Memecoin merchants regarded as if it could well perhaps well be locking in income on Monday after a solid delivery to the year, in accordance to analysts, with memecoin trading volumes spiking while memecoin marketcap fell.

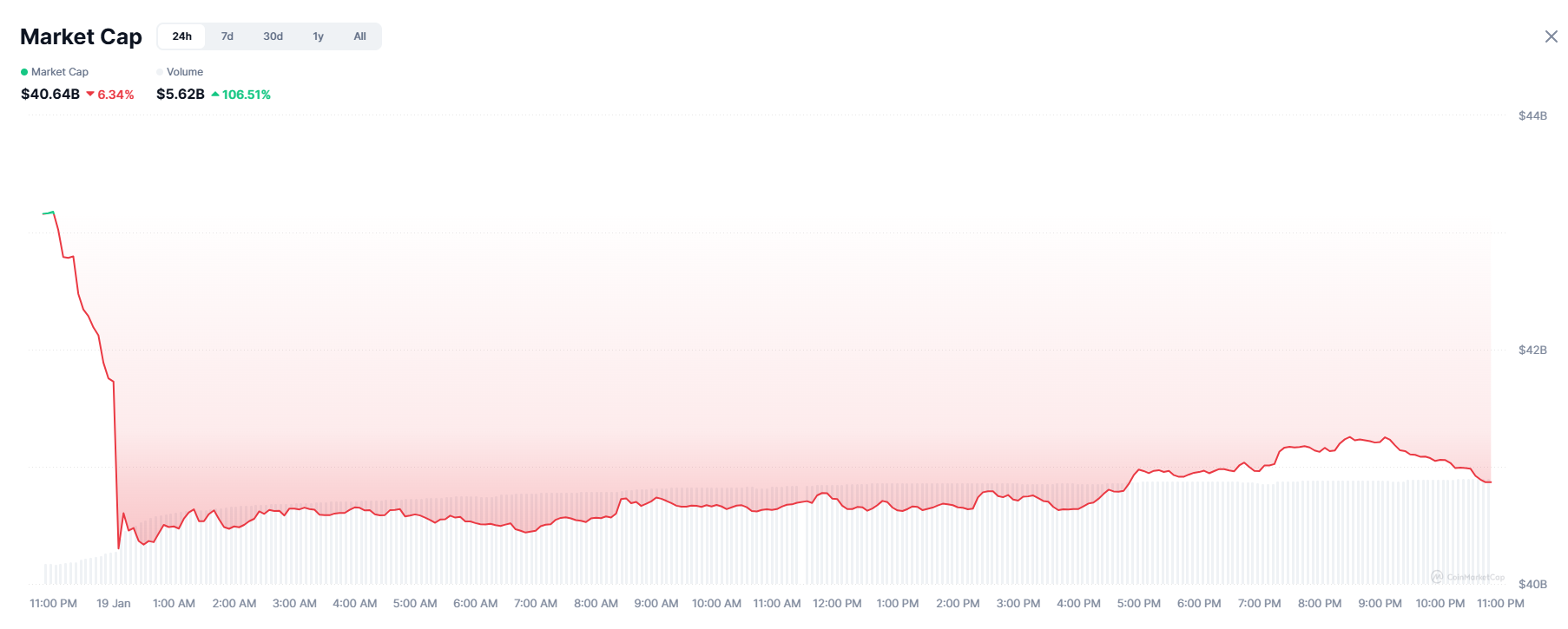

Memecoin trading quantity spiked to $5.62 billion on Monday, rising 106% from a day earlier, while memecoin market capitalization fell 6%, in accordance to crypto data platform CoinMarketCap.

The amount has since dropped succor appropriate down to $3.6 billion, down bigger than 24% for the day.

Vincent Liu, the manager investment officer at Kronos Examine, suggested Cointelegraph a surge in memecoin trading quantity alongside a falling market cap choices to heavy churn rather than unusual capital entering the market and generally reflects profit-taking, short-term flipping, and capital rotation.

“In skinny liquidity stipulations, elevated activity can unexcited push costs lower even as quantity spikes,” he said. “The preliminary surge and subsequent tumble in quantity imply speculative momentum has cooled.”

“Once profit-taking, liquidations, and rotation trades are absorbed, momentum merchants step succor, spreads widen, and participation thins. Volume generally spikes in transient around catalysts before snappy normalizing.”

The year started with a bang for memecoins

Memecoins noticed a solid delivery to the year as their market capitalization surged from $38 billion on Dec. 29 to $47.7 billion by Jan. 5, before cooling in the next days.

Kadan Stadelmann, the manager expertise officer of the blockchain-powered Komodo Platform, suggested Cointelegraph that gains in the sphere are generally the results of hypothesis and are seemingly candidates for reversion rather than preserving steady.

“The total fundamentals of the memecoin market are sad and pushed by hypothesis. This leads to constant capital rotations between memecoins, inflicting designate downturns in definite money and appreciation in others,” he said.

Connected: PEPE, BONK post double-digit gains: Are memecoins succor?

Crypto market turbulence decimated memecoins in particular closing year, driving the decision of crypto project screw ups to over 11.6 million in 2025, the ideally suited stage recorded for a single year, in accordance to a epic by CoinGecko review analyst Shaun Paul Lee.

Memecoins will rely on Bitcoin in 2026

There’s also been a most modern uptick in social media chatter around memecoins, in accordance to market intelligence platform Santiment.

Discussions have centered largely on frustration about repeated rug pulls, though merchants remain drawn to the tokens for like a flash gains, said Santiment.

Memecoins are amongst the riskiest bets in crypto, and their success or failure generally is a temperature confirm on how remarkable risk investors are willing to elevate.

Stadelmann predicts Bitcoin (BTC) will play a mammoth position in the memecoin sector this year and its performance could well support or hinder the market.

“Memecoins’ market performance in 2026 will as long-established rely on Bitcoin, which underperformed gold in 2025. The identical could well happen in 2026, which could well perhaps be bearish for memecoins,” he said.

Magazine: Memecoin degeneracy is funding groundbreaking anti-rising old review