Bitcoin (BTC) is at the center of the financial markets after breaking its all-time excessive in per week to surpass the $70,000 label in the newest rally. In this line, the considerable goal is on where Bitcoin will land next, brooding about that the document excessive has deviated from the past norms of emerging after the halving tournament.

In taking a watch at the next Bitcoin trajectory, crypto buying and selling knowledgeable TradingShot projected in a TradingView post on March 8 that the next memoir for Bitcoin will doubtless goal over $300,000.

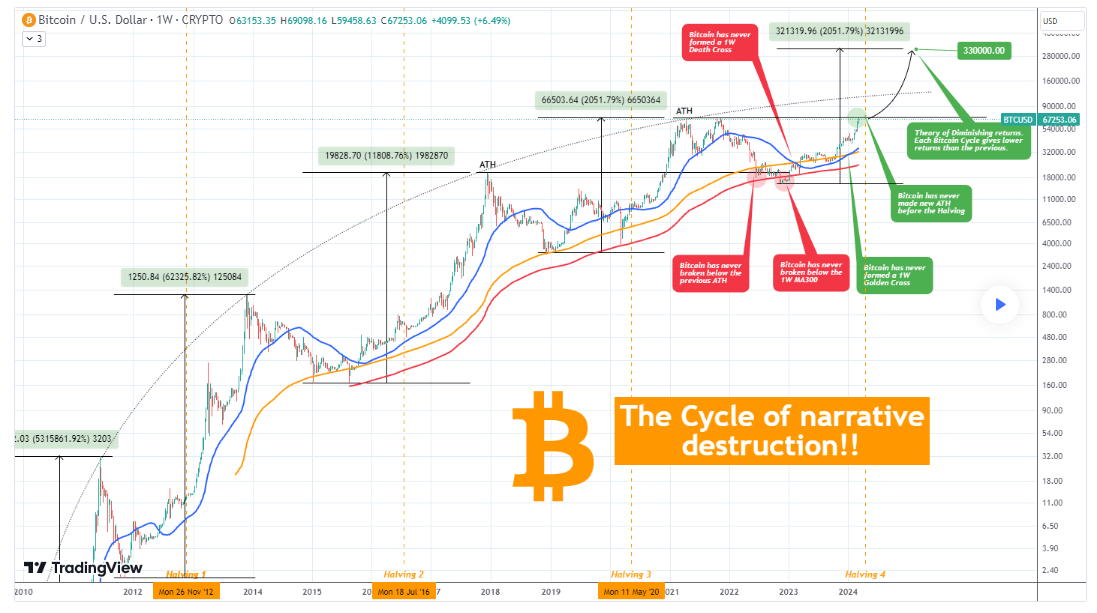

The analyst presented the ‘Cycle of Narrative Destruction,’ highlighting how historic patterns will doubtless affect the next BTC trajectory. In step with the knowledgeable, Bitcoin’s journey for the explanation that beginning of the 2021 cling cycle has been marked by surprising twists, prompting hypothesis on the next memoir to be broken.

The first memoir emerged on June 13, 2022, when Bitcoin breached the old document excessive of $19,350. This surprising proceed scheme the stage for a series of memoir shifts.

One more memoir emerged in November 2022, post-FTX smash; it dipped below the one-week involving average of 300 for the first time, main to the inaugural one-week death nefarious by February 2023. A swift recovery in 2023 saw Bitcoin net its one-week golden nefarious between December and January 2024.

TradingShot identified that these events discipline archaic expectations, emphasizing Bitcoin’s unpredictable and dynamic nature, offering both challenges and opportunities for market members.

Analysing Bitcoin’s next memoir

With five main memoir breaks in only 18 months, the following rely on is how Bitcoin will construct next, with the analyst presenting the Theory of Diminishing Returns (TODR).

TODR posits that every and each cycle could presumably accrued yield lower returns than the old one. Inspecting historic records, the first cycle delivered a staggering 531,681% returns, followed by 62,325%, 11,808%, and the newest 2,051%. If Bitcoin were to interrupt the Theory of Diminishing Returns, it would must develop fair a minute over 2,051% someday of the present cycle.

“That means that we could presumably neatly be taking a watch at a Cycle top above $330,000! Of route, if that happens, it would indicate that Bitcoin can even spoil above its historic Parabolic Development Channel, that will be view of one more memoir destruction,” he acknowledged.

Following its fresh all-time excessive, Bitcoin has corrected below the $70,000 label. Nonetheless, it maintains buying and selling above the considerable $65,000 crimson meat up zone, which analysts negate mandatory for sustained features.

Bitcoin faces market exhaustion

Despite this correction, the total sentiment in opposition to the asset stays bullish, particularly with the upcoming halving anticipated to expand the crypto market vastly.

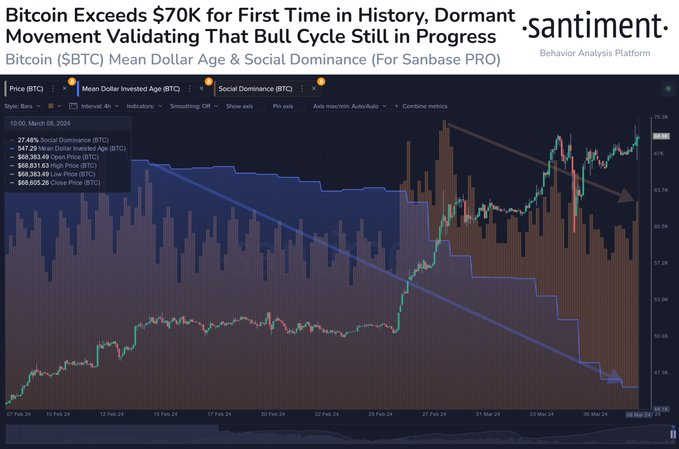

Nonetheless, concerns about doubtless market exhaustion net surfaced, with records from Santiment indicating that discussions about Bitcoin live “quite healthy.”

“The proportion of discussions connected to $BTC vs. assorted sources is at a fairly healthy 27.5% apt now, but not nearly at the euphoric ranges shown when $60K used to be being eclipsed simply 9 days previously… and this is a GOOD thing. #FOMO and greed are in total top indicators,” Santiment acknowledged.

As of the present press time, Bitcoin is priced at $68,481, boasting weekly features of approximately 10%.

Disclaimer: The swear on this build of residing could presumably accrued not be view of investment recommendation. Investing is speculative. When investing, your capital is at menace.