Retail investors are scrutinizing the crypto marketplace for signs that it might perhaps perhaps well fair agree with bottomed out to gauge when to aquire more crypto resources, consistent with crypto sentiment platform Santiment.

“Retail merchants are searching to meta-analyze the market, searching to search out signs of others quitting to time their very own entries, which in total occurs halt to bottoms,” Santiment acknowledged in a say on Saturday.

Santiment has linked this to the be conscious “capitulation,” which has change into a top-trending crypto time period on social media, consistent with the platform’s records.

The time period describes investors selling their holdings out of difficulty that the market won’t get better, a scenario that analysts in total video show when assessing whether or now not the market has reached a bottom.

“Capitulation” might perhaps perhaps well fair agree with already came about, says Santiment

“If everyone is staring at for ‘capitulation,’ the underside might perhaps perhaps need already came about whereas they had been staring at for a clearer signal,” Santiment acknowledged.

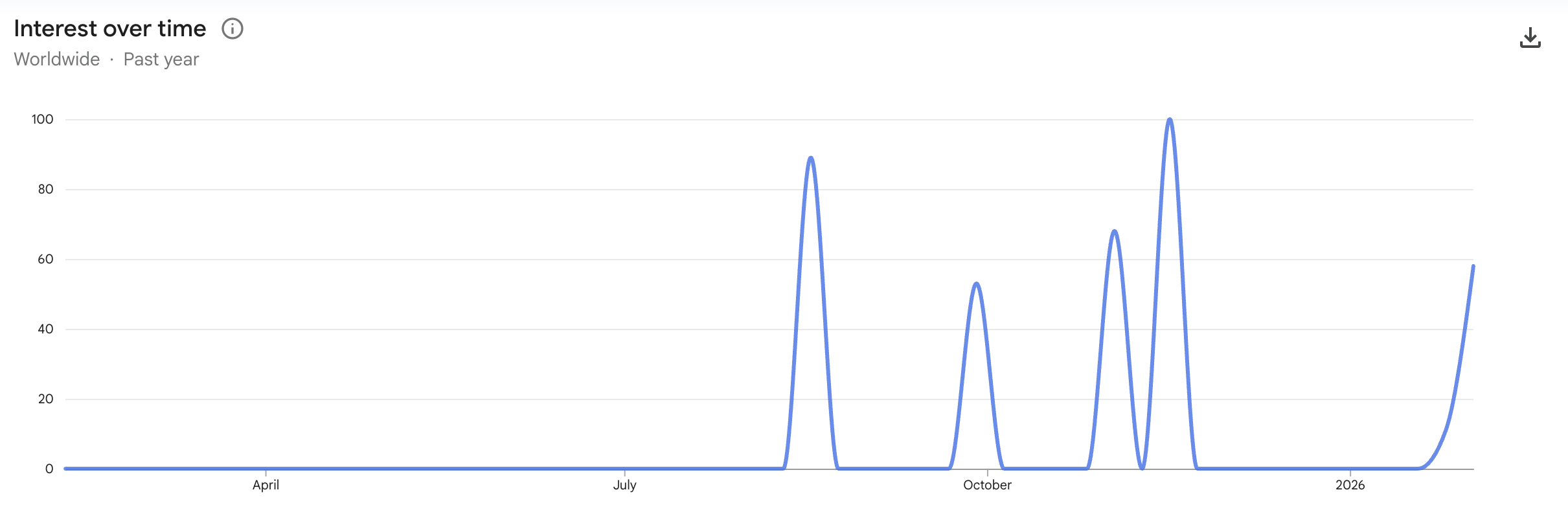

Within the period in-between, Google Developments records reveals searches for “crypto capitulation” rising from a earn of 11 to 58 between the weeks ending Feb. 1 and Feb. 8.

Crypto investors are normally cautious about calling a market bottom too quickly. History reveals costs can preserve falling even when most folks mediate the worst is over.

Market analyst Caleb Franzen acknowledged in an X post on Saturday that whereas capitulation is the “be conscious of the week,” many investors don’t realize that “endure markets in total expertise a couple of capitulation occasions.”

It comes as Bitcoin’s (BTC) worth dropped as low as $60,000 on Thursday, a stage it hasn’t considered since October 2024, amid its ongoing downtrend.

Some analysts are skeptical of the “cycle bottom”

Crypto analyst Ted acknowledged in an X post on Friday that “the day previous’s dump seems love capitulation, nevertheless it undoubtedly’s now not the cycle bottom.”

Echoing a same sentiment, crypto analyst CryptoGoos acknowledged, “We have not considered factual Bitcoin capitulation thus a ways.”

Linked: Over 23% of merchants now put a question to of pastime charge gash at next FOMC assembly

Over the final 30 days, Bitcoin has fallen 24.27%, trading at $68,970 as of publication, consistent with CoinMarketCap.

The Crypto Anxiety & Greed Index, which measures total crypto market sentiment, fell additional into the “Rude Anxiety” territory on Sunday, with a earn of seven, signaling indecent warning among investors.

Magazine: Bitcoin’s ‘most attractive bull catalyst’ will more than likely be Saylor’s liquidation: Santiment founder