After weeks of hotfoot efficiency and a dominating bullish sentiment, the crypto market shifted to a moderately bearish short stance. Bitcoin (BTC) has led the circulate, with a retracement down under the old all-time high give a rob to line at $69,000.

This process has also modified the open ardour (OI) panorama in the derivatives market with most up-to-date big liquidations. Previously, long positions were dominating all cryptocurrencies, which is now going on with short positions.

Actually, crypto merchants skilled a long squeeze against their positions, driving costs at lower levels. Which capability truth, the scenario currently favors short squeezes, expected to happen if short-sellers get liquidated, driving costs upwards.

In explicit, Finbold spotted two cryptocurrencies on CoinGlass with the next short-squeeze doable that can perchance presumably pump next week.

Brief squeeze alert for Ethereum (ETH)

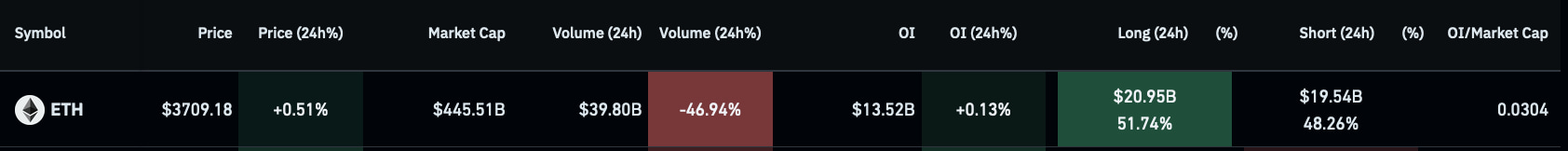

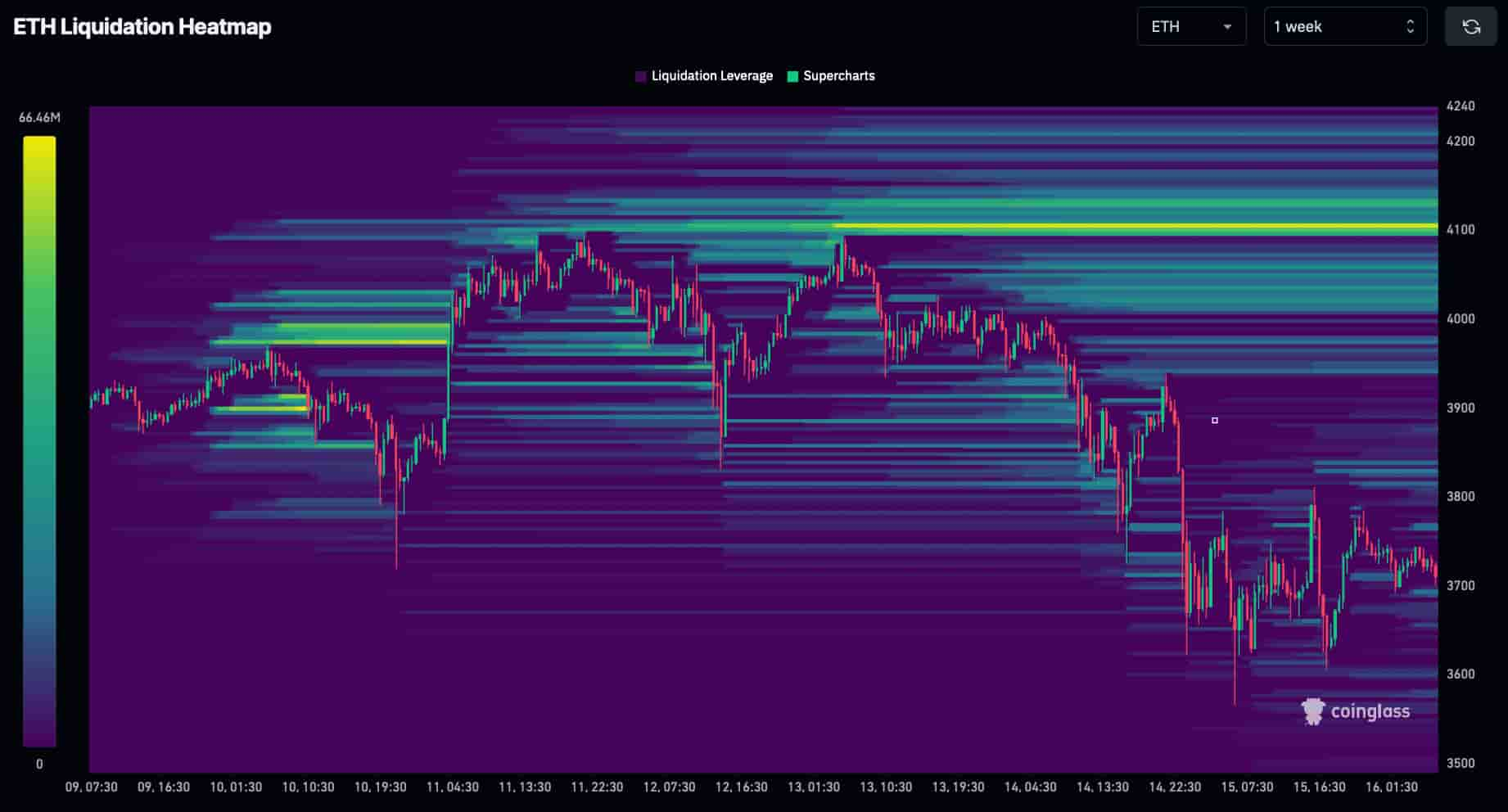

First, Ethereum (ETH) is trading at $3,709 with just mark action less virtually 47% of its day after day volume. This lower volume reflects on long positions dominating the previous 24 hours by 51.74%.

Nonetheless, the final open ardour in greater time frames is easy dominated by shorts. Pondering the previous 24 hours most tantalizing represents 0.13% of Ethereum’s total OI.

The ETH weekly liquidation heatmap evidences that, with cumulative short liquidations in the $4,100 zone. Market makers could perchance presumably hunt this zone by plot of a short squeeze, pumping the price into this liquidity pool and above.

Litecoin (LTC)

