Prominent crypto analytics firm Glassnode says Bitcoin is in a lengthy lasting uptrend powered by merchants who’re aloof doubting the energy of BTC.

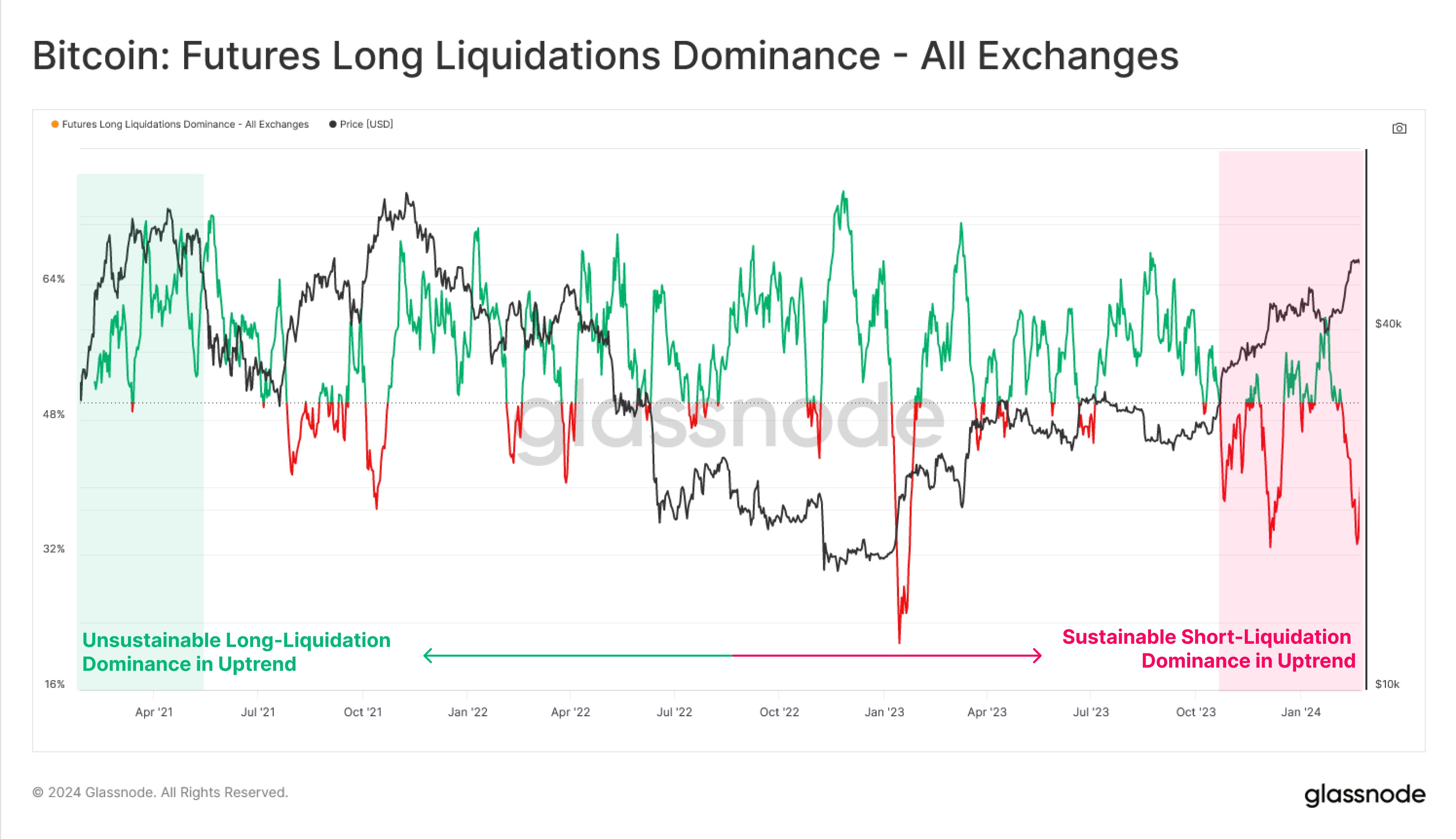

In a unique put up on the social media platform X, the analytics firm says Bitcoin’s fresh bull flee seems very diversified from the one witnessed in 2021 when BTC bulls had been the utilization of excessive leverage to pressure up the set apart of the crypto king.

In step with Glassnode, bears who’re shorting BTC are getting liquidated, triggering brief squeezes and offering gas for Bitcoin rallies.

A brief squeeze occurs when merchants who borrow an asset at a definite set apart in hopes of marketing it for lower to pocket the variation are forced to aquire relief the sources they borrowed as momentum moves in opposition to them, triggering extra rallies.

