Fast Take cling of

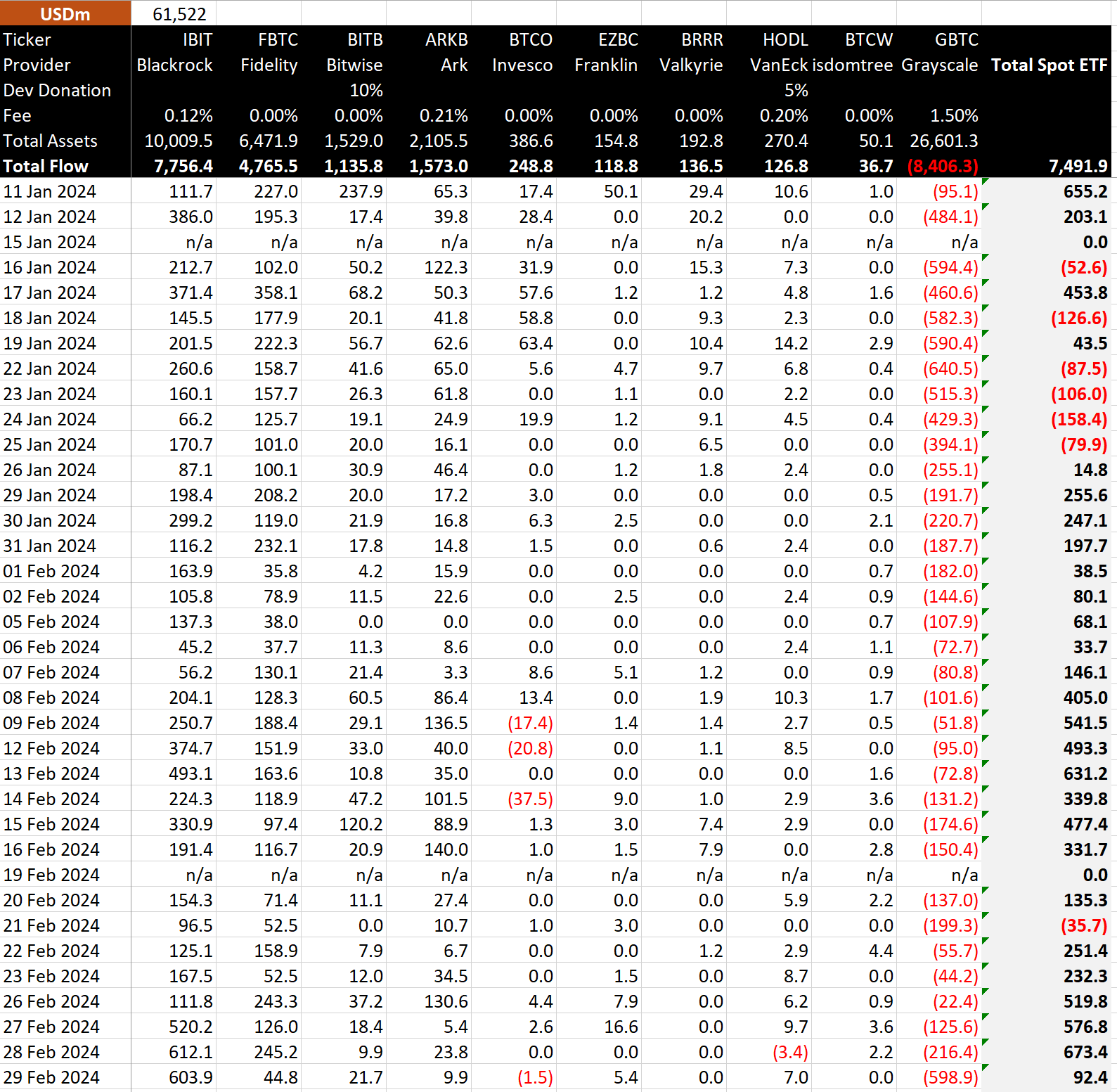

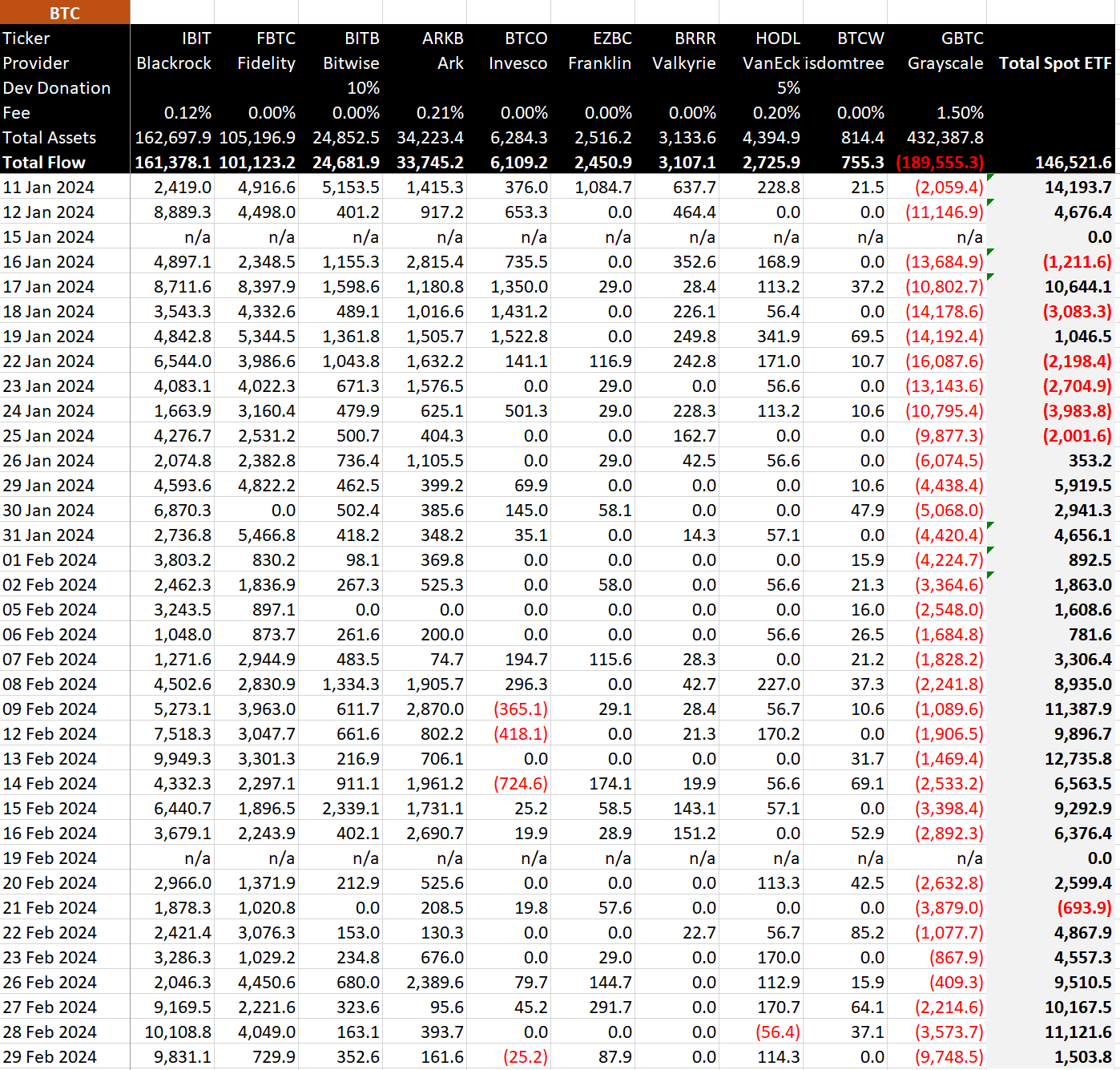

Knowledge from BitMEX means that BlackRock’s IBIT had one other mighty day for the Bitcoin ETFs. It witnessed the second-largest inflow since trading began, with $604 million coming below administration, a equivalent to roughly 10,000 BTC. This dramatic inflow escalated the cumulative total of inflows for IBIT to an spectacular $7.8 billion. As a outcome, BlackRock’s total Bitcoin holdings devour surged to 161,378 BTC.

Knowledge from BitMEX also confirmed a extensive outflow from the Grayscale Bitcoin Belief (GBTC), which experienced its second-largest outflow since inception, with a staggering $599 million exiting its ETF. This outflow has pushed GBTC’s total outflows to a caring $8.4 billion.

In consequence, the total inflows on the day amounted to a mere $92 million, a equivalent to roughly 1,500 BTC.

Moreover, the total fetch flows for all set aside Bitcoin ETFs devour reached a critical benchmark of $7.5 billion, equating to roughly 146,522 BTC.