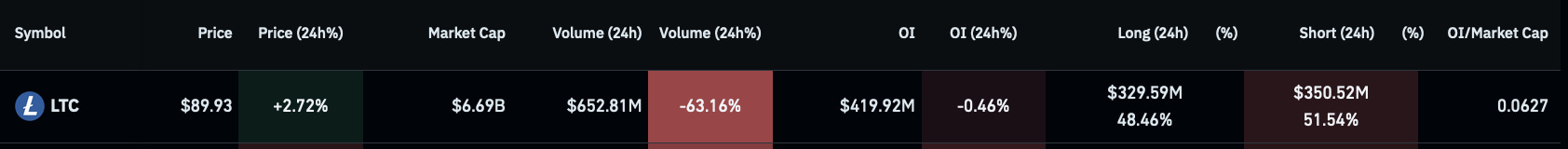

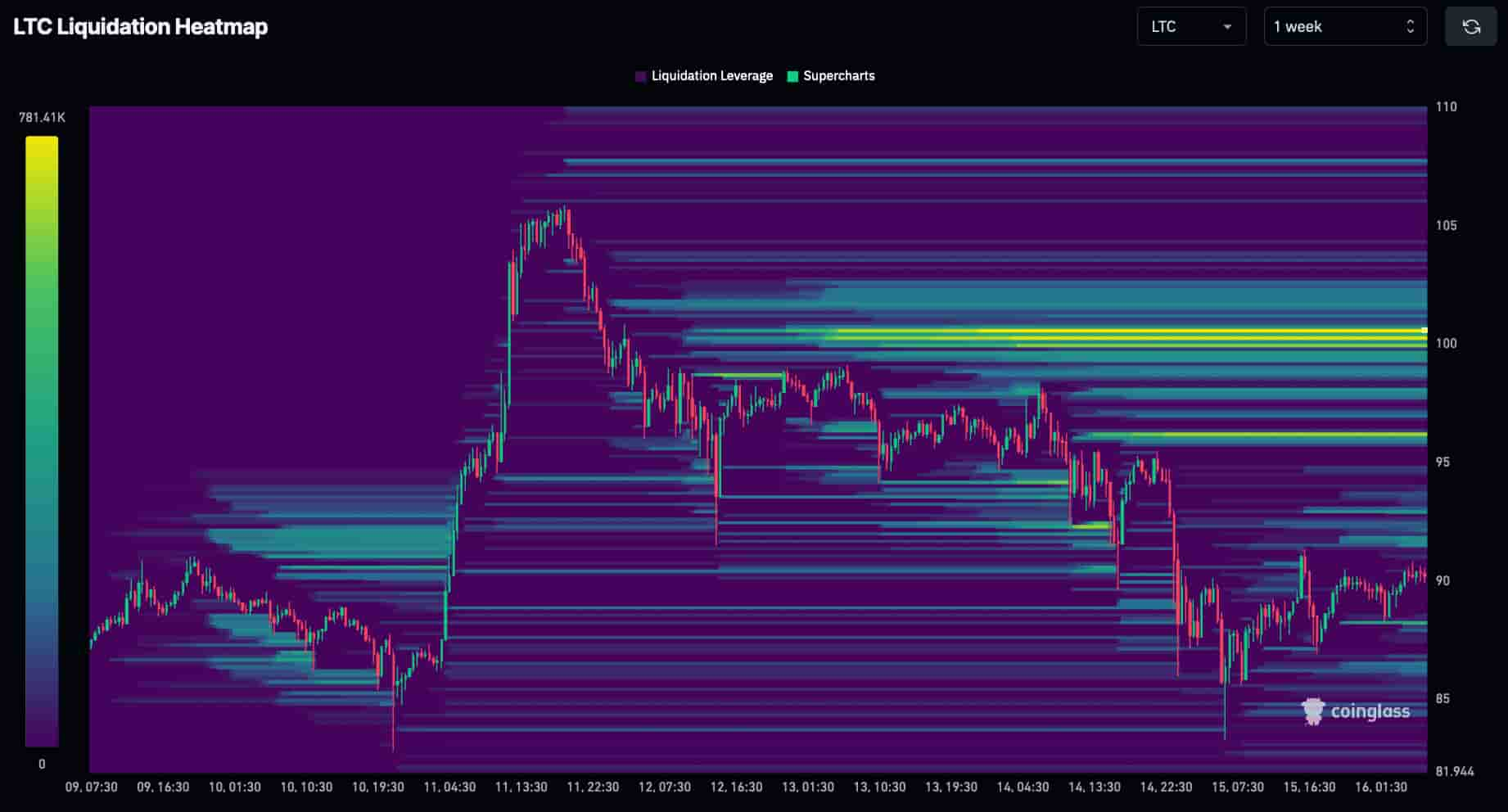

Second, Litecoin (LTC) is trading at $89.93, moderately up 2.72% in the final 24 hours following the ‘Funds’ crypto memoir.

In an identical sort, LTC has a fundamental liquidity pool to the upside, the fruit of a short space dominance in Litecoin’s OI. In particular, the heatmap presentations three of those swimming pools in the $100 psychological resistance zone. Thus, a probable target for a most likely short squeeze next week.

In summary, a short squeeze rally to the doable zones would characterize 10.5% and 11.2% gains for ETH and LTC, respectively. Nonetheless, cryptocurrencies are volatile and unpredictable resources. Traders must open positions carefully while applying appropriate likelihood management to defend some distance from liquidation.

Disclaimer: The bellow material on this honest also can easy not be belief to be funding advice. Investing is speculative. When investing, your capital is at likelihood.