A brand novel Coinbase Institute yarn argues that the supreme divide in world finance is now no longer rich versus glum, but between those which possess yell catch admission to to capital markets and people that assemble no longer, which it describes because the “brokered” versus the “unbrokered.”

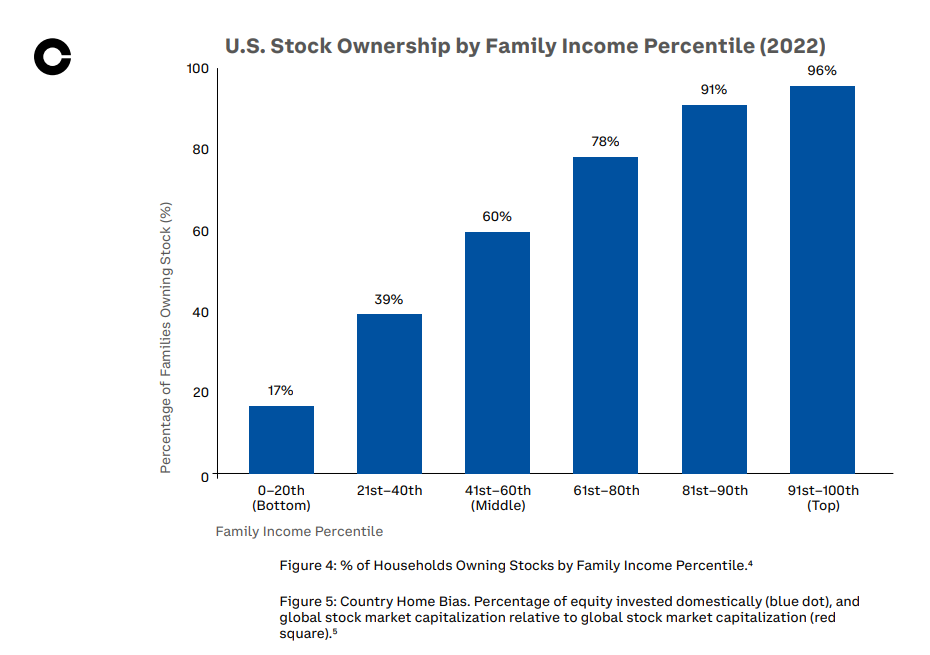

The yarn estimates that broken-down intermediated rails exclude roughly four billion unbrokered people from owning productive resources or raising capital at scale. Closing this hole, it argues, will require rebuilding core market infrastructure so smaller investors and issuers can participate straight away as antagonistic to via layers of intermediaries.

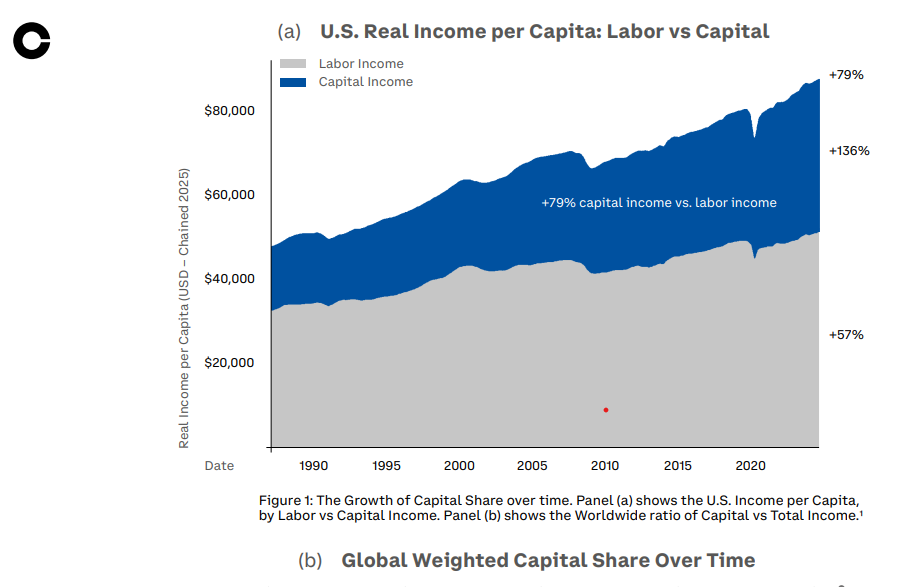

Primarily basically based on the yarn, over the final 40 years in america alone, capital income grew 136% whereas labor income lagged at glowing 57%.

The paper’s central voice is that catch admission to to capital markets, no longer glowing fundamental banking, has change into the particular gatekeeper of wealth introduction.

Primitive techniques rely on layers of brokers, custodians and clearing properties, making it uneconomical to aid smaller investors or issuers and leaving a “capital chasm” between the brokered minority and everybody else.

Linked: Bermuda companions with Coinbase and Circle for ‘completely onchain‘ economy

Meanwhile, possession of shares, bonds and funds clusters closely in developed economies, amongst already brokered households.

Why Coinbase needs permissionless rails

Coinbase’s argument is no longer glowing that tokenization matters, but that permissionless tokenization is foremost if the unbrokered are to revenue.

The yarn claims that permissioned consortia and closed challenge blockchain fashions are more likely to replicate current vitality dynamics, with about a gatekeepers deciding who can command, checklist or catch admission to tokenized resources.

By contrast, it likens an launch, permissionless architecture to cyber web protocols like TCP/IP, where somebody can contain on the a comparable rails and interoperability can’t be quietly revoked later.

Linked: Sygnum sees tokenization and divulge Bitcoin reserves taking off in 2026

Tokenization is already occurring

The yarn arrives as tokenization is already titillating from pitch decks into production across both crypto and broken-down finance.

Franklin Templeton’s tokenized US money market fund shares, issued on public blockchains, to illustrate, give investors onchain fund items that might well resolve sooner whereas finest internal current securities guidelines.

In banking, JPMorgan runs a dwell Tokenized Collateral Network on its Kinexys platform, utilizing blockchain‑basically basically based tokens representing resources like money market fund shares to fade collateral between institutional purchasers more efficiently whereas preserving the underlying resources on the bank’s balance sheet.

Meanwhile, the Original York Stock Replace unveiled a blueprint on Monday for a 24/7 shopping and selling venue for tokenized shares and exchange-traded funds (ETFs) with blockchain‑basically basically based post‑trade infrastructure and stablecoin settlement.

The unlock of the yarn coincides with the annual assembly of the World Financial Forum in Davos. Coinbase CEO Brian Armstrong said in a post on X that he deliberate to utilize conferences to discuss market structure legislation, tokenization, and what he described as financial freedom via updated financial techniques.

Magazine: TradFi is constructing Ethereum L2s to tokenize trillions in RWAs — Inner memoir