Firstly of February, the worth of Bitcoin tumbled to a brand contemporary low now not considered since US President Donald Trump acquired elected in November 2024. This downside volatility is believed to had been precipitated by the overleveraging within the $BTC market on the time. Primarily essentially based completely on the latest on-chain recordsdata, the Bitcoin derivatives market has witnessed an enormous flush-out over the past week.

$BTC Market Now At Diminished Possibility Of Liquidation Cascades

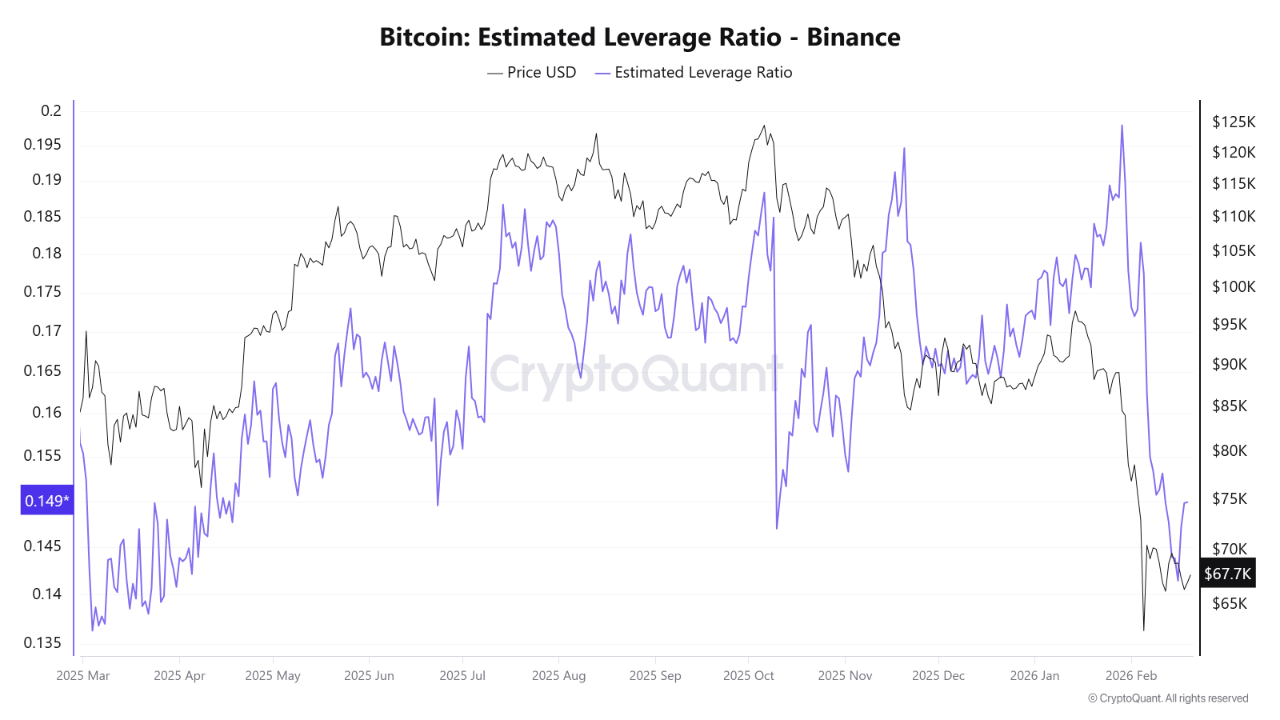

In a contemporary Quicktake put up on the CryptoQuant platform, vendor CryptoOnchain printed a dramatic flush-out within the Bitcoin derivatives market on Binance, the enviornment’s very finest crypto commerce by trading quantity. The connected indicator right here is the Estimated Leverage Ratio (ELR), which has considered a fundamental decline in contemporary weeks.

The Estimated Leverage Ratio is an on-chain metric that measures the ratio of starting up hobby and the reserve of an commerce (Binance, in this case). This indicator tracks the in type amount of leverage passe by traders in a particular market or commerce. A excessive ELR worth most regularly implies elevated market possibility, signaling that limited heed actions can also potentially lead to fundamental liquidations and further heed actions.

As reported by NewsBTC in slack January, the ELR was as soon as at an awfully excessive level of round 0.1980, indicating an overheated and extremely speculative market. Following the shatter of the Bitcoin heed, the on-chain metric has additionally cooled off, falling to round 0.1414.

Primarily essentially based completely on CryptoOnchain, this 28% decline within the Estimated Leverage Ratio highlights a shiftbin market dynamics. The market quant said that the drop in ELR means that a severe deleveraging tournament has came about, with the accompanying heed decline inflicting the closure of numerous overleveraged long positions.

CryptoOnchain added:

While the speedy heed circulate was as soon as painful, wiping out excess leverage is fundamentally wholesome. It gets rid of the “derivatives bubble” and leaves the market structure phenomenal lighter and no more inclined to crude, unexpected volatility.

The crypto analyst concluded that the possibility of further liquidation cascades is diminished, now that the Estimated Leverage Ratio has fallen to same old levels. On the opposite hand, the Bitcoin market needs natural shopping strain and valid query from the assign market to rebuild a bullish structure and resume a sustainable upward pattern.

Bitcoin Trace Overview

As of this writing, the worth of $BTC sits round $67,950, reflecting a almost 2% jump within the past 24 hours. Primarily essentially based completely on recordsdata from CoinGecko, the premier cryptocurrency is light down by extra than 1% on the weekly timeframe.