The sphere’s most keen cryptocurrency Bitcoin (BTC) had a unbelievable trace rally this week shooting the whole draw to $64,000. Since then, the Bitcoin trace has confronted some retracement and at label procuring and selling at $61,158 phases with a market cap of $1.2 trillion. At present is the weekly Bitcoin choices expiry with traders expecting some volatility going forward.

Bitcoin Choices Expiry Hints At Vital Market Construction

As the expiration of cryptocurrency choices approaches, indispensable figures emerge in the market panorama. A entire of 19,000 Bitcoin (BTC) choices, valued at a notional trace of $2 billion, are spot to depart out with a blended notional trace of $790 million. The Keep Name Ratio stands at 1.49 for BTC choices while the Maxpain point is indicated at $55,000 for BTC.

This data comes amidst an eventful week in crypto markets, marked by Bitcoin’s surge to over $64,000 and a noticeable uptrend in major term implied volatilities (IVs), reaching phases remaining seen in January 2024 and March 2023.

Using the bullish sentiment in the spot market is the Bitcoin ETF, which has experienced unparalleled beneficial properties this week. Nonetheless, no topic modest rises inBitcoin choices volume and positions, investors are extra and extra adopting spot-safe solutions, contributing to a sturdy market structure. Bitcoin now commands over 50% of the entire cryptocurrency market share, while consideration is anticipated to shift in opposition to Ethereum as the bull market progresses, experiences Greeks.Reside.

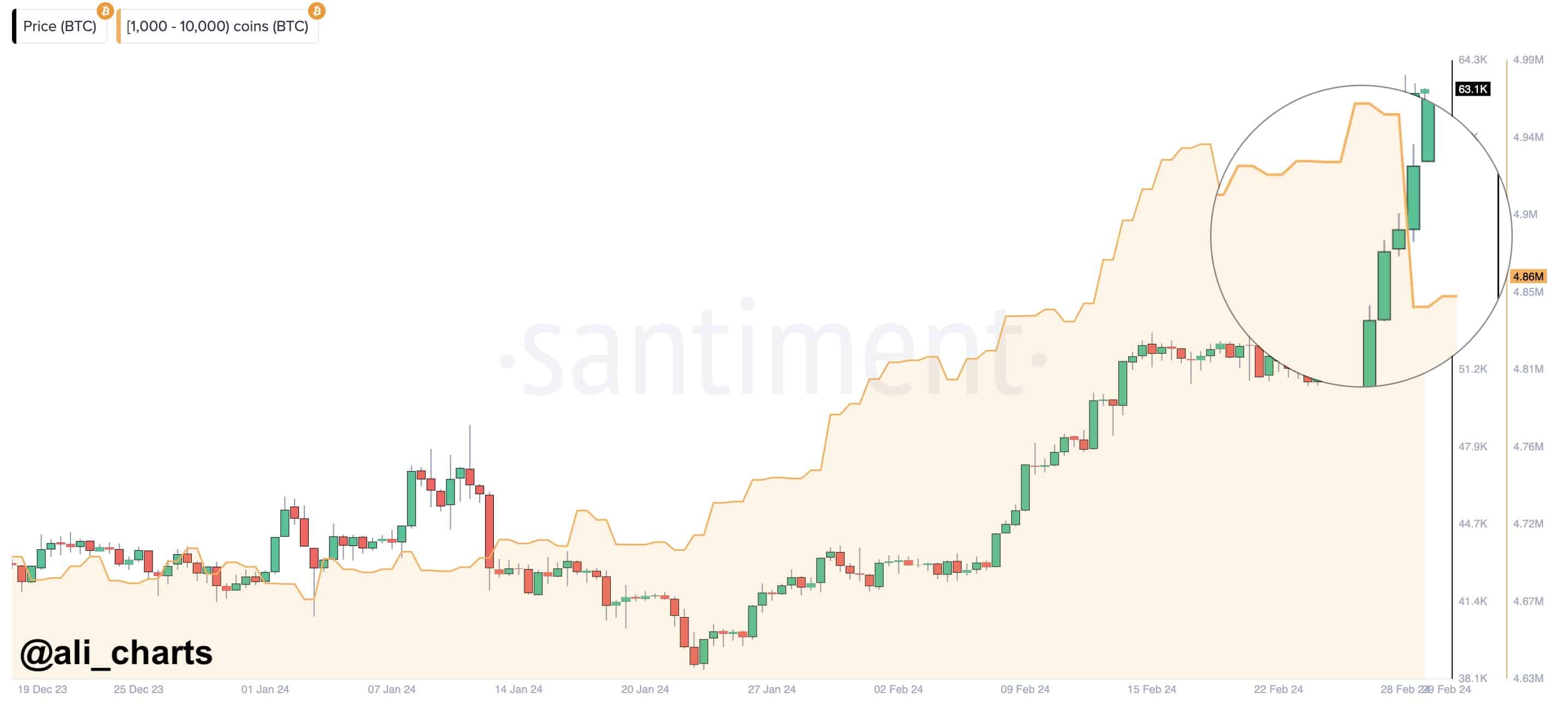

BTC Whales on Selling Spree

Per crypto analyst Ali Martinez, there’s been a critical surge in profit-taking among Bitcoin whales. Over the relaxation three days, they’ve offloaded over 80,000 BTC, the same to about $4.8 billion. Investors and traders can need to bellow warning in gentle of this pattern.

On the quite about a hand, outflows from the Grayscale’s GBTC ETF proceed to upward push as soon as more this week, doubling every subsequent day. As per data from Farside investors, the GBTC outflows on Thursday, February 29, stood at a staggering $600 million. Despite this, the inflows proceed to remain tough with BlackRock’s IBIT main by a mountainous margin. The entire inflows into spot Bitcoin ETFs as of Thursday stood at $510 million.