Over the final week, Avalanche (AVAX) designate has skilled a broad amplify, accumulating a 21.93% issue. Despite its most novel surge in designate, the Relative Strength Index (RSI) remains healthy, suggesting that AVAX would possibly well develop extra.

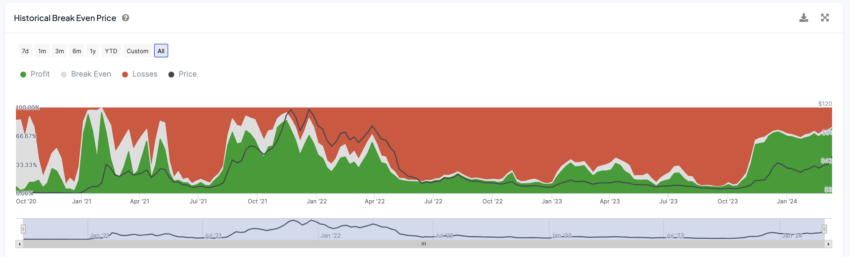

In the in the meantime, 75% of AVAX holders are in a a hit region. Historical recordsdata reveals that this stage repeatedly serves as a famous tipping point for AVAX, indicating that the asset would possibly well be at a pivotal 2nd for future efficiency.

AVAX RSI Is Shut to 70, but It’s Tranquil Healthy

Over the final few days, there changed into as soon as a noticeable decrease in the 7-day Relative Strength Index (RSI) for AVAX, shedding from 75 to 69. Despite this decline, its designate astonishingly surged from $40 to $61 inner the span of per week.

The RSI is a momentum oscillator to earn the trail and magnitude of directional designate movements. It operates on a scale ranging from 0 to 100, the set an RSI figure above 70 from time to time signals an overbought situation, indicating that the asset will likely be priced elevated than its accurate designate, and a studying below 30 suggests an oversold teach, hinting that the asset would possibly well be undervalued.

The noticed decrease in the RSI, in tandem with a outstanding uptick in designate, implies that even if there’s a diminutive decline in the shopping for momentum for AVAX, its market designate has managed to climb elevated. This arena would possibly well be attributed to tough investor confidence or recognizing intrinsic designate inner AVAX.

With the RSI hovering spherical 69, it verges on the purpose of coming into the overbought zone. Tranquil, it remains inner what’s going to likely be conception just a few moderately healthy vary, indicating neither overvaluation nor undervaluation in a broad intention.

Will bear to the RSI shield its region below the overbought designate with out experiencing a steep decline, this would possibly well extra point out a continued hobby from merchants, thereby providing a foundation for added upward circulation in designate. This arena suggests that merchants are mute serious about supporting AVAX, doubtlessly leading to sustained designate appreciation.

75% of AVAX Holders Are Now Profitable

Following the most novel upswing in its market designate, a ambitious 75% of AVAX holders, amounting to 5.6 million americans, safe themselves in a a hit region. This marks a broad shift from the steadiness noticed over the outdated two months, the set the proportion of a hit AVAX holders oscillated between 50% and 60%.

The same surge to 75% a hit holders changed into as soon as closing witnessed in 2021. After that surge, AVAX designate skilled a huge rise from $75 to $117 inner staunch 20 days. This historical context illuminates the importance of the Historical Destroy Even Stamp as a metric.

No doubt, this metric gauges the moderate designate at which all present holders would neither manufacture nor lose money, offering insights into the total profitability of an funding in the cryptocurrency market over time.

For AVAX, 23% of holders are mute at a loss, which would possibly well point out that these holders will proceed holding their AVAX, ready for it to rise extra so they’ll generate earnings. This is even extra well-known since AVAX is mute 57.91% below its all-time excessive, which reinforces the doable arena the set holders will now not commence promoting their AVAX rapidly.

AVAX Stamp Prediction: Trudge to $70 All over again?

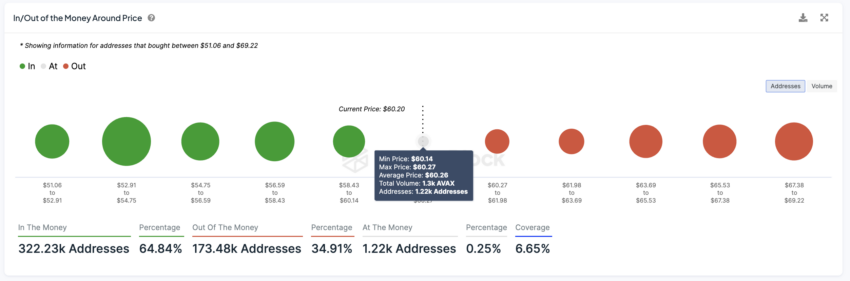

If the uptrend continues, we would possibly well test an ascent to the $70 designate. That would possibly well be the first time since 2022 AVAX has reached that designate. A great amplify of 16.67% from its present designate. To be in a region to fabricate that, AVAX would must damage key resistances at $63, $65, and $67. However, they don’t seem that solid in comparison with AVAX strengthen zones.

The chart in point of curiosity, an In/Out of the Cash Spherical Stamp (IOMAP), visually represents the set designate ranges align with clusters of investor exercise. It presents a heatmap for areas with vast numbers of “In the Cash” addresses, doubtlessly acting as strengthen zones, and areas of “Out of the Cash” addresses, suggesting doable resistance zones.

In the Cash addresses are americans that bought AVAX at a designate decrease than the present designate, implying they are currently in a a hit region. Out-of-the-Cash addresses bought at elevated costs and are on the 2nd at a loss.

On the opposite hand, AVAX has key strengthen at $58 and $56. These ranges symbolize key thresholds the set the asset has previously found a solid shopping for hobby, acting as a security obtain towards extra declines. If AVAX can’t shield these serious strengthen ranges, it’s miles going to also succumb to bearish pressures, taking flight towards the $52 stage.

This form of decrease would signify a 13.33% reduction from its present designate, underscoring the importance of these strengthen zones in warding off a extra gigantic tumble in designate.