Morgan Stanley, a leading worldwide funding monetary institution and wealth management firm, has filed for Bitcoin publicity in a lot of institutionally centered funds to ship the shatter digital asset to the final public.

In an SEC filing, Morgan Stanley said that some funds would own oblique publicity to Bitcoin thru its investments in ETFs.

Morgan Stanley Wants Bitcoin Exposure

Morgan Stanley needs to mix the no longer too long up to now launched space Bitcoin ETFs into 13 funding vehicles. These comprise Abet Portfolio, Asia Different Portfolio, Counterpoint Worldwide Portfolio, and Worldwide Different Portfolio. Nonetheless, these funds are restricted from allocating bigger than 25% of their assets to Bitcoin ETFs.

Peaceable, Morgan Stanley acknowledged that these investments also own the identical dangers as investing in cryptocurrencies and Bitcoin.

“The Fund could maybe fair operate funding publicity to Bitcoin now not without delay thru investing in Bitcoin ETFs. The amount of the Fund’s funding in Bitcoin ETFs will possible be subject to sure limits on the time of funding. The hazards of investing in Bitcoin ETFs are same to the dangers of investing in cryptocurrencies on the total. Investments in a Bitcoin ETF expose the Fund to the total dangers related to Bitcoin,” the filing reads.

Here shouldn’t be any longer the first time Morgan Stanley has positively responded to crypto-related investments. Several of the firm’s funds previously held Grayscale’s Bitcoin Believe (GBTC) shares sooner than it transitioned to a space-traded ETF.

The funding monetary institution’s fresh filing could maybe a good deal boost the adoption and enlargement of newly introduced space Bitcoin ETFs. For the reason that launch in January, Bitcoin ETFs own spurred a surge in Bitcoin’s mark, surpassing $60,000. This surge is fueled by mountainous ETF inflows exceeding $7 billion and crucial accumulation by dapper investors.

While many now stay awake for this upward style to persist, consultants warn of a doable Bitcoin mark correction. Technical analysts famend that Bitcoin could maybe fair be drawing close indicators signaling a cycle high.

“Since 11th of September, Bitcoin has developed 233%. The worst closing mark decline modified into modified into -15.7% from January 8 to January 22. I issue a dip below 55,000 would be a looking out out opportunity, though the form of dip shouldn’t be any longer my prediction,” procuring and selling extinct Peter Brandt said.

Be taught extra: Bitcoin Price Prediction 2024 / 2025 / 2030

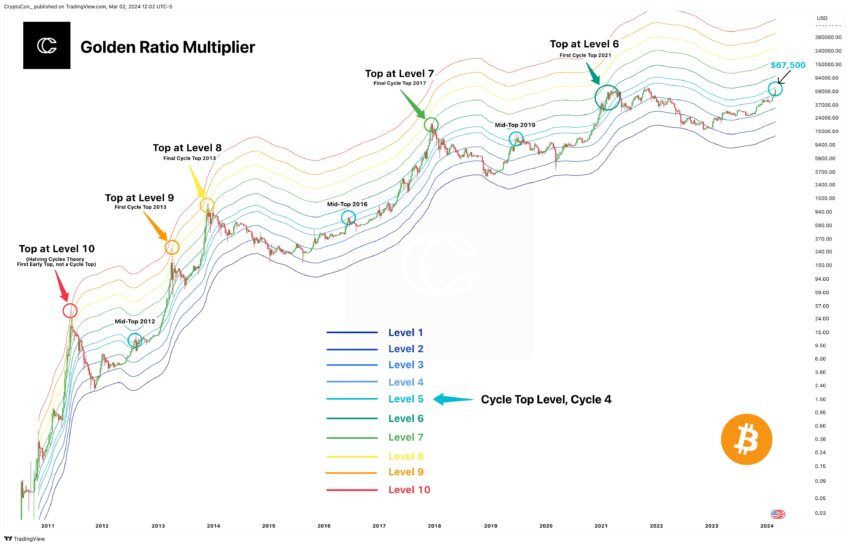

Yet one more indicator, the golden ratio multiplier, means that Bitcoin tops infrequently happen around “Stage 5.” This threshold sits at $67,500 in the unusual cycle. Interestingly, this indicator has proved valid in all outdated cycles, with Bitcoin many cases retracing after reaching this level.

“Stage 5 is where every cycle mid-high has been made on these bands, keeping the most exorbitant mark target for any mid-high mark level,” technical analyst CryptoCon explained.

Disclaimer

The total knowledge contained on our web location is printed in factual faith and for frequent knowledge purposes most attention-grabbing. Any motion the reader takes upon the certainty found on our web location is precisely at their very grasp likelihood.