The crypto market capitalization fell 6% over the last 24 hours as major sources moved sharply lower. The promote-off extended previous digital tokens, weighing on main crypto-targeted treasury companies akin to BitMine and MicroStrategy.

Whereas both companies proceed to signal sturdy conviction by draw of ongoing accumulation, the downturn highlights rising force on digital asset treasury companies.

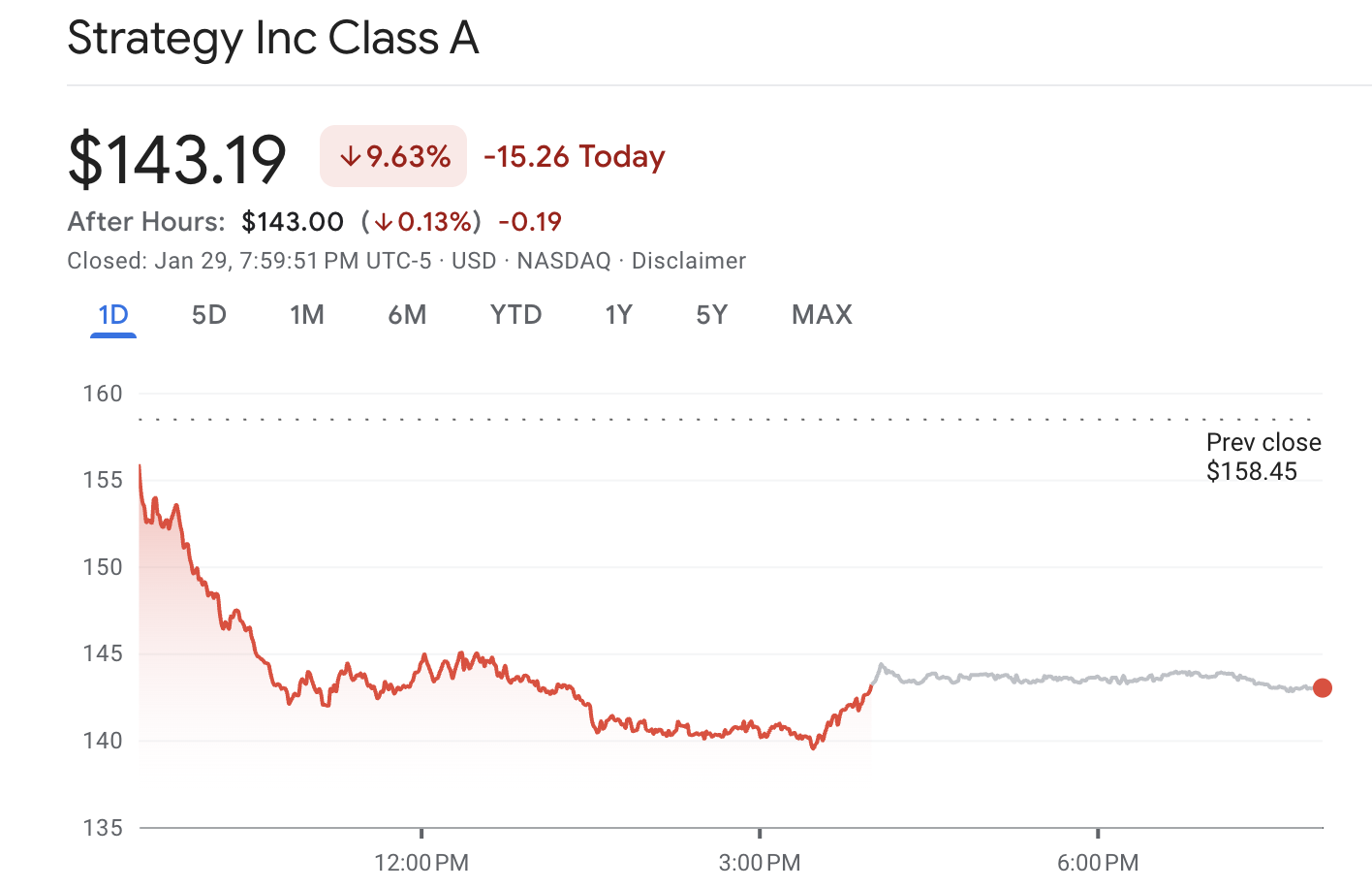

MicroStrategy Stock Slides to With regards to 16-Month Low

BeInCrypto reported that macroeconomic tensions weighed on crypto markets over the last 24 hours. Bitcoin fell 6.7%, while Ethereum extended its losses to 7.6%.

All over early Asian trading hours, both sources slid to two-month lows on Binance. Particularly, the tip company holders of these sources were furthermore impacted available within the market crash that unfold all over worthwhile metals, crypto, and equities.

Per Google Finance records, shares of Plan (formerly MicroStrategy) fell 9.63% to shut at $143.19 on Thursday. This marked its lowest stage since September 2024. In after-hours trading, MSTR slipped a additional 0.13%.

Economist and celebrated Bitcoin critic Peter Schiff commented on the inventory’s decline, noting that MSTR is quite 70% down from its peak.

“Saylor spent $54 billion over the last five years shopping over 712K bitcoin at a median value of correct over $76K. His total unrealized invent is no longer up to 11%. Too contaminated he didn’t aquire gold!” he wrote.

The inventory drawdown comes as the company continues to double down on Bitcoin. On January 26, Plan disclosed its most traditional Bitcoin acquisition, shopping $264.1 million price of $BTC at a median $90,061 per coin. This became Plan’s fourth major aquire this month, lifting total holdings to 712,647 $BTC, now price about $59.1 billion.

On the other hand, the company’s core contrivance faces tighter constraints. With its market web asset value extra than one slipping below 1.0x, Bitcoin-per-portion accretion nearing zero, shareholder dilution growing, and reliance on capital markets deepening, continued Bitcoin accumulation dangers turning into dilutive except equity premiums return.

BitMine Expands $ETH Holdings Whereas Shares Sink

Resembling Plan, BitMine’s inventory (BMNR) furthermore posted losses, closing Thursday at $26.70, down 9.89%. This marked its lowest stage since November 2025.

Particularly, earlier this week, the company made its largest Ethereum aquire of 2026, acquiring 40,000 $ETH. The firm now holds about 4,243,338 $ETH price around $11.68 billion.

The holdings equal 3.5% of the general Ethereum provide. Extra than half of its holdings are staked. On the other hand, on-chain records from CryptoQuant indicates that BitMine is sitting on an unrealized loss of about $3.8 billion, highlighting the rising force on crypto-heavy treasury methods all over essentially the most traditional market downturn.

Tom Lee says “protect stacking and HODL” while $BMNR drops to $26, down every other 11% lately to original 2026 lows after his December, then January predictions form no longer pan out.

Sheeeeeesh. pic.twitter.com/FxWzXOAz3y— Urkel (@SteveUrkelDude) January 29, 2026

The fascinating declines in BitMine and Plan are no longer remoted. Other crypto-targeted companies, including Metaplanet, Strive, and Sharplink, have furthermore recorded drawdowns, though on a smaller scale than the two market leaders.

The publish Crypto Sell-off Hits Company Treasuries as Plan and BitMine Shares Walk With regards to 10% seemed first on BeInCrypto.