The Bitcoin (BTC) mark saw wild buying and selling instances on Tuesday, rapid hitting recent all-time highs above $73,000 rapidly after the discharge of hotter-than-expected US inflation recordsdata, sooner than shedding into the $68,000s.

BTC has since recovered over 3.5% from earlier session lows to $71,000, with its violent $4,500 mark swing having wiped out positions held by leverage trader price over $100 million, as per coinglass.com.

The Bitcoin mark’s stable rebound from sub-$70,000 intra-day lows will embolden the bulls, who remain very grand up to the mark.

Bitcoin is up 12.7% in seven days and 42% within the previous 30 days, as per CoinMarketCap.

Driving the upside has been a mixture of bullish fundamentals.

These embody colossal power inflows into the no longer too long within the past launched space Bitcoin ETFs and FOMO as Bitcoin gears up for its four-yearly halving tournament.

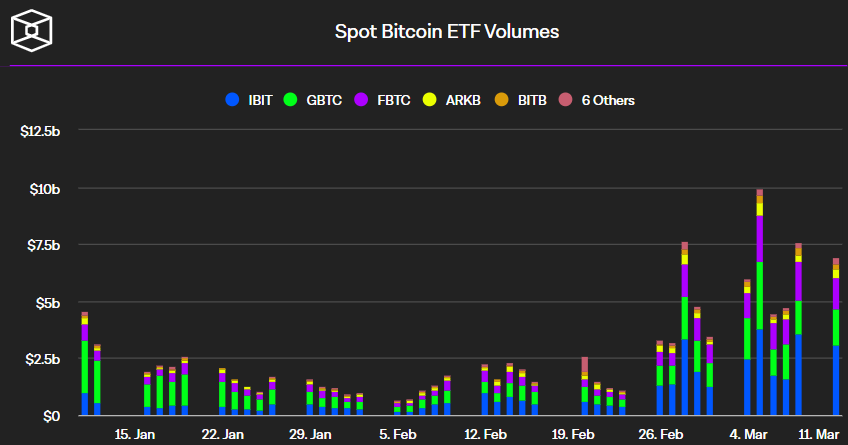

Plight ETF buying and selling volumes clocked in at shut to $7 billion on Monday, as per The Block recordsdata.

Final week, volumes averaged over $6.5 billion per day.

That’s a extra than 6x jump from early February when on a traditional basis volumes had been averaging around $1 billion per day.

Surging quiz for space Bitcoin ETFs has powered the mark greater. Source: The Block

Surging quiz for space Bitcoin ETFs has powered the mark greater. Source: The BlockThe set aside Subsequent for the Bitcoin Model?

And whereas essentially the most contemporary hotter-than-expected US inflation figures has pushed wait on on Fed price decrease expectations, with the CME Fed Watch Instrument exhibiting that money markets now mark a 32% of no price cuts by June (up from 28% on Monday), analysts attain no longer request this to agree with a lasting affect on the recent bull market.

“There’s simply too grand bullish momentum in crypto,” Nansen analyst Aurelie Barthere acknowledged in a analysis existing.

“We attain no longer request a first-rate sell-off for crypto as this repricing has took space within the previous few months without questioning the bull market.”

The crawl at which recent BTC tokens are issued to community validators (or miners) is scheduled to halve subsequent month.

With the provide shock of the halving looming coupled with a huge influx of recent quiz from the ETFs, Bitcoin mark risks remain tilted strongly to the upside.

While there would possibly perhaps without problems be non permanent setbacks, Bitcoin stays in a period of mark discovery because it scales all-time highs.

In such instances, shoppers are inclined to focal point on main spherical numbers as their mark targets.

$100,000 is one such stage that the market is doubtless to be fixated on.

There stays an out of doorways chance that Bitcoin can rally here sooner than the April halving.