Ondo (ONDO) is increasing a inserting paradox. The token impress has fallen extra than 80% from its all-time excessive (ATH), yet total value locked (TVL) has reached a unique document.

This divergence raises questions about the project’s like minded possible. On the same time, business leaders are projecting a sure outlook for the tokenization sector in 2026.

Ondo Prices Drop Sharply After Unlocking

Ondo is a decentralized finance (DeFi) protocol obsessed with the tokenization of true-world resources (RWAs). The protocol permits customers to entry ragged financial merchandise. These encompass US Treasury bonds, credit funds, and tokenized equities on the blockchain.

BeInCrypto Mark data reveals that ONDO fell from a peak above $2.1 to round $0.35. This represents a decline of extra than 80%. In early 2026, ONDO persevered to location decrease lows and showed no sure indicators of restoration.

ONDO) Mark Performance. Provide: BeInCrypto Mark”>

ONDO) Mark Performance. Provide: BeInCrypto Mark”>

The harmful impress action would possibly maybe presumably stem from token release stress. Ondo recently carried out an release of 1.94 billion tokens on January 18. This quantity accounted for 57.23% of the issued provide.

The surprising broaden in circulating provide added selling stress and heightened investor concerns. Since the release, ONDO has dropped one other 10%.

Ondo’s January Paradox: Is The Mission Undervalued?