Says Glassnode,

“It’s miles worth noting that at each and each Bitcoin ATH (all-time high) peaks in 2021, lengthy merchants dominated liquidation volumes, as leveraged positions had been power-closed inner the intra-day volatility.

As such, seeing this sort of intrepid dominance of directional brief merchants being liquidated suggests many merchants private been making a wager in opposition to the prevailing uptrend since October.”

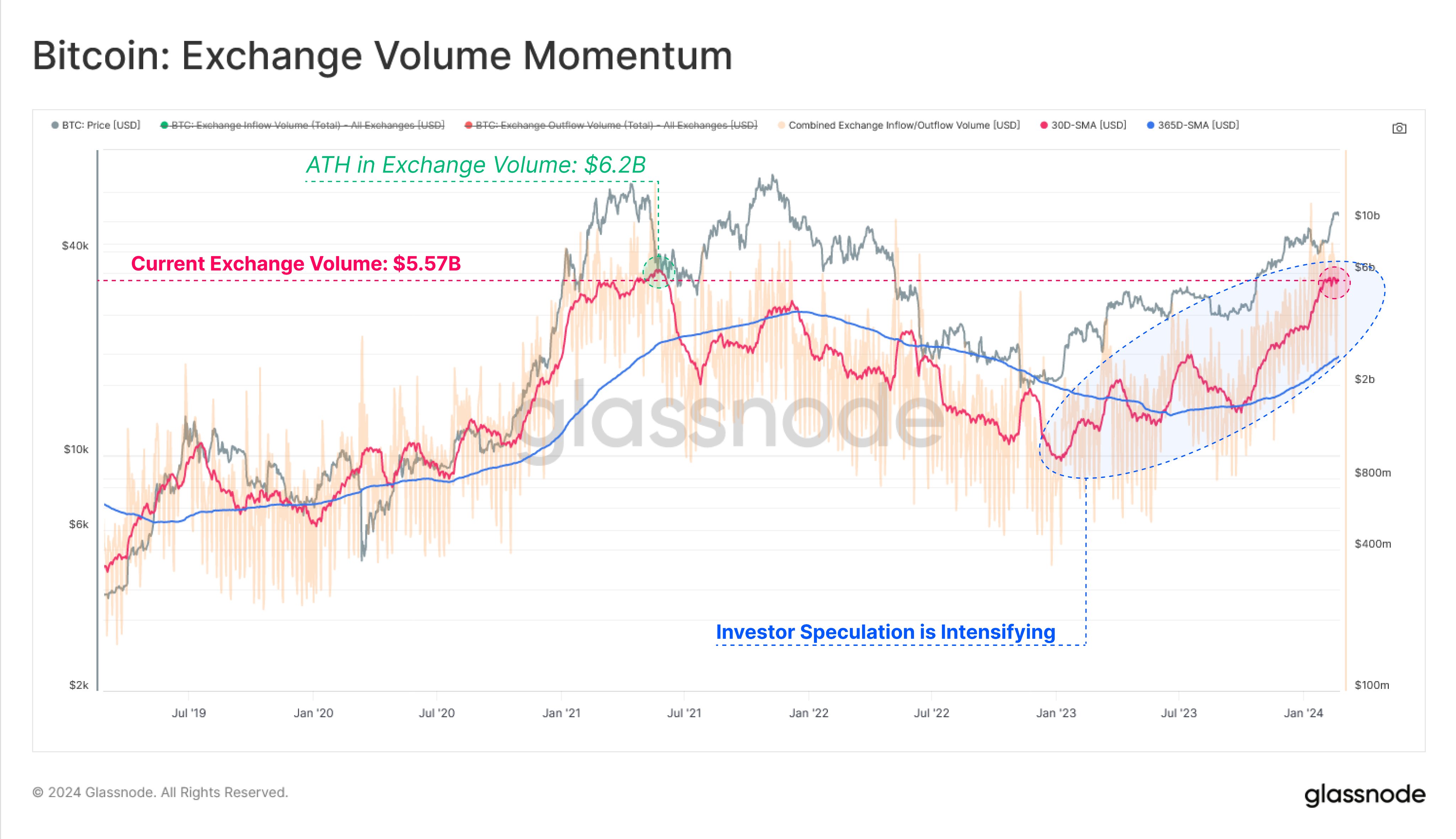

Glassnode additionally notes that Bitcoin is transferring inner and outside of crypto exchanges at a fee harking relief to November 2021, when BTC printed its all-time high of about $69,000.

“The total volume of Bitcoin deposits and withdrawals to exchanges has persevered to enhance, reaching a staggering $5.57 billion in everyday volume flowing inner and outside of exchanges, rivaling disclose seen one day of the November [2021] market all-time high.”

At time of writing, BTC is procuring and selling at $61,825.

Generated Image: Midjourney