Grayscale Investments misplaced $8.4 billion from the Grayscale Bitcoin Belief (GBTC) since converting it to an substitute-traded fund (ETF) on January 11, 2024. The outflows advance as merchants explore new merchandise from banks and diversified monetary establishments.

The day gone by’s outflows from the GBTC fund totaled virtually $600 million, making February 29 the 2nd ideal day of outflows ensuing from the US Securities and Replace Fee popular the ETF. Ranking outflows from the Grayscale fund now total roughly $8.4 billion.

Grayscale GBTC Records Outflows as Opponents Heats Up

The outflows from Grayscale coincide with increased ask for substitute-traded merchandise from diversified suppliers. Whereas merchants pulled $610 million from Grayscale by myself final week, this was accompanied by inflows of $436 million into diversified US Bitcoin ETFs. Furthermore, extra establishments are providing crypto-linked funds.

The day gone by, studies surfaced of US banks Wells Fargo & Co and Bank of The US launching set up Bitcoin substitute-traded funds for wealth administration customers. Early this week, news surfaced of one more Wall Road giant, Morgan Stanley, expressing hobby in a group up in Bitcoin ETF.

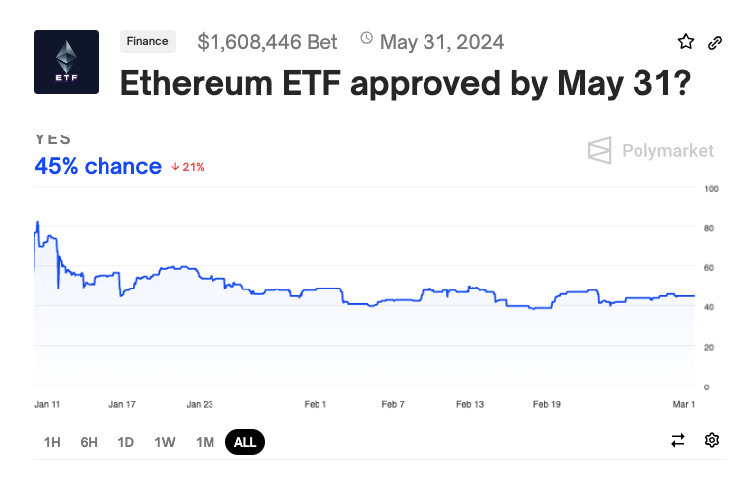

More crypto-focused companies care for Coinbase and Ark Invest would possibly quickly launch ETFs for diversified cryptos care for Ripple (XRP), Ethereum (ETH), and Chainlink (LINK). Ripple’s CEO Brad Garlinghouse said he expects extra funds to hold a examine the launch of set up Bitcoin ETFs.

Learn extra: What Are Altcoins? A Files to Replacement Cryptocurrencies

The principle crypto ETF to hold a examine the Bitcoin funds will in all likelihood be merchandise that song the payment of Ethereum. Whereas these were firstly expected in Would possibly also, Bloomberg analyst James Seyffart predicts they’ll also easiest advance later this twelve months. Anticipation of the approvals has seen the ETH impress skyrocket from $1,629 on September 1, 2023, to $3,436 at press time.

BeInCrypto requested observation from Grayscale on the outflows from its Bitcoin Belief nonetheless had no longer heard relieve at publication. Investors had previously urged that the 1.5% administration rate Grayscale costs for managing its Bitcoin fund was chargeable for early outflows.

How ETFs Affect Search facts from and Provide

A facet-glean of ask for ETFs that song the payment of Bitcoin is the ask for additional BTC. Miners manufacture roughly 900 BTC for precisely fixing the hashes of transaction blocks. Blockchain hashing imbues a transaction block with a particular fingerprint that miners must bet.

When ask for ETFs is excessive, licensed ETF individuals describe the issuer. The issuer will then procure new ETF shares and purchase Bitcoin to relieve up their shares. Intuitively, they’re going to redeem shares and sell Bitcoin when there is much less ask.

Issuers’ BTC purchases can use up coins that are being freely traded on the launch market. But until miners add to the circulating provide by promoting coins they mine, the most sharp resources on hand on the launch market shall be of us who diversified funds or merchants are prepared to sell. Consequently, ETF issuers also can face a momentary shortage if no one is prepared to sell the quantity they must meet ask.

Learn extra: What Is Bitcoin? A Files to the Well-liked Cryptocurrency

In a recent interview with CNBC, Matt Hougan of Bitwise Asset Administration described this dynamic. He said the brand new ask from retail merchants, establishments, and advisers is outstripping the speed at which new coins enter the market.

“There’s merely this big provide/ask dynamic going on. Ranking new ask and a mounted provide and…a reduction in new provide coming up in April with the halvening…With Bitcoin moral now, its moral about provide/ask, and there’s too grand ask and no longer ample provide,” Hougan said.

The Bitcoin halving or ‘halvening’ is a quadrennial match in which the Bitcoin tool will lower the desire of BTC mined each and on each day basis from 900 to 450. This reduction will introduce an additional provide shock. Per Hougan, awaiting Bitcoin to effect $200,000 also can no longer be unreasonable.

Disclaimer

The overall recordsdata contained on our website online is printed in steady faith and for overall recordsdata functions easiest. Any action the reader takes upon the records realized on our website online is precisely at their indulge in threat.