Set Bitcoin ETFs rep flows had been hostile on Friday despite most critical inflows recorded by BlackRock, Constancy, Bitwise, and Ark 21Shares Bitcoin alternate-traded funds (ETFs). The Genesis and Gemini glean 22 situation took a toll on the Bitcoin ETF rep flows as GBTC outflow price grew within the last few days. On the quite loads of hand, the week became ample for Bitcoin ETFs with a $1.7 billion rep influx.

Bitcoin ETFs Recorded $140 Million Novel Outflow

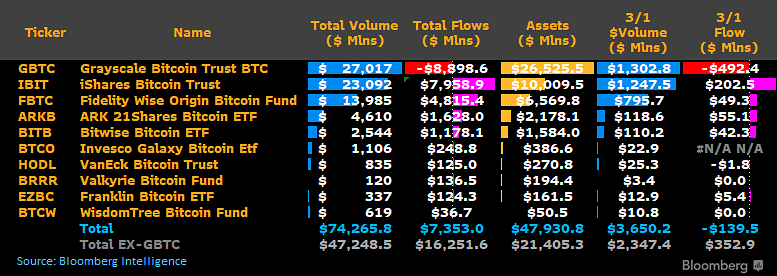

Set Bitcoin alternate-traded funds (ETF) witnessed $140 million rep outflow on March 1, per recordsdata by Bloomberg and BitMEX Analysis. This came amid wide $492.2 million GBTC outflow, with Bitcoin ETFs influx taking a hit.

Bloomberg ETF analyst James Seyffart mentioned the substantial outflows from GBTC had been nearly indubitably connected to Genesis and Gemini glean 22 situation. Crypto lender Genesis remaining month got bankruptcy court approval to promote 35 million GBTC shares worth $1.3 billion.

Set Bitcoin ETFs recorded wide purchasing and selling volumes on March 1. Eric Balchunas, senior ETF analyst at Bloomberg, effectively-known that this became the “third-biggest day ever Wed and Thur. All told $22b traded this week, about a month’s worth of volume in 5 days.” He also checked out the quite loads of of inflows subsiding within the following few days.

BlackRock’s iShares Bitcoin ETF (IBIT) seen $202.5 million influx, falling substantially from the original biggest inflows. Following the most contemporary influx, BlackRock’s rep influx hit over $7.95 billion and asset holdings jumped over $1o.5 billion.

Constancy Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF seen $49.3 million and $55 million inflows, respectively. Bitwise (BITB) and other position Bitcoin ETFs seen marginally low inflows. VanEck Bitcoin ETF (HODL) seen one more outflow of $1.8 million.

Significantly, GBTC recorded one more fundamental outflow of $492.4 million after a $598.9 million outflow on Thursday. GBTC rep outflows reached over $8.89 billion up to now.

Furthermore Learn: Bitcoin Provide Shock — Bitcoin ETFs Maintain Already Scooped Up 4% of Total BTC

BTC Impress Rally to Withhold or a Topple Forward?

BTC mark purchasing and selling sideways within the relaxation 24 hours after a 45% rep remaining month. Impress is currently purchasing and selling at $62,046, with a 24-hour high and low of $57,093 and $63,913, respectively. Furthermore, the purchasing and selling volume has lowered by 30% within the relaxation 24 hours, indicating a decline in passion amongst traders.

Most up-to-date reports agree with hinted a ability correction in BTC mark to $42K after bitcoin halving, giving traders one more purchase-the-dip quite loads of for $100K.

Bitcoin futures and solutions start interests (OI) remain at file ranges, with complete futures OI rising over 1% to $27.26 billion, as per Coinglass recordsdata. Bitcoin mark to $100K prediction stays despite Bitcoin solutions places exceeding calls attributable to sky-high funding rates.

Furthermore Learn: Binance Burns 2.21 Billion Terra Luna Traditional, LUNC Impress Skyrockets Over 30%