After experiencing fixed features in fresh days, the price of Bitcoin (BTC) appears to be consolidating above $60,000, a stage that’s also functioning as a toughen. Alternatively, uncertainty persists concerning the next path for Bitcoin, because the asset did no longer retain its price above $64,000 after rapid touching it.

Having a watch ahead, crypto analyst Ali Martinez has presented a scenario that would possibly per chance well also pause in Bitcoin losing and finding capability toughen around the $50,000 zone.

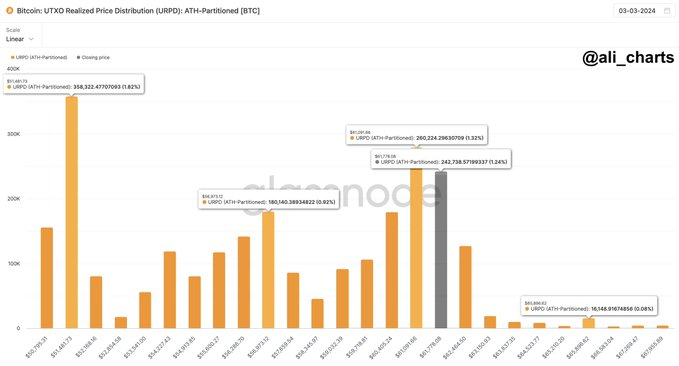

In a post on X (previously Twitter) on March 3, Martinez noted that bigger than 500,000 BTC had changed hands within the slim vary of $61,100 to $61,800, organising a sturdy toughen save.

In step with the analyst, if Bitcoin stays above $61,000, it would possibly per chance well also pave the vogue for a climb in direction of $65,900. Alternatively, a note of caution is warranted in a bearish flip. If Bitcoin dips below the established toughen, a correction would possibly per chance well be ended in, doubtlessly main the digital asset to as little as $51,500.

“Will contain to BTC dip below toughen, a correction would possibly per chance well also lead it down to $56,970 or even $51,500,” he said.

Indeed, the wide transaction quantity for BTC has happened amid a rising put a question to of for save Bitcoin alternate-traded funds (ETF), with a height volume of $73.91 billion on March 1. In the very long time frame, this product is idea a pair of bullish catalyst.

What subsequent for Bitcoin?

The level of interest remains mainly on Bitcoin’s capability to prevail in a single other all-time high, supported by catalysts like the upcoming halving match. Whereas $100,000 is the next likely scheme in 2024, Finbold reported that some analysts order the halving on my own would possibly per chance well also merely now no longer be the one real key.

On this context, crypto procuring and selling knowledgeable Gareth Soloway suggested that the likelihood of Bitcoin reaching $100,000 it would maybe be bolstered by increasing liquidity in the market. Alternatively, he emphasised that Bitcoin remains inclined to extra corrections despite a sure long-time frame outlook.

Bitcoin observe diagnosis

Bitcoin became procuring and selling at $62,634 by press time, having won nearly 1.5% in the final 24 hours. Over the past seven days, Bitcoin has rallied by almost 20%.

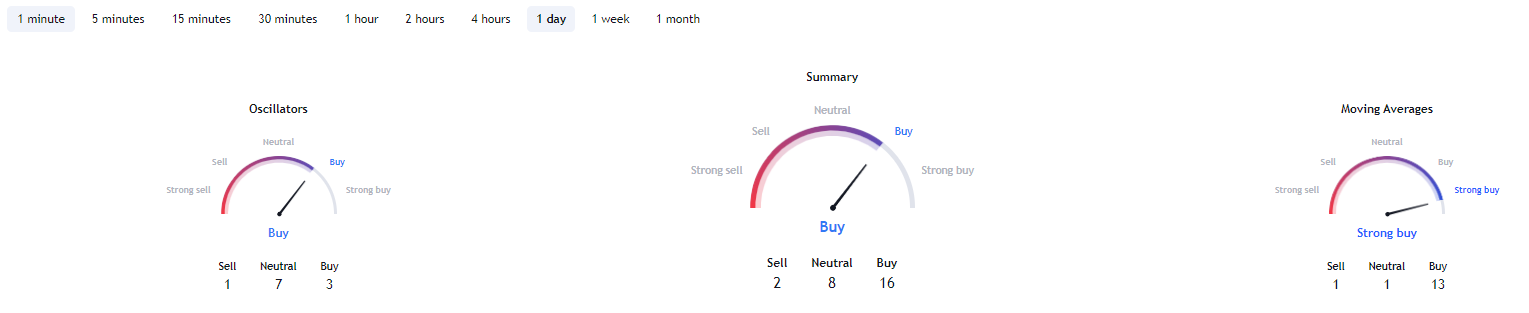

No topic the analyst’s likelihood of a bearish outlook, Bitcoin’s technical indicators are dominated by bullish sentiments. Let’s declare, a summary of the one-day gauges retrieved from TradingView suggests a ‘aquire’ sentiment at 16, whereas shifting averages notify a ‘stable aquire’ at 13. Oscillators imply a ‘neutral’ stance at 8.

Although Bitcoin has displayed bullish sentiments recently, the risk of losing the $61,000 toughen persists. This risk is extra elevated if factors much like increased whale selling come into play.

Disclaimer: The screech on this space would possibly per chance well also merely aloof now no longer be concept about investment recommendation. Investing is speculative. When investing, your capital is at risk.