Hedera is down more than 10% throughout the final seven days, and the drop isn’t any longer stunning a routine pullback. The HBAR sign structure is weakening, capital is flowing out, and sentiment has slipped to multi-month lows.

Together, these indicators characterize a rising threat of a deeper correction. On the identical time, dip investors and derivatives positioning provide a narrow course for a rebound. Whether or no longer HBAR breaks down or stabilizes now is dependent upon a few key ranges.

Head-and-Shoulders Pattern and CMF Breakdown Signal Structural Probability

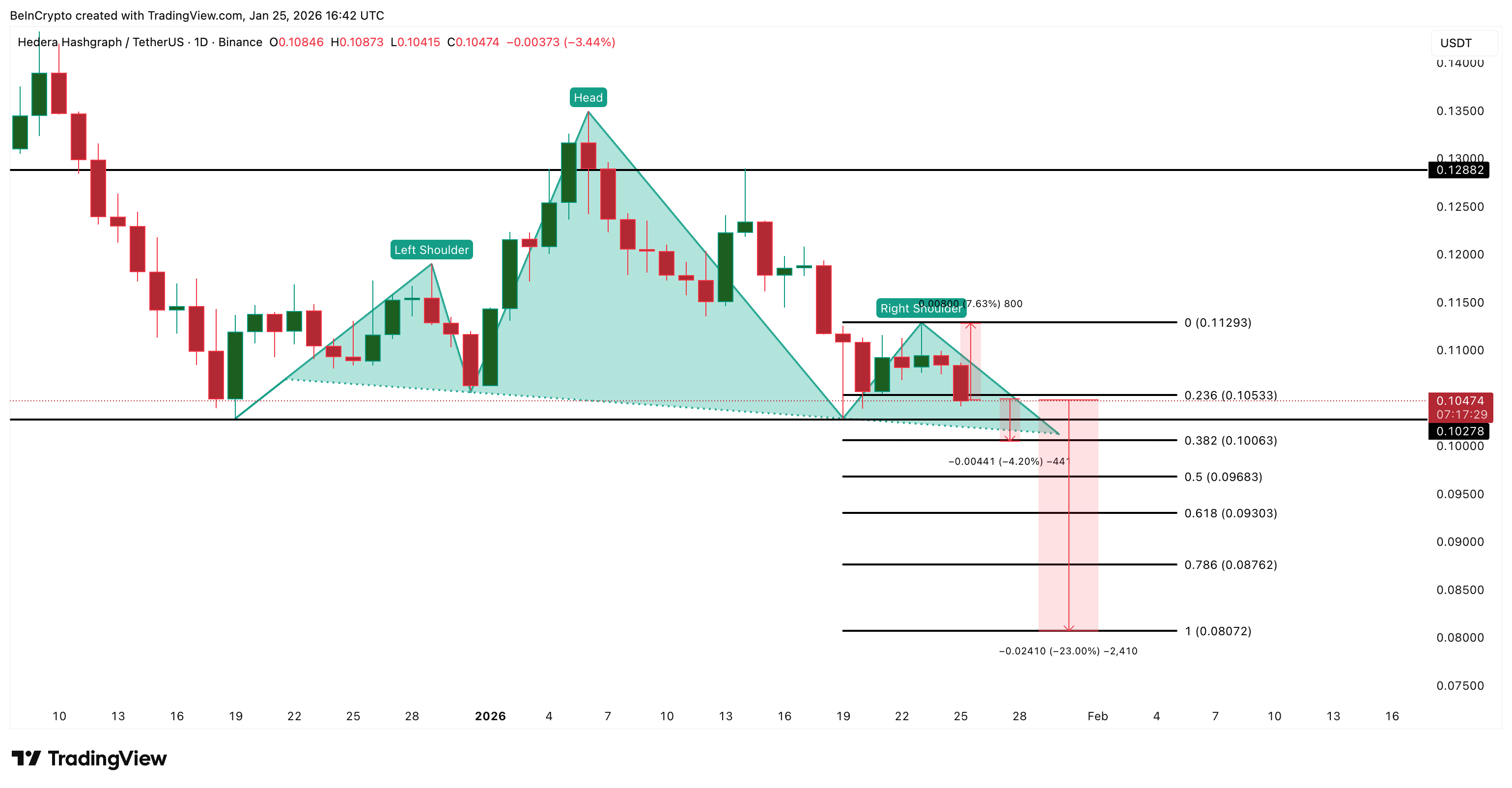

The payment chart exhibits Hedera keen nearer to completing a head-and-shoulders pattern. It on the entire indicators a bearish reversal once the neckline breaks.