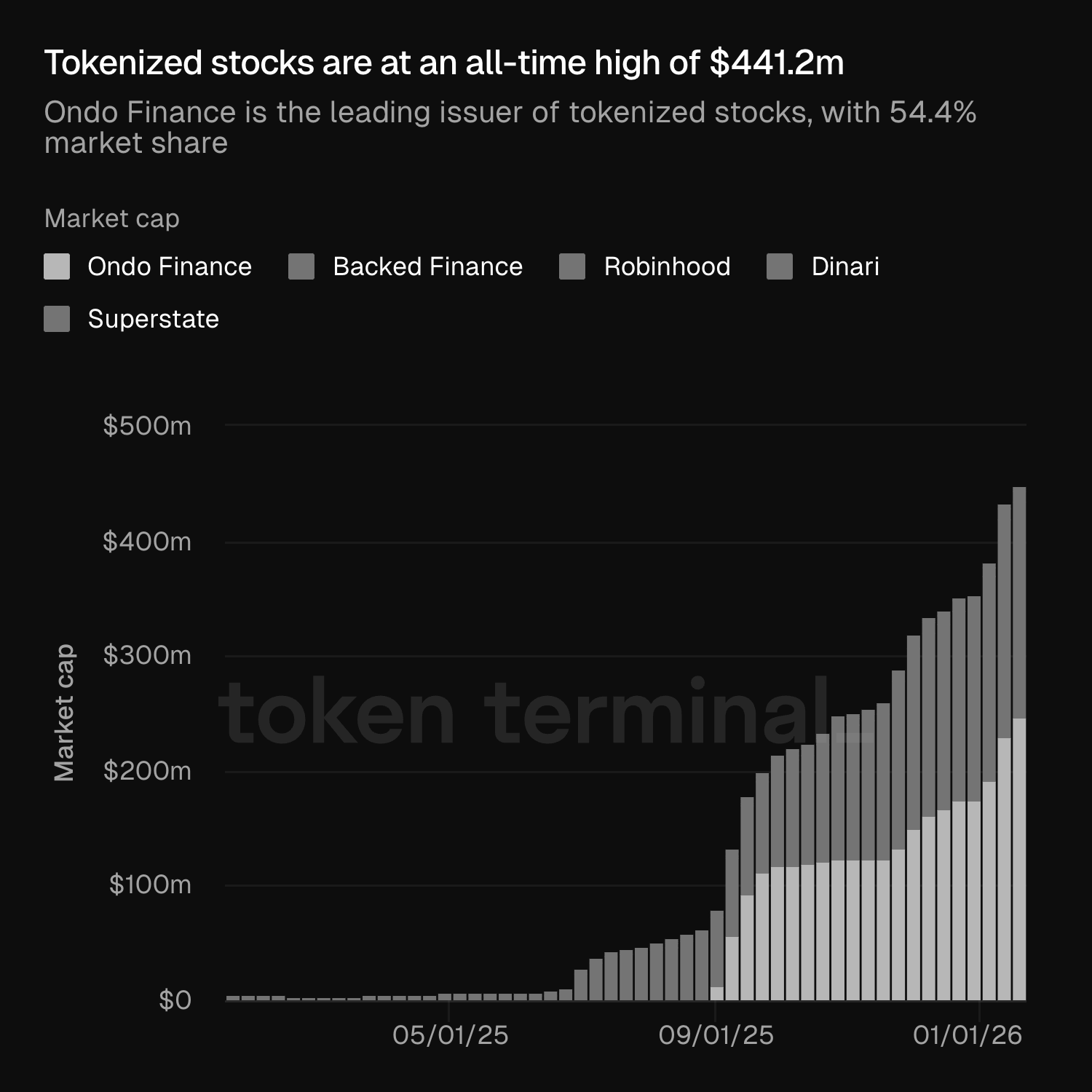

Nonetheless, Token Terminal data reveals steady momentum within the tokenized equity sector. The total market value of tokenized stocks has reached a unique ATH of $441.2 million. Ondo Finance leads the sphere with a 54.4% market share.

Charts save that tokenized equity market capitalization has surged since September closing year. This expansion occurred even because the broader crypto market entered a downturn over the same length.

The facts suggests that whereas many retail investors have withdrawn capital, enterprises proceed to allocate funds to tokenized equities.

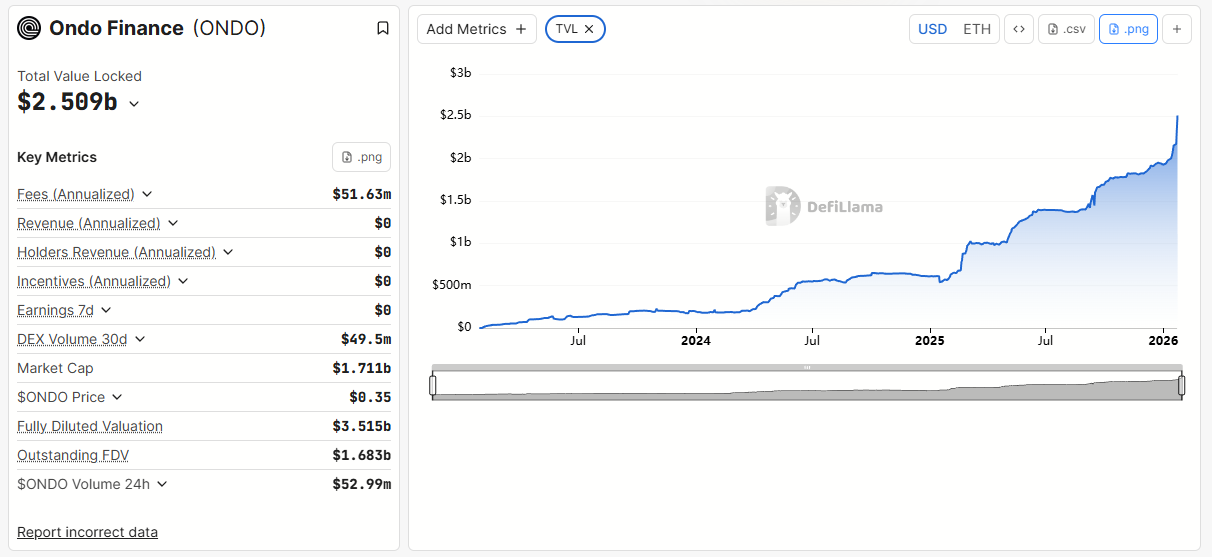

Besides to, Ondo’s TVL increased sharply in January. It reached an ATH above $2.5 billion, in step with DefiLlama data.

