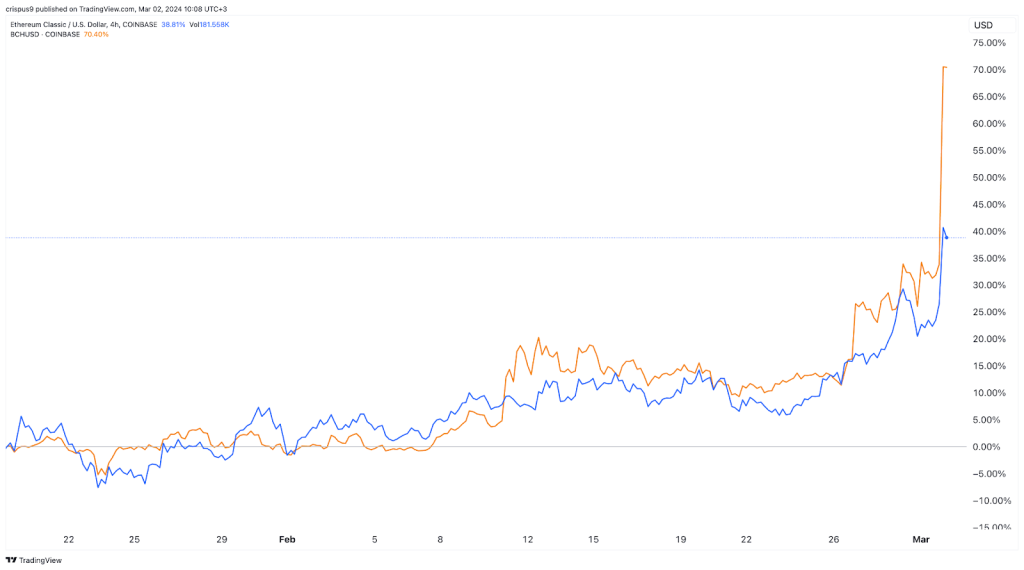

Bitcoin Money (BCH) and Ethereum Classic (ETC) costs spiked this week because the final mood in the crypto enterprise persisted. BCH spiked by extra than 30% on Saturday and reached its highest point since January 2022. Equally, ETC surged to $33.Forty five, its highest stage since September 2022.

BCH vs ETC price chart

Upcoming Bitcoin Money halving

The principle reason Bitcoin Money price persisted hovering was thanks to the upcoming halving, which is location to happen in the following 20 days.

Bitcoin Money was created as a tricky fork of the foremost Bitcoin. As such, adore Litecoin, it retained the solutions that Bitcoin has, including halving.

Halving is a process the build the quantity of rewards offered to miners is reduced by half of. On this case, BCH halving is location to happen on March Twenty 2nd when it reaches a block height of 840,000. The present block height stands at 835,160 whereas the block reward stands at 6.25 BCH. After halving, the reward will transfer to a pair.125.

Customarily, cryptocurrencies are inclined to rally before halving. To illustrate, Litecoin price jumped sharply before its halving tournament in August final year. Equally, Bitcoin has now pumped to over $61,000 before its halving tournament in April.

The other main reason the BCH price is pumping is that it’s in most cases considered as a more cost-effective different to spend money on BTC. It is shopping and selling at $400 whereas BTC has moved to over $62,000. Which ability that, many traders imagine that attempting to search out the coin will bring greater rewards than investing in Bitcoin. Apart from, cryptocurrencies are inclined to contain a shut correlation with one one more.

Ethereum ETF approval

Meanwhile, the Ethereum Classic price is hovering thanks to the ongoing crypto rally. Particularly, it’s being influenced by the performance of Ethereum, which has moved above $3,400 in the previous few days.

ETH’s price action mirrors that of Bitcoin, which surged tough before its space ETF approval. Now, eight corporations, including Blackrock, Franklin Templeton, and VanEck contain all applied for a neighborhood Ethereum ETF.

If the ETF is accredited, analysts imagine this would possibly perchance well judge about robust inflows as Bitcoin currently has. Most importantly, here’s happening at a time when Ethereum’s supply has dived sharply.

Therefore, Ethereum Classic price is hovering because it’s considered as a wiser different to Ethereum. Take care of BCH, which came from BTC, ETC came from ETH by technique of a tricky fork in the ecosystem.

Additionally, many traders imagine that ETC is a more cost-effective different to carry out get entry to to ETH. On this case, ETC was shopping and selling at right $33 whereas ETH was shopping and selling at over $3,400. Which ability that, traders imagine that investing in ETC will lead to greater ends up in the long high-tail.

Most importantly, Ethereum Classic is additionally expected to trip a halving tournament in Would possibly perhaps. That tournament will lead to lower rewards to miners, a transfer that will impact its supply.

The put up Right here’s why Bitcoin Money (BCH) and Ethereum Classic (ETC) are hovering seemed first on Invezz