Rapid Grab

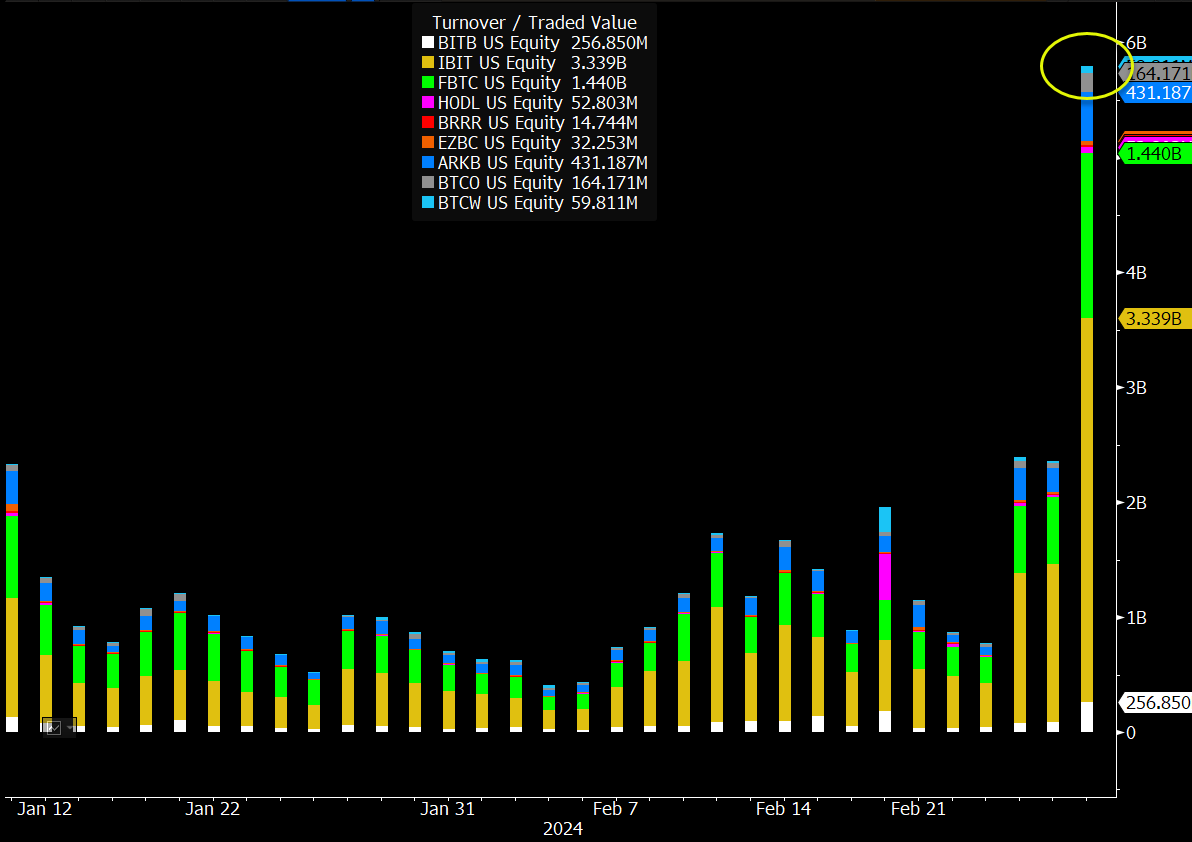

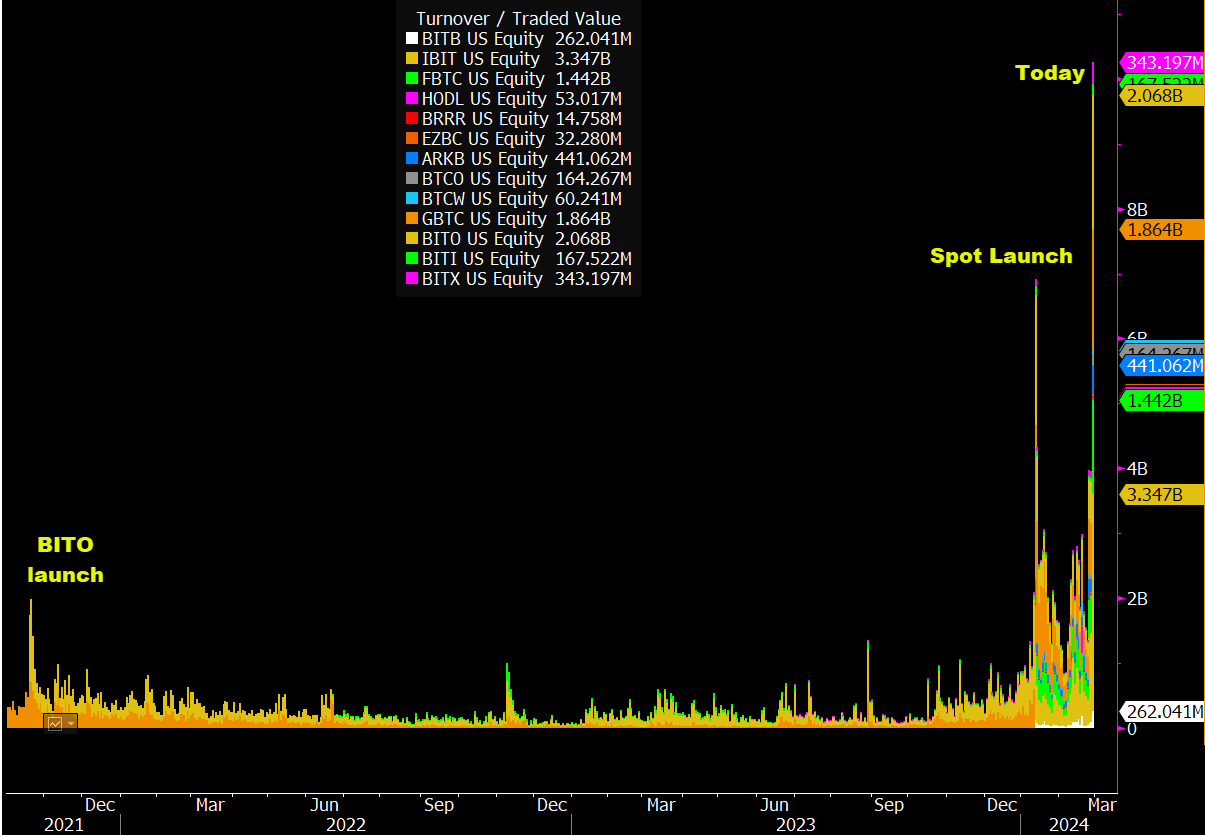

The day earlier than at the present time, Feb. 28, the newborn-nine space Bitcoin ETFs doubled their alternate quantity memoir, with roughly $6 billion traded.

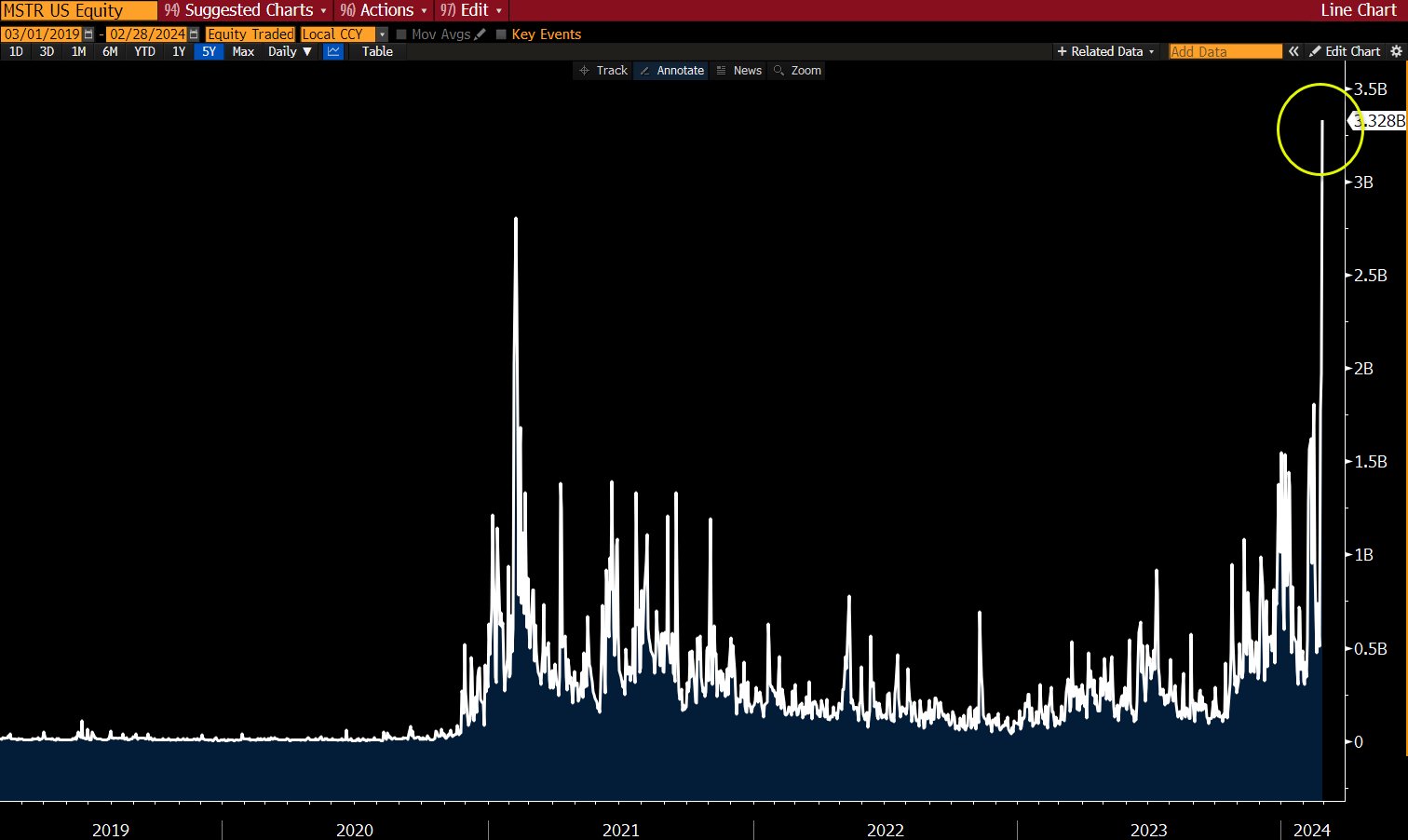

BlackRock IBIT emerged because the frontrunner with $3.3 billion, adopted by Fidelity with $1.4 billion. As well, IBIT surpassed the Invesco QQQ ETF on its fill, in keeping with senior Bloomberg ETF analyst Eric Balchunas.

The outdated memoir of $2.4 billion used to be situation on Feb. 26, as reported by CryptoSlate, citing an analysis from Eric Balchunas.

Coinciding with this trading frenzy used to be a memoir inflow of $673 million into ETFs, largely driven by BlackRock, with an influx of $612 million.