Bitcoin’s impress has entered a sideways consolidation part following a principal surge towards the $52K resistance stage, leaving market members hazardous about its next route. Then yet again, a short-term correction seems likely.

Technical Prognosis

By Shayan

The Every day Chart

Prognosis of the daily chart unearths a prolonged bull marketplace for Bitcoin, characterised by its upward circulation internal a clearly defined ascending channel. This pattern indicates get buyer dominance, doubtlessly aiming for a brand novel all-time high (ATH).

Despite this bullish sentiment, Bitcoin has encountered a indispensable resistance zone cease to the $52K mark after its fresh upward surge.

Which ability, a duration of consolidation correction is anticipated, permitting the market to search out make stronger ranges all the plot in which by plot of the channel’s mid-boundary and the 100-day fascinating sensible of $43K. Then yet again, a unexpected leap forward above the multi-month ascending channel could perchance perchance trigger a short-squeeze tournament, ensuing in yet every other surge in the short term.

The 4-Hour Chart

A nearer witness on the 4-hour chart unearths a duration of subdued impress action cease to the a entire lot of $52K resistance stage, with low volatility following a get bullish rally.

This consolidation part with small volatility suggests a balance between merchants and sellers until one team positive aspects dominance. If sellers rob control, a short-term corrective retracement towards the well-known make stronger zone spherical $48K could perchance perchance occur, aligning roughly with the 50% Fibonacci retracement stage.

Conversely, if merchants prevail, an impulsive surge could perchance perchance well be anticipated, aiming to breach the well-known resistance enviornment at $58K. Monitoring these wanted ranges and market dynamics will likely be wanted to navigate most likely fluctuations, given the predicted heightened volatility in the short term.

On-chain Prognosis

By Shayan

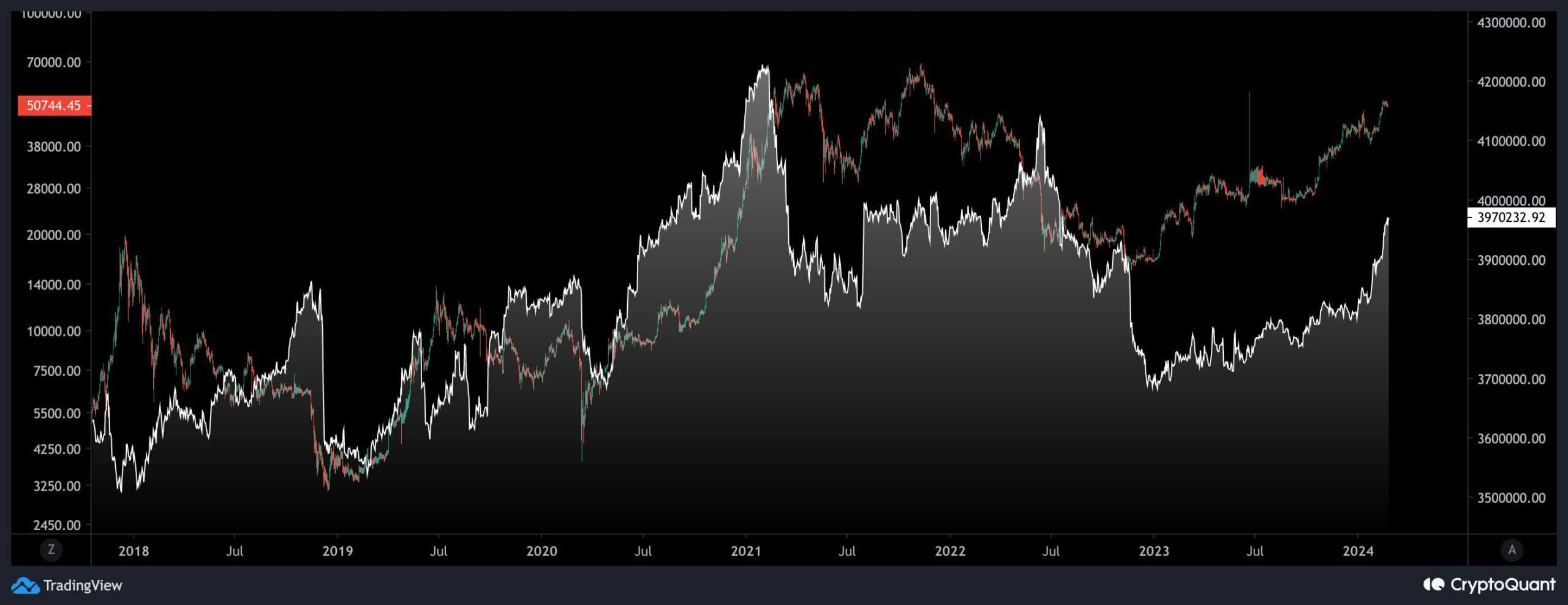

This chart depicts the UTXO (Unspent Transaction Output) worth bands, particularly specializing in holdings of between 1K and 10K Bitcoins alongside Bitcoin’s impress. This metric serves as a key indicator of enormous players’ accumulation or distribution habits internal the market.

An uptick in the metric indicators accumulation amongst valuable market members, such as whales or institutional investors, whereas a decline suggests distribution. Recent knowledge unearths a principal extend in the likelihood of UTXOs starting from 1K to 10K Bitcoins, a range on the entire connected to whales or institutions moderately than particular person investors. This surge, particularly following the approval of Bitcoin narrate ETFs, underscores heightened activity amongst institutional players.

Whereas now not yet reaching the ranges seen all the plot by plot of the latter stages of the 2021 bull market, the influx of whales and institutions into the market is noteworthy. Traditionally, such influxes like on the entire preceded the entry of most up-to-date particular person investors, marking a most likely transition level in the market cycle.