Willy Woo, a crypto analyst, has captured the crypto neighborhood’s attention alongside with his latest glimpse on Bitcoin (BTC), suggesting an impending necessary surge for the asset.

This optimism follows the approval of space Bitcoin ETFs, which Woo believes would channel extra enormous capital into the market, doubtlessly catalyzing a “enormous rally” in Bitcoin’s imprint.

Beyond Technical Prognosis: Market Sentiments And Prediction

Willy Woo took to X to fragment his diagnosis, drawing on Bitcoin’s historical performance to shed gentle on its future trajectory. Woo reminisced about July 2010, when Bitcoin’s imprint used to be a mere 0.7 cents, and the procedure it noticed a tenfold develop in precisely five days, followed by a 1,000x mumble over the following two years.

The analyst moreover attributed this mumble to Bitcoin’s exposure to global liquidity, particularly through its integration with the Mt. Gox exchange platform. This day, Woo sees a parallel scenario, albeit on a noteworthy grander scale, with Bitcoin gaining listings on global stock markets and overseeing around $100 trillion in capital.

In accordance with Woo, the influx of hobby and investment from these quarters would possibly per chance per chance dwarf the technical diagnosis charts that in the intervening time signal overbought conditions. This would perhaps per chance be paying homage to the unhurried 2020 cycle, when Bitcoin attracted necessary space purchases from high-receive-price people.

Jul 2010, BTC used to be 0.7 cents, it popped 10x in 5 days, then one other 1000x 2 years following.

Why?

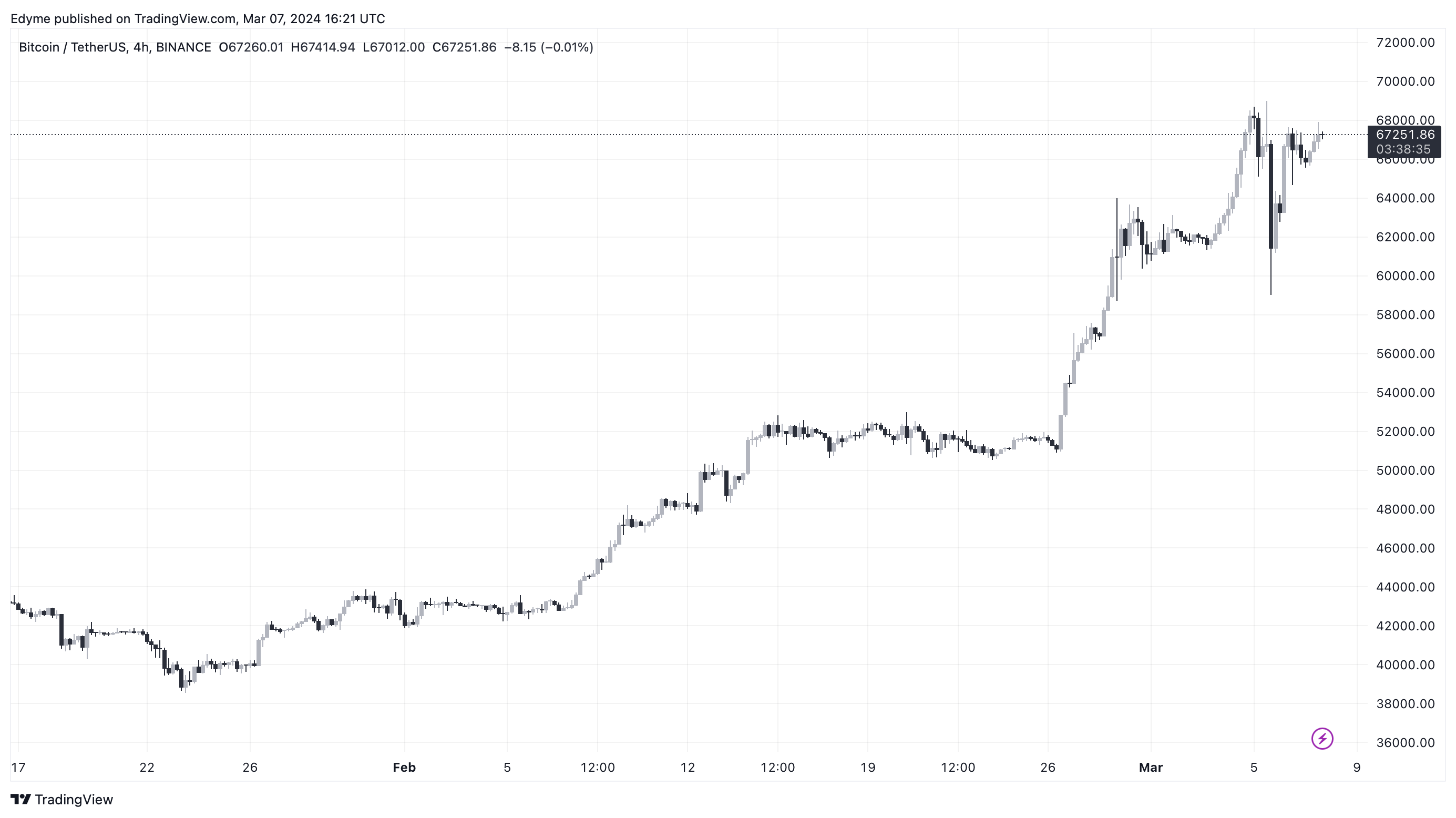

BTC used to be introduced to global liquidity with the appearance of MtGox.#Bitcoin just bought listed on the worlds stock markets which holds ~$100T of capital, and they also are piling in. pic.twitter.com/m7yxyUudK7

— Willy Woo (@woonomic) March 7, 2024

While Willy Woo parts to the structural conditions surroundings the stage for Bitcoin’s rally, other market analysts and traders are making their predictions. Peter Brandt, a successfully-regarded figure in the buying and selling neighborhood, has moreover shared his standpoint on Bitcoin’s probably for mumble.

Brandt’s diagnosis means that if the bull pattern post-April 2024 mirrors the momentum noticed since the November 2022 low, Bitcoin would possibly per chance per chance reach as high as $150,000 by October 2025.

When Bitcoin has a unexpected and engaging shake-out decline, the market is solely winking at you $BTChttps://t.co/Qip2tQ5h44 pic.twitter.com/KSbGYvTFlW

— Peter Brandt (@PeterLBrandt) March 6, 2024

Bitcoin Contrasting Views And Market Indicators

Amid the bullish forecasts, contrasting views and indicators counsel a extra cautious outlook. Crypto analyst and dealer Ali has these days identified probably signs of an impending imprint retracement for Bitcoin.

Utilizing the Tom DeMark (TD) Sequential indicator, Ali infamous a promote signal on Bitcoin’s day-to-day chart. This pattern warrants shut monitoring, given the indicator’s track epic of precisely predicting Bitcoin traits since the launch of the year.

Earlier conditions noticed a purchase signal in January preceding a 34% imprint develop, whereas a 4% imprint fall followed a promote signal mid-closing month. Because the TD Sequential develops a promote signal, there’s speculation about a probably transient correction for Bitcoin.

The TD Sequential indicator flashed a promote signal on the #Bitcoin day-to-day chart, which warrants shut attention!

Boasting a sturdy track epic in predicting $BTC traits since the year’s launch, this indicator beforehand signaled a purchase in early January, preceding a 34% surge, and… pic.twitter.com/T7DIjiCxzv

— Ali (@ali_charts) March 5, 2024

Featured image from Unsplash, Chart from TradingView