United States President Donald Trump announced on Saturday that he’s elevating the ten% world tariff rate announced on Friday to 15%, which will take discontinue straight.

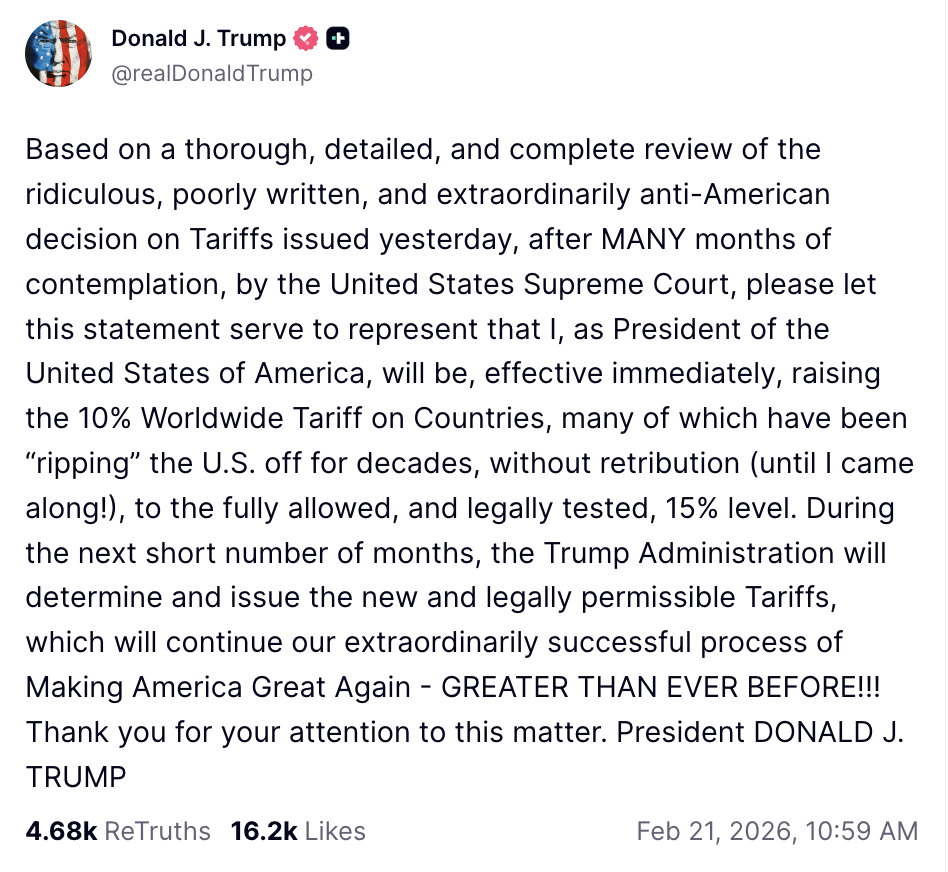

Trump reiterated his criticism of the Supreme Court’s decision to strike down his authority to levy tariffs under the Global Emergency Financial Powers Act (IEEPA). In a Saturday Truth Social put up, he acknowledged:

“As President of the United States of The United States, I will be, effective straight, elevating the ten% worldwide tariff on countries, different which beget been ‘ripping’ the US off for an extended time, without retribution, unless I came alongside, to the entirely allowed, and legally tested, 15% diploma.”

On Friday, Trump announced a 10% world tariff rate to be added on top of already current tariffs that remained legit after the court docket ruling, under different gorgeous statutes outlined in the Commerce Growth Act of 1962 and the Commerce Act of 1974.

Nonetheless, pro-crypto felony professional Adam Cochran acknowledged the scope of those felony guidelines also limits Trump’s authority to levy enormous tariffs indefinitely.

“The regulation he’s utilizing ideal permits this to be on countries now we beget a deficit with, for a local length of 150 days, and at a capped percentage,” he acknowledged.

Every contemporary tariff announcement from Trump introduced on turmoil in the crypto and stock markets, with extreme downturns that negatively impacted asset costs and fueled macroeconomic uncertainty among investors.

Crypto markets held agency in the wake of the most contemporary tariff bulletins

The crypto market, which most frequently experiences heavy promote-offs basically based entirely mostly on tariff bulletins, held agency in the wake of the most contemporary tariff headlines.

The price of Bitcoin ($BTC) held regular at the $68,000 diploma, and Ether ($ETH) also remained agency, displaying shrimp to no exchange since Friday when the contemporary tariffs were announced.

The Total3 indicator, which tracks all the market capitalization of the crypto sector, except for $BTC and $ETH, fell by lower than 1% on Saturday and stays at about $713 billion at the time of this writing.