- Arbitrum model is standing merely about 50% from its yearly lows, poised to lengthen north on Ethereum model’s cue.

- ARB would possibly well additionally fly 12% to certain the January 11 top of $2.4250, with eyes peeled on $2.6000.

- A break and close underneath $1.7307 would manufacture a decrease low, invalidating the bullish thesis within the technique.

Arbitrum (ARB) model s shopping and selling with a bullish bias, but continues to consolidate interior a unfold. The upside attainable for the Ethereum Layer 2 (L2) token will likely be reinvigorated as soon as ETH model nicks the $4,000 psychological stage, with ARB susceptible to appreciate the help of the following liquidity overflows into ETH betas.

Arbitrum model eyes 12% explosion

Arbitrum (ARB) model is confronting instantaneous resistance on account of the $2.2017 blockade, which markets to top of a market vary from $1.7307. With solid give a elevate to downward on account of the 50-day Easy Intelligent Real looking (SMA) at $1.8989, ARB model would possibly well additionally break the $2.2017 roadblock, clearing the path for an extension north.

A flip of the $2.2017 resistance stage into give a elevate to would put of dwelling the tone for Arbitrum model to lengthen to the $2.4250 top, stages closing tested on January 11. This form of transfer would constitute a 12% climb above present stages.

In a highly bullish case, Arbitrum model would possibly well additionally certain this vary high to attain of dwelling one other local top at the $2.6000 psychological stage.

Stumble on the ascending Relative Strength Index (RSI), which is proof of rising momentum. The quantity indicators are additionally bullish, to be conscious a strengthening pattern. These add credence to the bullish thesis.

ARB/USDT 1-day chart

On-chain metrics supporting Arbitrum model bullish thesis

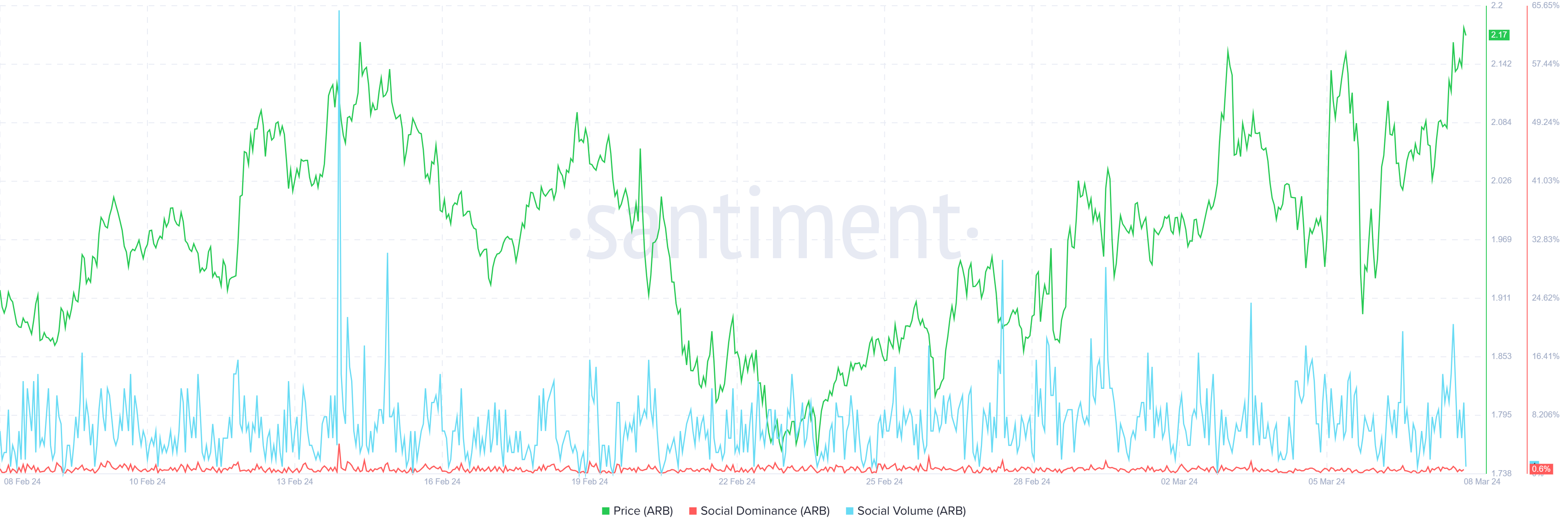

To delivery with, the social dominance and social quantity metrics are losing, which is bullish because it potential the ARB venture isn’t overhyped. When there would possibly well be too worthy hype spherical a venture, the price tends to inch the diversified potential.

