With energetic addresses on a proper ascent and its correlation with Ethereum painting a bullish portray, MATIC’s worth proposition is gaining traction. Does this mark the starting of a label rally, and if so, may possibly presumably well presumably also we glance it ascend to the $1.24 threshold?

This evaluation delves into the metrics forecasting MATIC’s possible trajectory, harnessing files to unravel the account.

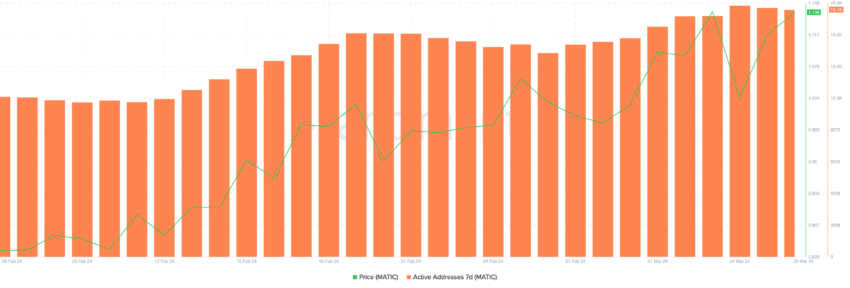

Active Addresses on the Upward push

Active MATIC addresses grew by nearly 60% in the final 30 days. Historically, we are succesful of glance a solid correlation between sing in energetic addresses and payment, as considered in the chart below.

On February 6, it registered 10,439 energetic addresses. That quantity jumped to 15,708 on March 3. The label adopted that lead, rising from $0.83 to $1.14 in the same duration — a 37.35% sing.

Matic hasn’t touched the $1.14 label level since April 2023.

Despite the considerable sing in energetic addresses and the label over the final month, issues hold began to plateau. Per historic files, a stop in the growth of energetic addresses frequently precedes a duration of label stabilization or a possible label correction.

This pattern suggests that lets interrogate the label of MATIC to apply run neatly with, doubtlessly coming into a consolidation phase or experiencing a downward adjustment in the discontinuance to future.

Correlation With Ethereum: A Bullish Concord

Historically, MATIC prices hold closely mirrored these of ETH, most incessantly showing a correlation coefficient exceeding 0.8. This connection intensified particularly final month. Particularly, the correlation soared from a modest 0.5 on February 1 to a striking 0.95 by March 6.

Given the most modern upward momentum of Ethereum, this discontinuance correlation may possibly presumably well presumably signal promising possibilities for MATIC. It may possibly perhaps in point of fact presumably well presumably also even manual MATIC in opposition to the $1.24 label target forecasted above.

Alternatively, a definite disparity becomes evident when examining the growth rates of each and each ETH and MATIC throughout the most modern year. The ETH label has escalated by a direct of 4.5 times extra than MATIC. With the backdrop of their historically sturdy correlation, it looks plausible to predict that MATIC may possibly presumably well presumably even hold the functionality for an upswing.

Additional evaluation finds that after MATIC sing for the year-to-date is positioned against that of the discontinuance 10 excellent cryptocurrencies except for memecoins and stablecoins, it lags behind. MATIC became outpaced by 9 of these significant cryptos, most productive managing to reach the next sing fee than AVAX.

MATIC Imprint Prediction: Is $1.23 Likely By March 15?

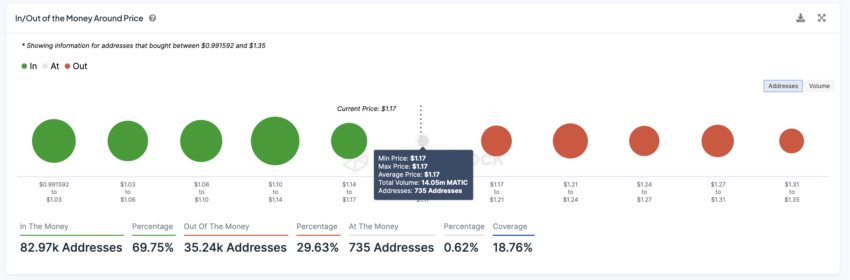

Inspecting the IOMAP chart reveals that the neat different of addresses “In the Money” suggests that there is predominant beef up at decrease label levels, namely round the neat concentration of traders at $1.10. If this level holds, it will possibly presumably well presumably also discontinuance additional downtrends.

If the label breaks above the $1.17 resistance, it will possibly presumably well presumably also show a solid bullish signal and doubtlessly lead to a additional upward cross in opposition to the following resistance levels round $1.21 and doubtlessly $1.24 or better. Right here’s for the reason that red bubbles (indicating addresses “Out of the Money”) previous $1.14 would birth to flip inexperienced (winning), thus lowering selling stress.

If the most modern beef up levels are broken, in particular if the label drops below the neat inexperienced bubble between $1.10 and $1.14, it will possibly presumably well presumably also trigger a bearish pattern. Right here’s on legend of breaking a predominant beef up level may possibly presumably well presumably lead to a loss of self assurance and doubtlessly reason a promote-off.

Furthermore, the correlation with ETH can decrease. Although it continues to hold a excessive correlation, MATIC’s label may possibly presumably well presumably also undergo if ETH enters a bearish pattern.

Disclaimer

The total easy job contained on our internet protest material is published in merely faith and for regular files applications most productive. Any motion the reader takes upon the easy job found on our internet protest material is precisely at their very beget possibility.