SynFutures, a decentralized perps change, has been waking waves in DeFi for the past few years. It has a lot patrons, a natty user flawed, and a ambitious trading volume, that diagram it has the entire components that could well abolish it a project to spy in 2024 and past. On this article, let’s dive into SynFutures to esteem the project and examine what’s so special about its latest product releases and campaigns.

Early Stage

SynFutures is a multi-chain decentralized derivatives change. The project has the backing of a immense resolution of gargantuan VCs, including Pantera, Polychain Capital, DragonFly, and Popular Crypto, and the DEX not too prolonged ago raised over $22 million in a Sequence B funding spherical. SynFutures V1, the principle iteration of the platform, launched in June 2021 and launched the opinion of single-token liquidity thru the Synthetic Automated Market Maker (sAMM) mannequin. This allowed LPs to fund any pool on the protocol with excellent one token, in most cases a stablecoin.

Single-token liquidity introduced a lot consideration and interest to the project, which fleet adopted up on its success with the launch of SynFutures V2. V2 launched permissionless list, permitting LPs to list any crypto tokens, coins, NFTs, and indices in 30 seconds with out prior approval. With permissionless list and single-token liquidity, the project aims to turn into the principle derivatives destination for gargantuan and shrimp property.

In step with studies from Messari, V1 and V2 get a cumulative volume of more than $23 billion, with over 10,000 customers and nearly 250 pairs listed for change. The achievement is impressive, serious about the project has but to suppose a token. As soon as that announcement is made, we are in a position to search recordsdata from increased trading job from fresh customers and airdrop farmers, which is ready to probably boost its trading metrics, and the prices earned thru these activities can even shoot up.

Birth of V3

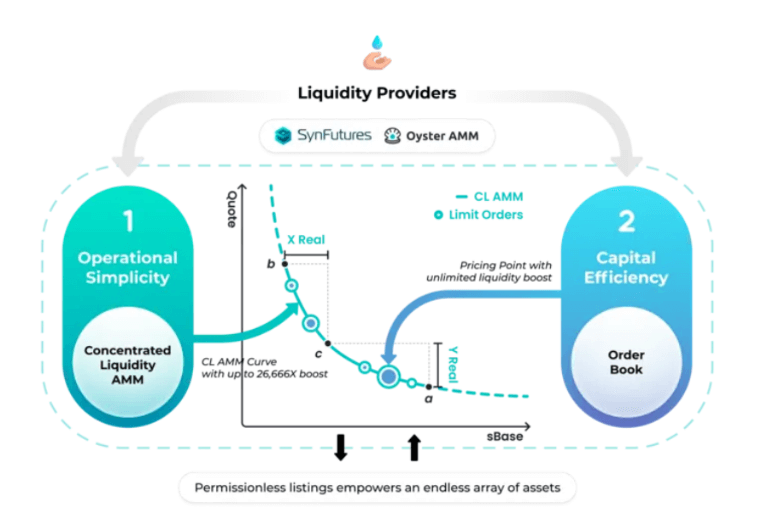

The protocol excellent launched SynFutures V3 on Blast mainnet. Just like the earlier versions, V3 introduces an give a raise to that will majorly impact liquidity suppliers (LPs) and merchants. The fresh model comes with a fresh AMM mannequin called Oyster AMM (or oAMM), permitting LPs to provide concentrated liquidity for any by-product pair listed on the platform. LPs can already provide single-token liquidity, however with the fresh AMM, LPs can even be ready to provide single-token concentrated liquidity. This fresh characteristic could well give a raise to capital effectivity for liquidity suppliers and rating them increased returns while lowering slippage for merchants; it’s a salvage-salvage acknowledge for all events interested.

How V3 works

In step with the SynFutures V3 whitepaper draft, the Oyster AMM mannequin became inspired by the synthetic Automated Market Maker (sAMM) mannequin from SynFutures V1 and the Concentrated Liquidity Market Maker (CLMM) mannequin from Uniswap V3.

In the account for e-book mannequin, liquidity is in most cases concentrated for the duration of the asset’s latest note, while the AMM mannequin spreads it for the duration of the total note vary. This makes AMMs less atmosphere pleasant for LPs and outcomes in more slippage for merchants. To lead sure of this, Oyster introduces concentrated liquidity that enables LPs to set up a unfold for the duration of the latest note where their liquidity could well perchance be active. To boot to, Oyster also will enable merchants to plan limit orders the spend of the account for e-book mannequin. These orders are then placed on the AMM curve as one other source of liquidity.

While Oyster AMM just isn’t the principle time a project has tried to combine AMM with an account for e-book, the earlier makes an attempt get mostly adopted a hybrid machine where some parts of the transaction occur off-chain while others occur on-chain. Such a machine within the waste depends on the centralized administrators who retain an eye on the off-chain portion of the transaction, thereby making it neither decentralized nor trustless. Such techniques are also exposed to doable backdoors and other vulnerabilities. Oyster, alternatively, is completely on-chain, guaranteeing transparency and increased security.

Combining AMM and Orderbook on-chain is a flowery job. Due to the this fact, to abolish obvious the two forms of liquidity complement every other, Oyster makes spend of a structure called ‘Pearl,’ which is a series of the entire concentrated liquidity covering a note level and all initiate limit orders on the similar note. The image and the clarification beneath provide a step-by-step story of how the mannequin works and the scheme in which an account for will get accomplished in Oyster AMM.

- When a market taker locations a fresh account for, Oyster first tests the Pearl at that note level.

- It then takes liquidity from the limit orders show at that Pearl. The transaction is completed if the liquidity within the limit orders is ample to have the market taker’s account for.

- If not, Oyster AMM then takes liquidity from the AMM. This increases the payment and strikes it along the AMM curve.

- If the account for will get fulfilled on the curve, the transaction ends. If not, the payment keeps increasing till the next Pearl is reached.

- The same project is adopted all once more, where the liquidity from the limit account for is stuffed first, and then liquidity from the AMM is taken.

- This project continues till the total account for is stuffed.

This twin diagram permits SynFutures V3 to get seriously increased capital effectivity than most of its chums within the derivatives dwelling. It even affords higher capital effectivity than a assign Dex love Uniswap V3. The table beneath, taken from their whitepaper, exhibits the capital effectivity comparability between UniSwap V3 and SynFutures V3 at a explicit vary.

| Mannequin | Fluctuate | Capital Effectivity Enhance |

|---|---|---|

| Oyster AMM | 99.99% to 100.01% | 39,997.0x |

| UniSwap v3 | 99.99% to 100.01% | 20,000.5x |

SynFutures & Oyster Odyssey

To get an even time the launch of V3 and Oyster AMM, SynFutures has launched ‘Oyster Odyssey’ advertising campaign that rewards customers with components for providing liquidity on the protocol, the machine is designed to reward user engagement and contribution to SynFutures ecosystem.

The components machine is designed to reward customers who provide liquidity and produce fresh customers to the platform. There will be a thriller box mechanism and a scamper-the-wheel machine which adds an component of fine fortune and fun to the advertising campaign.

Alternate on SynFutures V3 to be taught more.

Conclusion

Environment pleasant spend of capital is foremost in DeFi, especially within the early stage, where the total liquidity available is limited. While AMM units democratized liquidity provision, it suffers from decrease capital effectivity. Making improvements to upon it is a essential step in taking DeFi mainstream. SynFutures’ Oyster AMM is one such development that enables a trader to theoretically raise a change with zero slippage while accrued being completely on-chain; that is a welcome building.