Knowledge reveals the cryptocurrency futures market has considered liquidations amounting to $700 million within the day prior to this as Bitcoin has long gone through its volatility.

Bitcoin Has Viewed Intense Imprint Circulate In Previous 24 Hours

The day gone by has been a limited little bit of a rollercoaster for Bitcoin, with the asset registering spirited rate motion in each and each directions nonetheless in a roundabout arrangement going up because the bulls get out.

The chart under reveals what the price motion for the cryptocurrency has looked worship recently.

The price of the asset appears to enjoy loved spirited bullish momentum recently | Provide: BTCUSD on TradingView

From the graph, it’s visible that Bitcoin within the origin witnessed some spirited bullish momentum, by which the coin no longer fully broke above the $60,000 stage, nonetheless went as a lot as the touch the $64,000 rate.

This excessive, which is the height for the year thus a long way, fully lasted fleet, on the other hand, as BTC crashed down spectacularly to under the $59,000 rate. The asset has since recovered to bigger stages, now floating round $62,700.

The rest of the cryptocurrency sector has furthermore long gone through its volatility, with prices fluctuating all the most realistic likely arrangement throughout the coins. As is in total the case with such spirited rate motion, the futures market has suffered many liquidations.

Crypto Futures Market Has Long gone Thru A Squeeze In The Previous Day

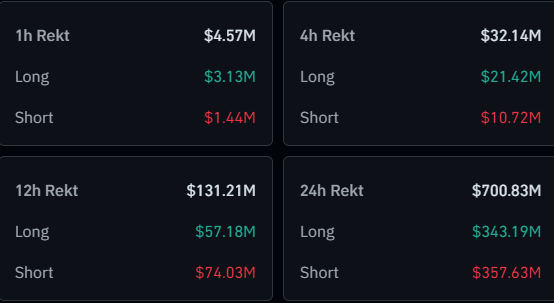

In step with records from CoinGlass, the cryptocurrency futures market has witnessed the liquidation of contracts price greater than $700 million within the closing 24 hours.

The table under displays the linked records in regards to the liquidations.

A big quantity of liquidations seem to enjoy passed off within the day prior to this | Provide: CoinGlass

It would seem that fully $131 million of the liquidations came inside twelve hours, suggesting that a lot of the flush change into positioned inside the preceding half of-day length. That is sparkling, as Bitcoin change into most unstable inside this window.

It furthermore appears that the long-to-short ratio in this liquidation occasion has been fairly balanced, although the price has elevated within the day prior to this. This would possibly occasionally doubtless recommend that some aggressive longing passed off as Bitcoin approached $64,000, and the next pullback wiped these high shoppers.

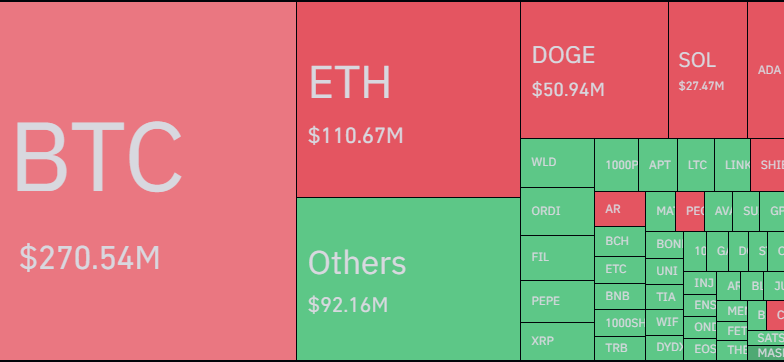

The table under reveals how the distribution has sought for the many symbols.

Looks worship BTC has topped the charts once extra | Provide: CoinGlass

As is continuously the case, Bitcoin futures contracts enjoy again been accountable for an extraordinarily noteworthy fragment of the total market liquidations, contributing round $270 million.

What’s diversified this time, on the other hand, is that this half, though an extraordinarily noteworthy, isn’t even half of the total liquidations. This can near down to the truth that speculators would possibly well per chance well honest now be taking half in round with altcoin positions after gaining self belief from the BTC rate surge.

Dogecoin, the most efficient performer amongst the conclude coins with its 34% soar, has occupied an extraordinarily noteworthy half amongst the alts, with nearly $51 million in liquidations.