On Jan. 30, Cardano founder Charles Hoskinson presented that he has signed an integration settlement to bring USDCx, a Circle-linked stablecoin product, to the Cardano ecosystem.

The infrastructure amble represents a strategic effort to lower the community’s DeFi impart ceiling by setting up a sustained, legitimate waft of on-chain buck liquidity.

In a social media put up from Japan, Hoskinson characterised the deal as a milestone for the community, which has historically trailed within the support of rival dazzling-contract platforms in getting access to excessive-liquidity stablecoins.

He talked about:

“We [now] have win admission to to Circle’s community, Circle’s protocol, Circle’s technology, and the chubby liquidity of the Circle community as a entire, and the added privateness advantages of USDCX and the entire applied sciences therein.”

The settlement comes because the Cardano neighborhood has continuously sought “Tier 1” stablecoin depth, viewing it as a mandatory prerequisite for additional aggressive pricing on decentralized exchanges (DEXs), deeper lending markets, and tough derivatives liquidity.

Whereas the announcement marks a diplomatic victory for the ecosystem, key execution diminutive print, along side the rollout timing and the preliminary scope of the integration, dwell unconfirmed.

What is USDCx?

The introduction of USDCx requires a nuanced working out of its technical structure, as it is now not a “native $USDC” asset minted straight by Circle on the Cardano blockchain. As an alternate, Circle positions USDCx as a $USDC-backed stablecoin issued on a companion or “a long way away” chain.

Below this framework, reserves are held as $USDC and deposited into Circle’s xReserve on a “offer” chain. These resources are then represented on the companion chain, equivalent to Cardano, by potential of an computerized attestation and minting waft.

Circle presented xReserve in leisurely 2025 to lower the commercial’s reliance on third-birthday party bridges and wrapped resources, which have historically been targets of security exploits.

Notably, the xReserve model is designed to allow interoperability without the risks associated with passe bridging.

For Cardano, this distinction is serious. In need to relying on a fragmented, wrapped model of a buck token, USDCx is meant to characteristic as a straight away conduit to Circle’s broader liquidity community.

Hoskinson outlined that this setup is designed particularly for ecosystems outdoors the Ethereum Virtual Machine (EVM) sphere.

In step with him:

“USDCX is mostly the the same asset[as[as$USDC], and the intention it works is there’s a one-to-one reserve. For the non-EVM chains worship Stacks and Aleo and others, there’s a mirroring stop that occurs, after which dApp builders, under the hood, can manufacture a bunch of stuff. Then it’s easy via their community to win admission to the the same liquidity as $USDC.”

USDCx would perhaps presumably support Cardano narrow the liquidity gap

Cardano’s aggressive push for stablecoin depth is pushed by stark on-chain files.

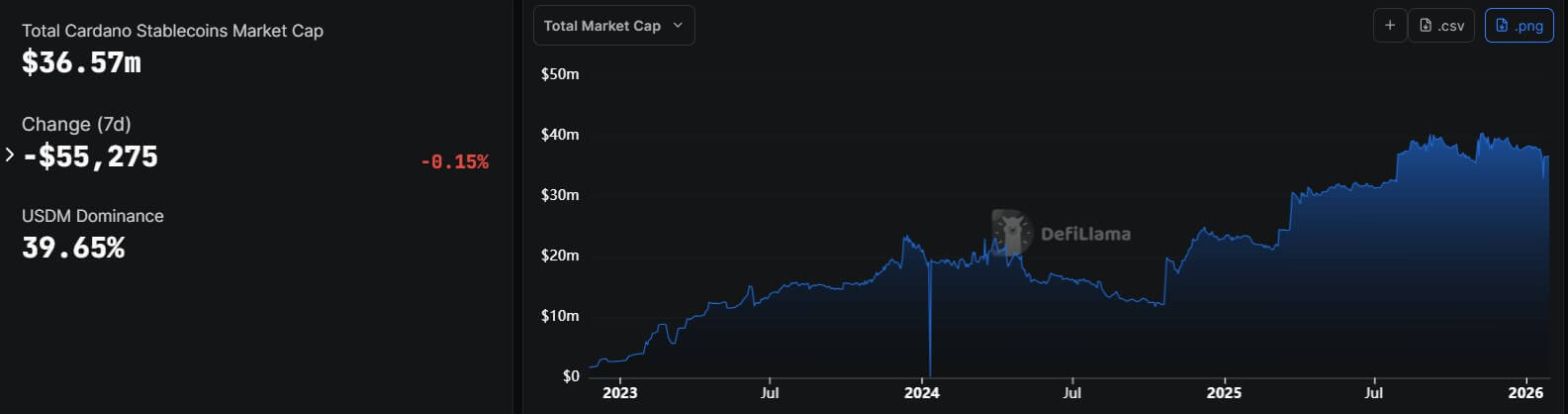

In step with DeFiLlama files, the community for the time being holds approximately $36.6 million in circulating stablecoins.