For the HBAR sign, the neckline sits near $0.102. A every day close below this level would activate a projected downside transfer of more than 20%, aligning with prior breakdowns from the same constructions.

This threat is reinforced by the Chaikin Money Hurry with the stream, or CMF. CMF measures whether capital is flowing into or out of an asset by combining sign and volume. When CMF falls below zero, it indicators web capital outflows.

HBAR’s CMF has now damaged below a descending toughen line and slipped decisively below zero. The closing time CMF dropped this sharply used to be in early December, stunning earlier than Hedera fell nearly 25%. This tells us the recent sign weak spot is backed by real selling stress, no longer stunning low volume drifting.

HBAR Mark Structure”>

HBAR Mark Structure”>

Need more token insights admire this? Trace up for Editor Harsh Notariya’s Each day Crypto Publication here.

So long as CMF stays damaging and the neckline holds below stress, the bearish structure stays energetic.

Falling Sure Sentiment Adds a 2nd Layer of Stress

Mark weak spot is now being echoed by sentiment data.

Sure sentiment tracks how worthy favorable dialogue and commentary encompass an asset across social and market sources. When definite sentiment falls to local lows, it forever reflects fading self perception and reduced willingness to aquire dips.

Hedera’s definite sentiment has dropped to its lowest level since gradual October. Historically, the same sentiment troughs earn aligned carefully with sign declines.

On November 9, sentiment hit a neighborhood low whereas HBAR traded near $0.17. Interior two weeks, the payment slid to round $0.13.

The recent setup appears the same. Sentiment is weakening first, whereas sign is unruffled hovering above key toughen. This roughly divergence on the entire finally ends up within the payment keen lower to compare self perception ranges. With both structure and sentiment pointing down, downside threat is now clearly elevated.

Dip Making an try to derive and Derivatives Set Hedera Reversal Hopes Alive

No topic the bearish indicators, there are early indicators of toughen returning below the ground.

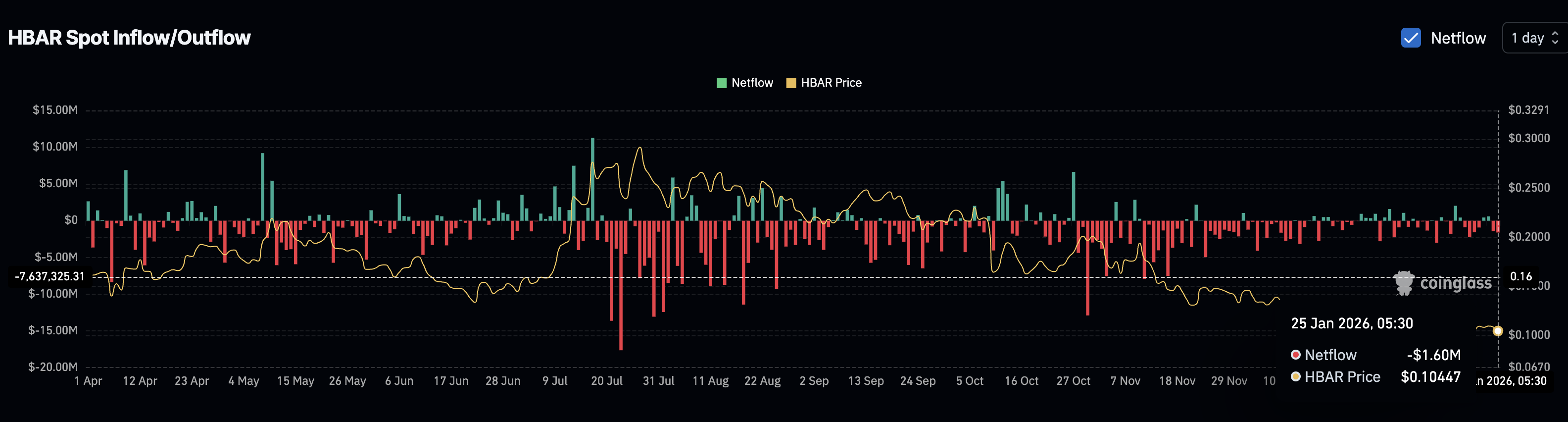

Space commerce data exhibits that web outflows earn picked up throughout the final two days as the HBAR sign corrected by practically 5%. Salvage outflows occur when more tokens leave exchanges than enter, which on the entire indicators attempting to derive or long-term conserving. On January 24, web outflows stood near $1.41 million, rising to roughly $1.60 million on January 25. This suggests dip investors are stepping in after most modern selling.

