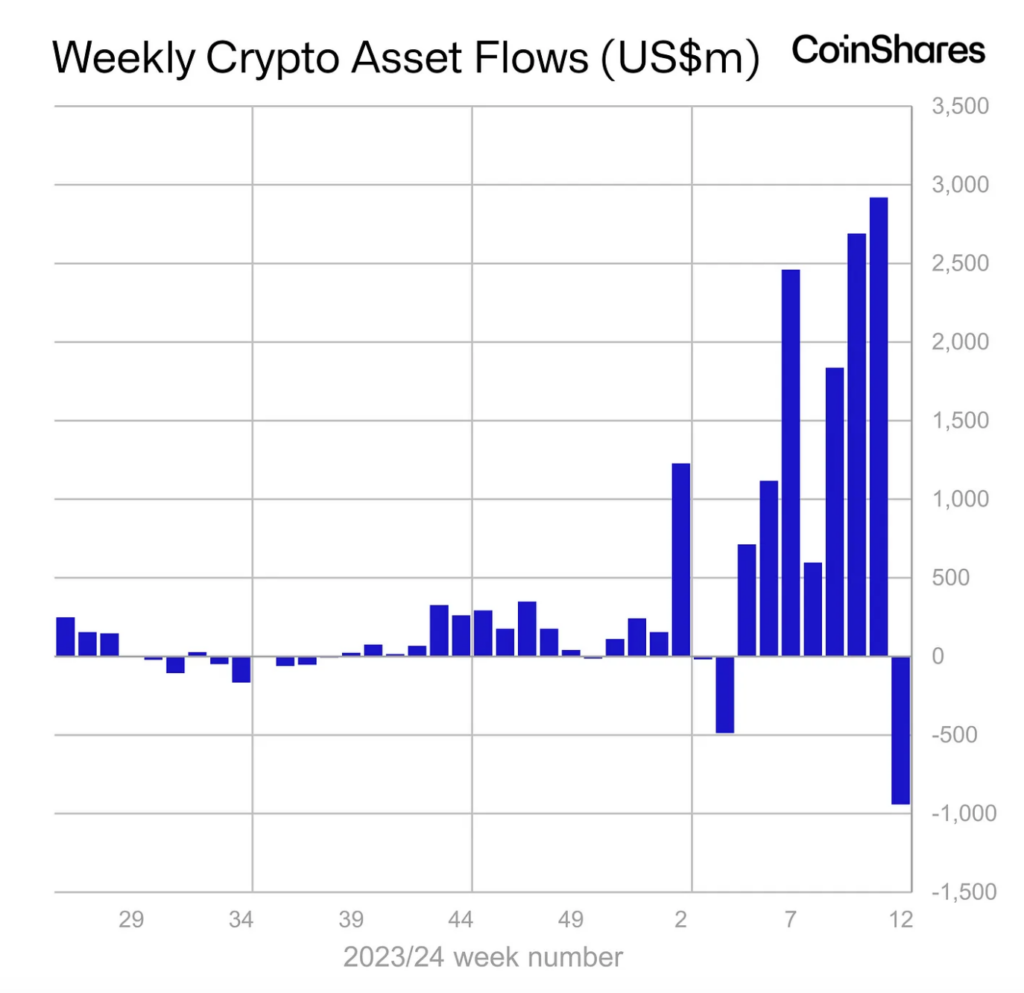

The outflow from crypto investment products from March 16 to 22 reached $942 million after the maximum historic inflow of $2.92 billion.

CoinShares consultants show mask that beforehand, clear dynamics had been observed for seven weeks. Right thru this length, inflows into instruments amounted to $12.3 billion. Commerce turnover amounted to $28 billion after a thunder $43 billion the outdated week.

The principle driver of the negative dynamics used to be outflows from GBTC from Grayscale for $2 billion. They exceeded fetch inflows to its opponents ($1.1 billion). This ability that, market members withdrew a thunder $904 million from Bitcoin (BTC) associated instruments after the ideal-ever receipts of $2.86 billion per week earlier.

Mixed with a rollback in quotes, the amount of digital sources beneath management diminished by $10 billion to $88.2 billion. A week earlier, the metric right this moment exceeded $100 billion. From structures that allow opening speedy positions on BTC, purchasers took $3.7 million after the maximum investment because the muse of the year of $26 million within the outdated seven days.

In Ethereum (ETH) funds, the outflow elevated from $13.9 million to $34.2 million. Investors withdrew $5.6 million and $3.7 million from instruments essentially based fully on Solana (SOL) and Cardano (ADA), respectively. Merchandise essentially based fully on Polkadot (DOT), Avalanche (AVA), and Litecoin (LTC) recorded inflows of $5 million, $2.9 million, and $2 million, respectively.

Great, per week earlier, inflows in cryptocurrency investment products amounted to $2.92 billion after $2.69 billion within the outdated reporting length. Thus, the inflow because the muse of the year reached $13.2 billion. For comparison, for the total 2021 the resolve used to be $10.6 billion.

You would possibly per chance perchance furthermore admire: Crypto market outlook for 2024: insights and predictions