Hasty Rob

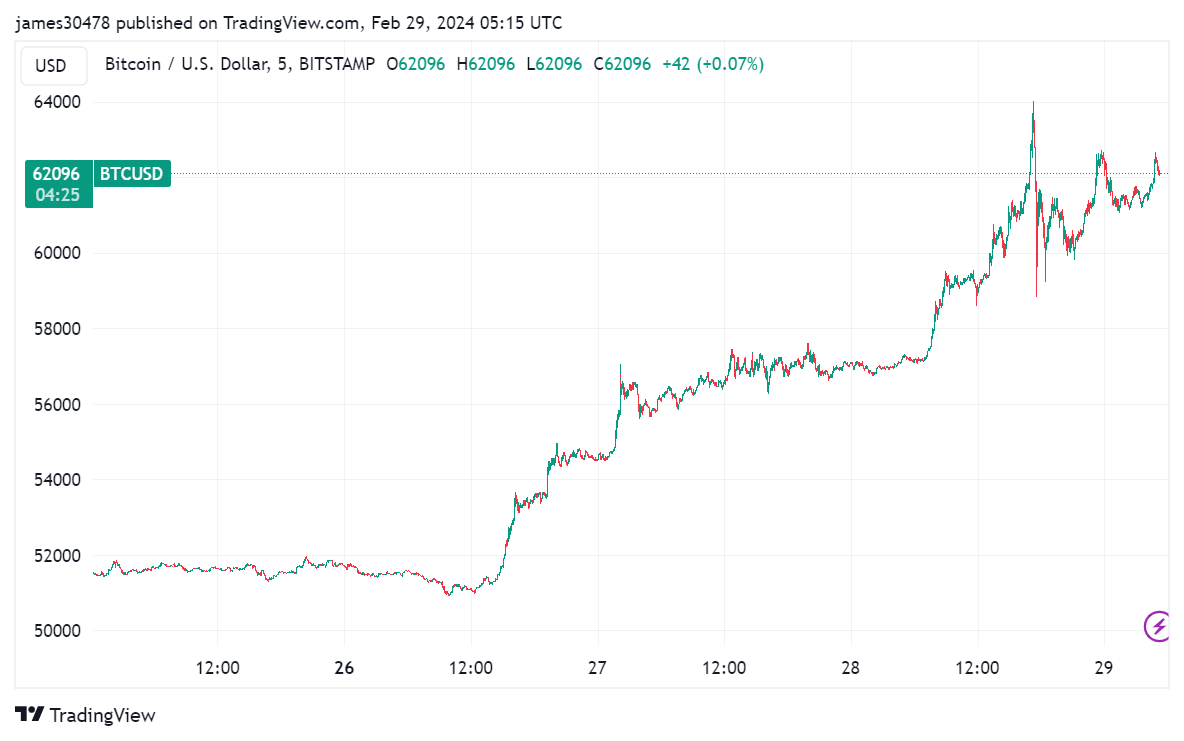

In a wild 24-hour sprint, Bitcoin’s imprint underwent a rollercoaster of fluctuations, skyrocketing to a peak of $64,000, subsequently plunging to $59,000, earlier than making a recovery to above $60,000.

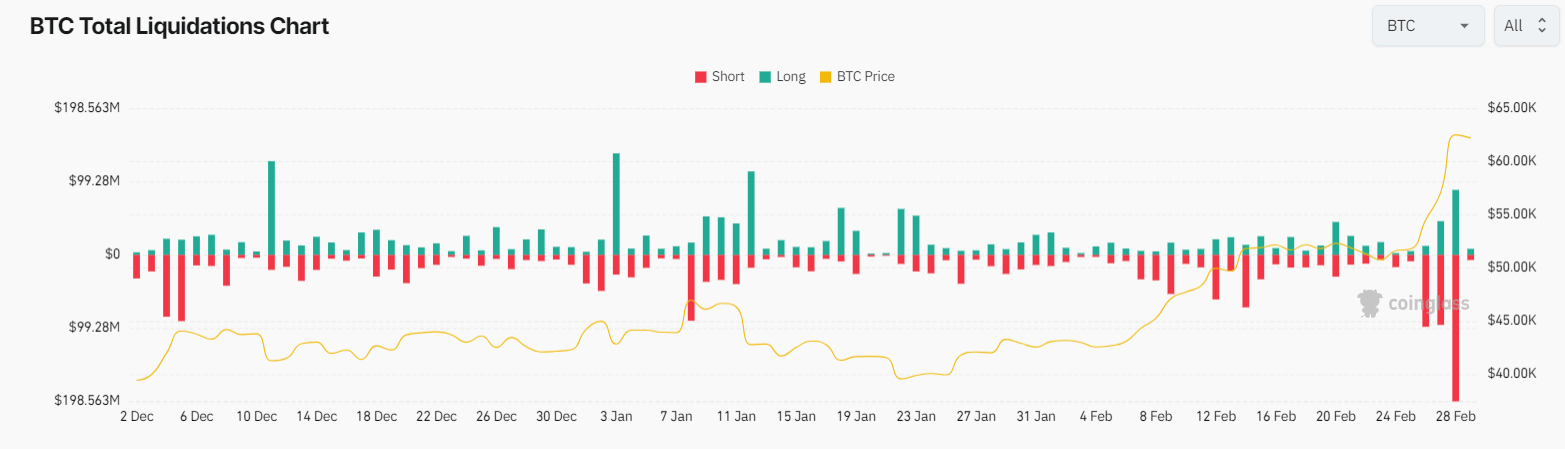

This climb caused a wave of liquidations, totaling roughly $800 million in the digital asset ecosystem, in step with Coinglass. All the strategy in which by Bitcoin’s ascent, rapid positions had been battered, while then long positions got liquidated attributable to Coinbase’s technical snag.

In response to Coinglass, the $300 million liquidation in Bitcoin, split between roughly $200 million shorts and $100 million longs, represents the ideally suited rapid liquidation tournament in the previous three months.

Attempting previous the tumultuous 24 hours, Bitcoin continues its upward style, notching a 44% assemble in February by myself. If the momentum holds by the last day of the month, Bitcoin will cease with six consecutive months of gains – a month-to-month efficiency no longer considered since December 2020, in step with Coinglass.