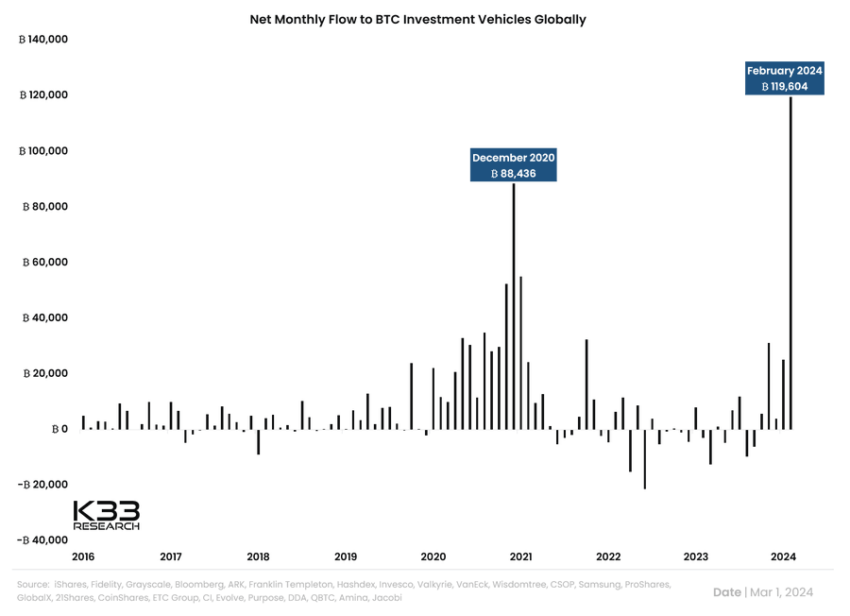

BTC surged by practically 50% early this 365 days, basically propelled by the introduction of Bitcoin Change-Traded Funds (ETFs). These ETFs beget greatly facilitated the accessibility of the main cryptocurrency for retail and institutional traders.

The recent mark action has sparked conversations among industry leaders about why institutional players are more and more drawn to the crypto market.

Why Institutions Are in Bitcoin

In a recent interview, Chainlink founder Sergey Nazarov identified that the influx of current traders into Bitcoin comes from the worldwide monetary machine, awaiting the next evolution within the crypto location: real-world asset tokenization. Nazarov emphasized that predominant monetary institutions are gearing up for asset tokenization, aiming to compete with or tap into the capital flowing into ETFs.

“The next stage is asset tokenization the assign banks recognize all these inflows into ETFs after which they build sources to compete with the ETFs or to receive some of that capital,” he stated.

Tokenization is the conversion of asset rights into digital tokens on a blockchain. This process promises enhanced liquidity, transparency, and efficiency for digitalized physical sources. Citing industry consultants, McKinsey forecasts a capacity $5 trillion commerce volume in tokenized digital securities by 2030.

Read more: What’s The Influence of Precise World Asset (RWA) Tokenization?

Likewise, BlackRock CEO Larry Fink believes tokenization represents a predominant technological step forward with the aptitude to radically change asset management.

“We beget the skills to tokenize at the present time. When you happen to’ve got a tokenized security and identity, the 2nd you aquire or promote an instrument on a total ledger, that is all created collectively. You’d like to discuss about factors spherical money laundering. This eliminates all corruption by having a tokenized machine,” Fink explained.

One other well-known ingredient riding institutional passion in Bitcoin, in step with US Presidential hopeful Robert Kennedy Jr., is its perceived position as a hedge in opposition to inflation. Kennedy smartly-known that Bitcoin’s recent mark performance additional bolstered its credibility as a refuge from central banks’ money-printing trends.

He also emphasized Bitcoin’s significance for transactional freedom, likening it to freedom of speech.

“We beget to make dart that that that folks making an are attempting to protect themselves in opposition to inflation can beget this, but also that they’ve transactional freedom and the authorities is now now not in a position to digitalize our foreign money admire they did in Canada,” Kennedy stated.

Read more: Bitcoin Be conscious Prediction 2024 / 2025 / 2030

Lastly, Galaxy Digital CEO Mike Novogratz opined that Bitcoin’s growth capacity will proceed attracting a “current military of traders.” In step with him, child boomers, who maintain a watch on $85 trillion of worldwide wealth, would possibly per chance perchance enter the Bitcoin market thru the sole within the near past launched Bitcoin ETFs. He urged that greater than half of of registered funding advisors (RIAs) would possibly per chance perchance facilitate this process.

Novogratz additional urged that Bitcoin’s market capitalization would possibly per chance perchance simply within the future surpass that of gold. The knowledgeable basically based this prediction on youthful generations, particularly Gen Z and Millennials, preferring Bitcoin over feeble sources admire gold.

Disclaimer

The whole info contained on our website material is published in appropriate faith and for total info purposes most interesting. Any action the reader takes upon the information stumbled on on our website material is precisely at their very own likelihood.