ARB Santiment: social dominance, social quantity

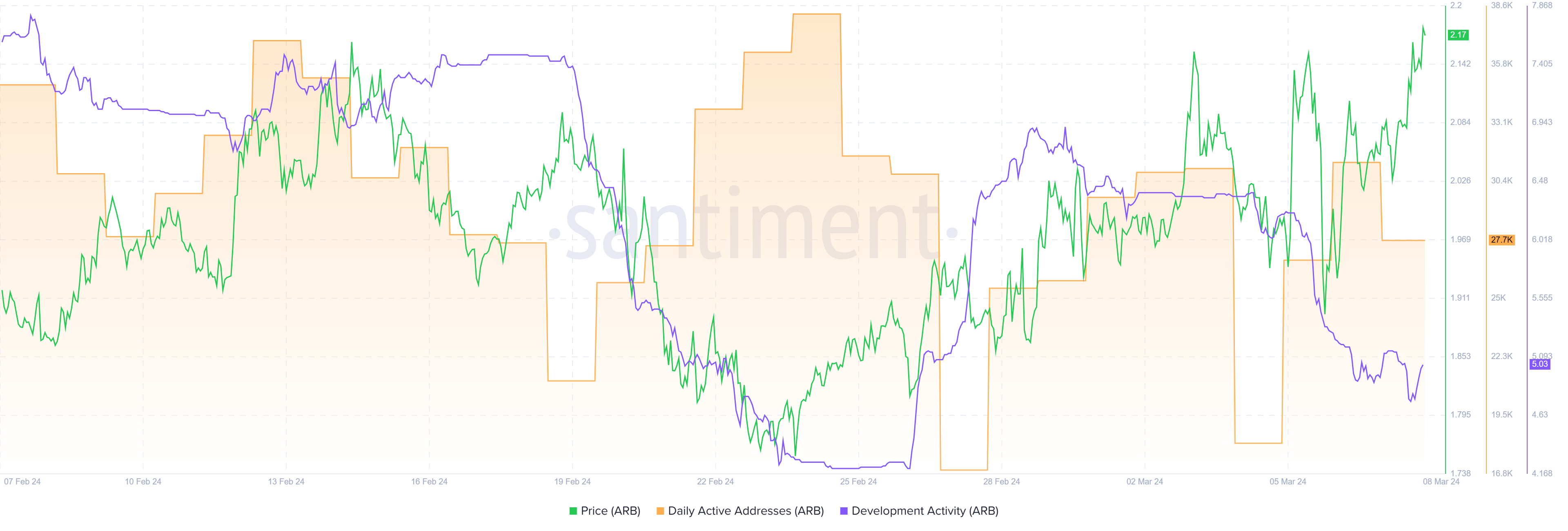

Furthermore, the number of day-to-day active addresses created for ARB, successfully pointing to crowd interaction, has elevated, as has the pattern project on the community. With extra addresses being alive to in ARB, coupled with community linked progresses, this metric is a bullish catalyst for the L2 token.

ARB Santiment: Day-to-day active addresses, pattern project

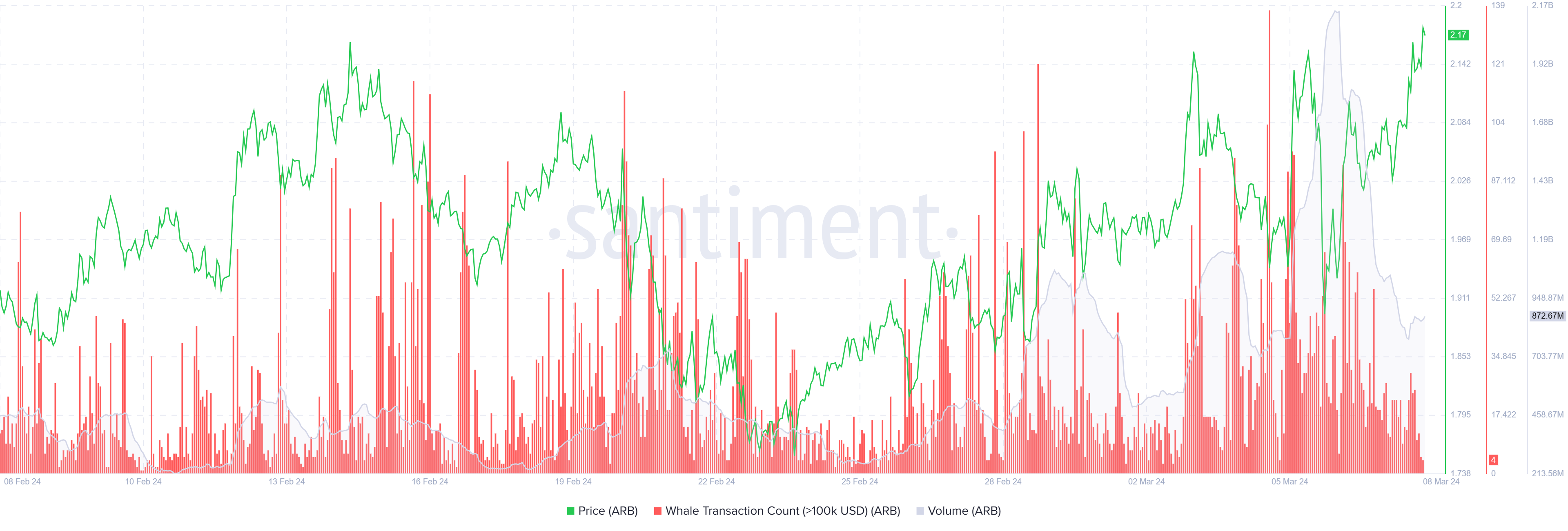

The whale transaction depend metric for transactions exceeding $100,000 has additionally confirmed considerable spikes over the closing few months. This coupled with the expansion in quantity is a bullish classic.

ARB Santiment: Whale transaction depend, quantity

On the flip facet, if merchants delivery to cash out on the beneficial properties made up to now, the Arbitrum model would possibly well additionally fall, first losing the give a elevate to on account of the 50-day SMA at $1.8989. A long tumble would possibly well additionally send ARB model to the $1.7307 give a elevate to, underneath which the ARB model would carry out a decrease low underneath the 200-day SMA at $1.6867. This is able to invalidate the bullish thesis.