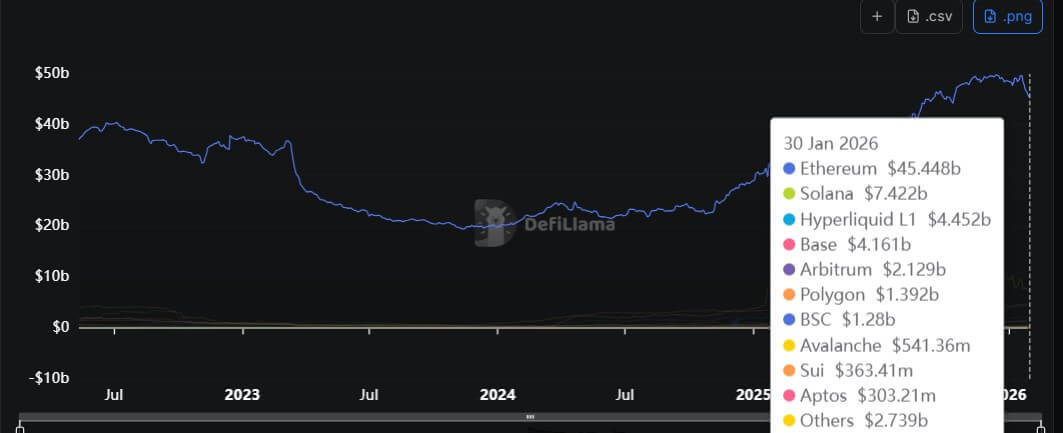

This resolve is particularly diminutive when when in comparison with leading DeFi hubs. For comparability, ecosystems worship Inappropriate and Solana have change into carefully “$USDC-native,” reporting stablecoin market caps within the billions and DEX volumes that are orders of magnitude increased than Cardano’s latest output.

Whereas Cardano supporters continuously argue that the community’s architecture prioritizes security and decentralization over speedily growth, the market has consistently rewarded ecosystems that can pair these values with deep buck liquidity.

In the period in-between, the USDCx settlement is the center piece of a broader institutional effort internal Cardano to fix its “plumbing.”

A contemporary ecosystem proposal sought neighborhood approval to allocate 70 million $ADA (approximately $30 million at the time) to onboarding tier-one stablecoins, custody suppliers, harmful-chain bridges, and pricing oracles.

This capital allocation reflects Cardano’s management’s realization that these utilities, continuously handled as baseline infrastructure by other chains, ought to be proactively secured to dwell aggressive.

What USDCx would perhaps presumably release for Cardano?

The attainable upside for Cardano hinges on its capacity to capture a part of the Circle’s $70 billion $USDC offer.

If Cardano, via the USDCx integration, captured even 0.10% of that notional liquidity, it would perhaps presumably suggest an further $70 million in buck imprint, which is roughly double the community’s latest stablecoin notorious.

Ought to peaceable that part reach 0.25%, the resolve would rise to approximately $180 million. This kind of shift would perhaps presumably materially tighten spreads for $ADA/stablecoin buying and selling pairs and comprise lending markets extra viable for institutional contributors.

Nonetheless, market analysts show off that stablecoins stop now not merely comprise DeFi activity by present; they offer the specified prerequisites for liquidity, which must then be met by credible market-making and shopper adoption.

By plugging into this community, Cardano is making a wager that USDCx will present the “speedily integration time” desired to jumpstart its lagging DeFi sector.

Pondering this, Hoskinson well-liked:

“We must the least bit times be obvious that we win USDCX integrated into the entire Cardano functions, so there’s a seamless shopper journey, and a seamless shopper journey with exchanges, so that you just’ll want to well maybe amble from $USDC and support with none further steps or work.”

Implementation risks

Despite the optimism surrounding the signed settlement, a entire lot of caveats dwell.

Hoskinson’s announcement confirms a appropriate and strategic partnership, but it indisputably does now not mean USDCx is are living. Notably, Circle’s developer documentation for xReserve does now not but explicitly checklist Cardano as a supported a long way away chain, indicating that the implementation is peaceable in early phases.

Execution risk is a essential predicament for traders. The success of the integration will depend upon how snappy essential Cardano decentralized functions (dApps) can incorporate the unique token.

Furthermore, the ecosystem must attract respectable market makers and be obvious harmful-chain routing is frictionless sufficient to compete with chains that already obtain native $USDC and USDT deployments.

Hoskinson, alternatively, stays confident within the timeline. “Here’s now not something that’s six months out,” he talked about, noting that the “ink is on paper” and the deal is signed.

He cited Circle’s prior work with networks equivalent to Aleo and Stacks as proof that the integration would perhaps maybe moreover be performed snappy.

The Cardano founder added:

“One in all the advantages of this unique USDCX is speedily integration time. It doesn’t require a ton of customized work to win working with Cardano on memoir of they’ve already performed these form of things. So we are very furious to scrutinize that come on in.”