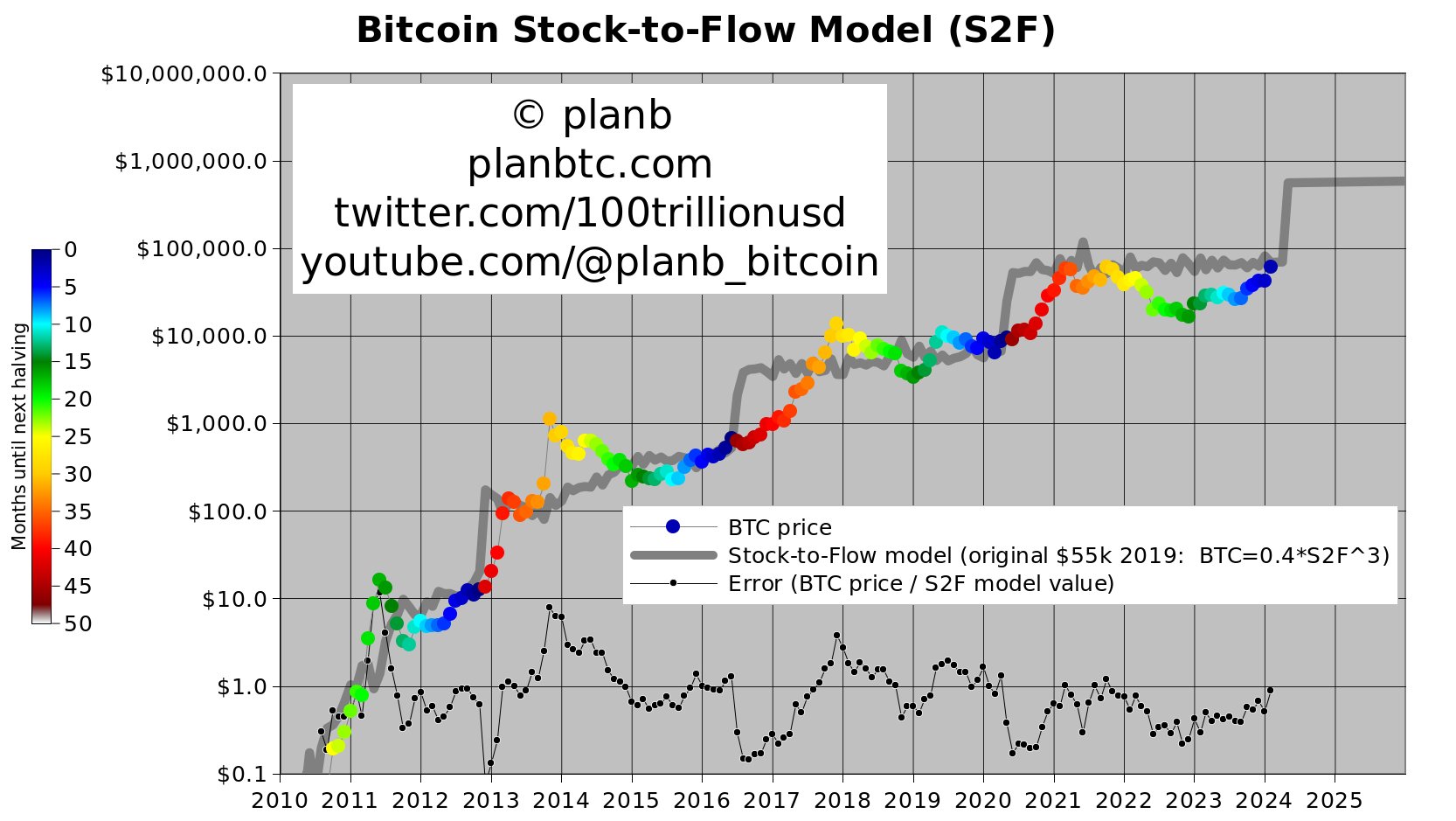

Macro investor and fund manager Dan Tapiero says he’s examining the historic accuracy of a predictive model that means Bitcoin (BTC) will reach $900,000 this cycle.

The CEO of investment firm 10T Holdings tells his 113,000 followers on the social media platform X that on-chain analyst PlanB’s stock-to-budge with the experience (S2F) model appears to be like to be a legitimate designate gauge for Bitcoin.

S2F aims to forecast the longer-timeframe market cycles in step with BTC’s halvings when miners’ rewards are decrease in half of.

Says Tapiero,

“Appears very now not going, nevertheless the vertical spikes up within the S2F model in 2013, 2016, 2020 had been all confirmed by designate motion within 365 days.

[The model] suggests a $900,000 Bitcoin designate within 12-18 months. Not my name, factual reading how model has labored.”