TVL represents the total value of resources that customers lock in a protocol. It reflects person participation and self assurance. The glory between falling market costs and rising capital inflows has led analysts to suspect that Ondo is undervalued. Sentiment and emotion in total drive market costs, causing retail investors to fail to see fundamentals.

“The unique fright within the markets is a blessing in disguise, in particular for projects like Ondo,” investor Kyren talked about.

This paradox becomes extra pronounced as tokenization emerged as a central theme at Davos 2026. Global leaders expressed optimism about asset tokenization. They described it as a bridge between ragged finance and DeFi.

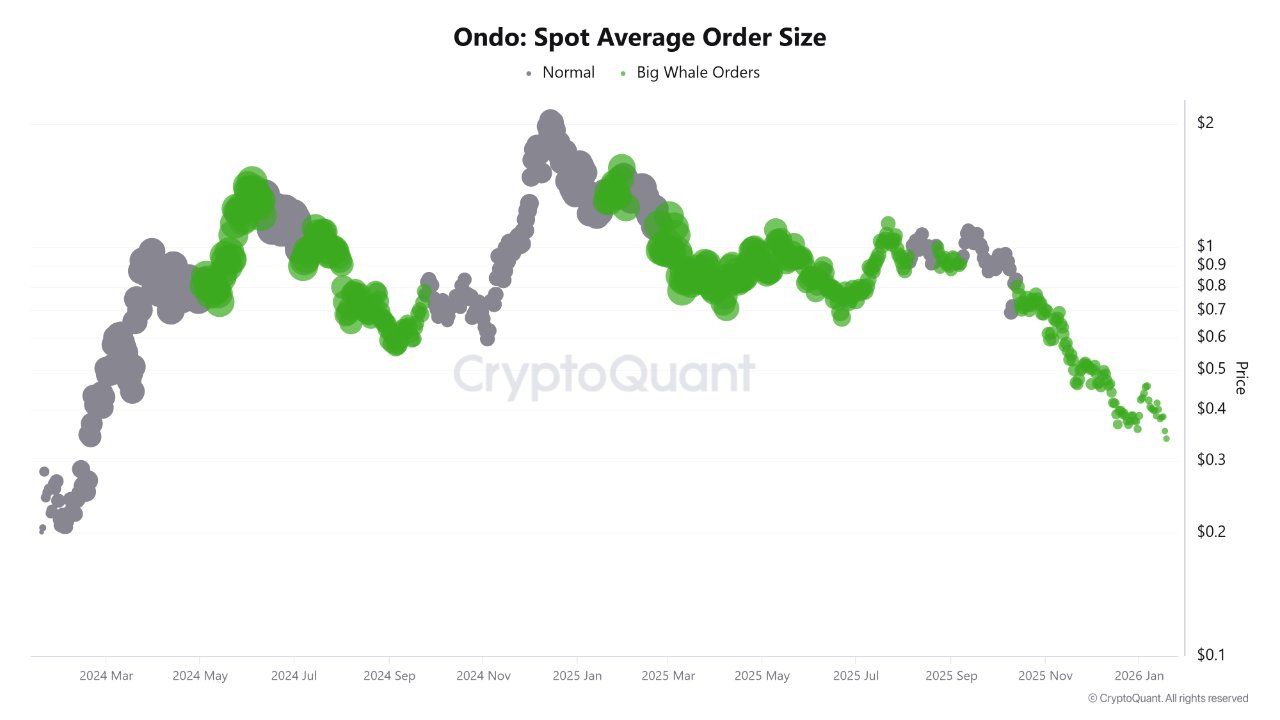

Commerce trading data additionally reveals that despite declining costs, many whale investors are treating the pullback as a risk.

CryptoQuant’s location moderate notify dimension data highlights the dominance of mountainous whale orders in most contemporary months, shown in inexperienced on the chart.

This sample suggests that ONDO would possibly maybe presumably face a gradual restoration once selling stress from release concerns fades and market fright subsides.

The put up Ondo (ONDO) Drops Over 80% Whereas TVL Hits a New All-Time Excessive looked first on BeInCrypto.