned at 59, a lower from 66 at its designate height on March 13 and down from 62 correct two days in the past.

This decline in RSI, is a momentum oscillator that gauges the high-tail and alternate of designate actions. This would most certainly most certainly signal a cooling length for MATIC’s outdated bullish momentum. RSI values differ from 0 to 100, with thresholds plot at 70 for overbought stipulations, indicating a possible designate reversal. It additionally has a threshold of 30 for oversold stipulations, suggesting a possible designate amplify.

Provided that MATIC’s RSI is now at 59, falling from greater values, it doubtless factors in direction of a length of consolidation. This stage means that MATIC is neither overbought nor oversold. Which capability the associated fee could most certainly most certainly stabilize in the immediate term as market people assess its subsequent directional stride.

MATIC Designate Prediction: EMA Lines Are Not Bullish

Whatever the sure indicators from rising day-to-day active addresses and a healthy RSI for MATIC, the EMA (Exponential Exciting Common) traces contemporary a much less optimistic outlook. EMA traces, that are a animated moderate that locations a greater weight and significance on the most contemporary records factors, are no longer aligning in a bullish pattern for MATIC designate.

Particularly, MATIC’s temporary EMA traces are positioned below its long-term traces, and all are above the hot designate line. This configuration on the final indicates a bearish sentiment, suggesting that the associated fee is below rigidity and should always peaceable be expected to claim no if contemporary traits continue.

Study Extra: Top 5 Yield Farms on Polygon

On the opposite hand, MATIC finds sturdy relieve at $0.95 and $0.90, hinting at possible consolidation spherical these phases from its contemporary designate. Must the market sentiment shift negatively, a downtrend could most certainly most certainly force MATIC’s designate down to $0.81.

Conversely, an even alternate in market dynamics could most certainly most certainly propel MATIC in direction of resistance phases at $1.17 and most certainly $1.30 if sustained momentum is carried out.