PlanB himself says that Bitcoin’s latest rally into the $60,000 range has the tip-performing digital asset now monitoring the value targets of his S2F model.

“Bitcoin February closing designate: $61,181. Attend to S2F model designate.”

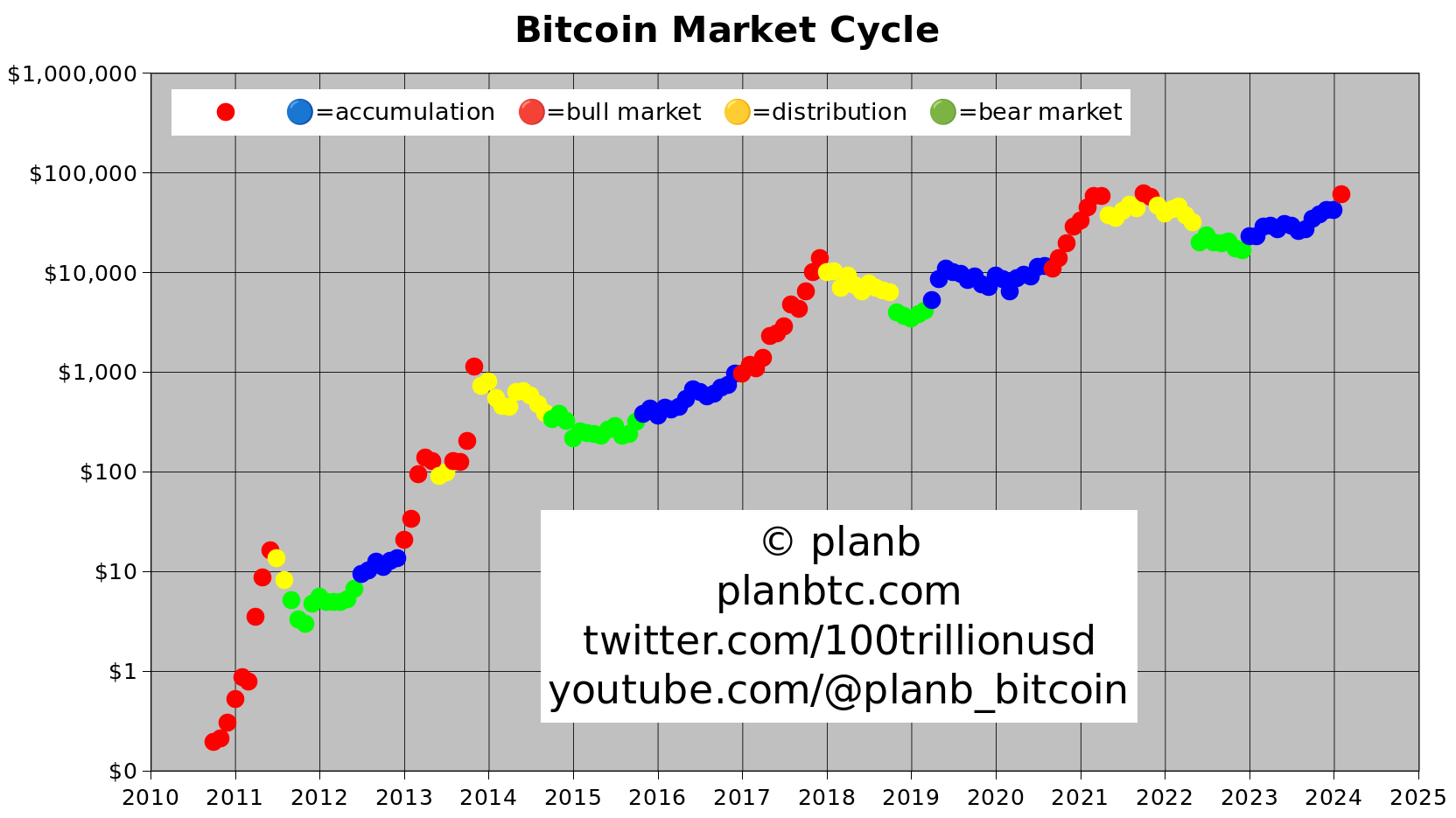

PlanB continues by predicting a Bitcoin bull market cycle has begun and would possibly per chance per chance merely last for roughly 10 months. However, he warns there would be some abrupt dips of about 30%.

“Accumulation half has ended: no extra easy buying opportunities in horny and slowly rising markets. Bull market has started. If historic previous is any recordsdata, we can see ~10 months of face-melting FOMO (fear of missing out): vulgar designate pumps combined with lots of -30% drops. Expertise!”

Shutterstock/solarseven/Natalia Siiatovskaia