HBAR Perps”>

HBAR Perps”>

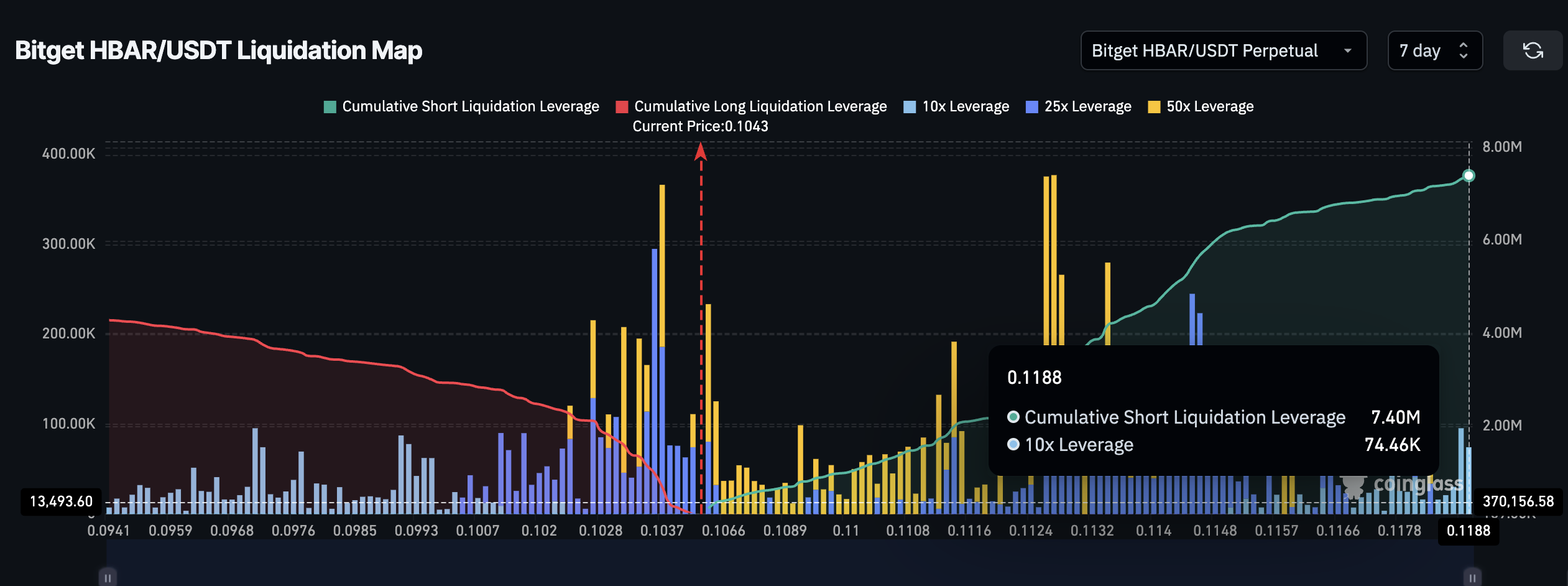

Derivatives data adds one other layer. On Bitget’s HBAR perpetual market, cumulative quick liquidation publicity over the subsequent seven days sits near $7.40 million, when compared with about $4.28 million in long liquidations. This 70% imbalance towards shorts capacity a nice fraction of traders are positioned for further downside.

When quick publicity outweighs longs by this margin, even a modest sign recovery can space off quick liquidations. These forced-aquire orders can speed upside moves. This creates a narrow window whereby bearish positioning would possibly maybe maybe gas a bounce.

Serious HBAR Mark Ranges To Music Now

HBAR sign stream now holds the closing acknowledge.

On the downside, $0.100-$0.102 is the important thing level. A every day close below it would ascertain the head-and-shoulders breakdown and beginning the course towards $0.080, matching the 20% downside projection.

On the upside, Hedera must first reclaim $0.105 to characterize non permanent stabilization. The actual take a look at comes at $0.112, which aligns with a key Fibonacci level and the right-shoulder resistance. A neat transfer above $0.112 would invalidate the right shoulder, weaken the bearish pattern, and sure space off a large cluster of quick liquidations.

HBAR Mark Analysis”>

HBAR Mark Analysis”>

If that occurs, the HBAR sign would possibly maybe maybe lengthen towards $0.128, the build prior present and resistance take a seat.

For now, the steadiness stays fragile. Bearish metrics are building, but dip attempting to derive and quick positioning leave the door a cramped beginning for a reversal. The following couple of every day closes will decide which side takes control.

The post Hedera Mark Faces 20% Probability as Bearish Metrics Stack Up — Can HBAR Jump Back? regarded first on BeInCrypto.