Most fascinating days after BitMine’s (BMNR) annual shareholder meeting in Las Vegas, controversy has erupted, exposing a bright divide between management and merchants.

It centers round governance, transparency, and the corporate’s courageous shift from a pure Ethereum staking vehicle to a “digital Berkshire-model” capital allocator.

BitMine Exec Addresses Shareholder Considerations After Controversial AGM

Shareholders criticized the meeting for absent executives, rushed presentations, and unclear vote outcomes.

Both the novel CEO and CFO failed to lend a hand, whereas the promised excessive-profile visitor audio system didn’t seem. Based fully on this, merchants record the gathering as poorly managed and disrespectful, with some likening it to a “clown show.”

Respectfully?

You and the board must conclude and take a onerous watch at what honest appropriate took spot and be supreme in regards to the elephant within the room. There are justifiable causes why shareholders are very upset. Disrespect being regarded as one of them.

That shareholder meeting didn’t meet the most… https://t.co/uhLWwTEXvx

— Christopher O’Malley (@chris_t_omalley) January 18, 2026

Considerations include been heightened by Tom Lee’s simultaneous management of Fundstrat, elevating questions on whether he might well dedicate ample consideration to BitMine.

Rob Sechan, a board member, acknowledged shareholder frustration however emphasized that the meeting occurred right thru a transitional length. Reportedly, several executive positions include been filled perfect days prior.

He defended the board’s oversight, noting that the AGM’s goal turned into once to observe the corporate’s “DAT-plus” plan and illustrate its long-term doable.

I hear the frustration on this, and I are seeking to acknowledge it straight.

This AGM took spot right thru a length of true transition. The executive crew at @BitMNR is largely impress novel, with several positions being filled within days of the meeting. This turned into once the first annual meeting…

— Rob Sechan (@RobSechan) January 18, 2026

Critics, however, argued that the board’s response failed to take care of traditional disorders of planning, transparency, and accountability.

Strategic Shift: From Staking to Digital Capital Allocation As MrBeast Deal Divides Patrons

Despite the governance criticism, management highlighted a principal strategic pivot. BitMine is tantalizing previous ETH staking to develop into a digital maintaining company, deploying its capital into initiatives that develop Ethereum adoption.

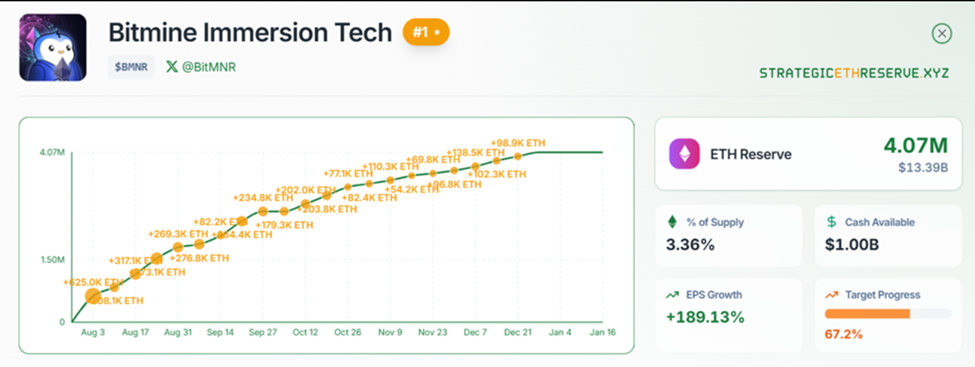

The corporate holds over 4 million ETH (roughly $14 billion) and generates $400–$430 million yearly from staking, with projections rising to $540–$580 million as it targets 5% of Ethereum’s total provide.

Sechan likened the technique to Berkshire Hathaway, describing it as disciplined capital allocation, adapted for the digital age.

“A capital imperfect plus disciplined deployment into productive companies is strictly what $BRK does. Identical thought, varied period and rails,” he wrote, countering critics who pushed aside the pass as overambitious.

Essentially the most contentious hiss turned into once BitMine’s $200 million commitment to MrBeast’s Beast Industries. The investment is designed to integrate Ethereum into the creator economy thru tokenized platforms and distribution networks.

Supporters argue the deal leverages regarded as one of the most perfect global consideration engines to hobble up adoption amongst Gen Z and Alpha audiences.

Critics, however, search for the partnership as a distraction from governance and operational priorities, questioning whether the corporate is overextending itself.

Taken together, the meeting exposed a stark pressure between ambition and accountability. Whereas BitMine’s strategic imaginative and prescient promises long-term hiss, stakeholders live wary of execution dangers and management gaps.

Sechan pledged improvements in transparency and engagement, with future meetings expected to be extra structured and interactive.

As BitMine seeks to steadiness governance, investor belief, and courageous innovation, the corporate faces a principal test. It must show that its “digital Berkshire” mannequin can lift each and each on ETH returns and its broader imaginative and prescient without alienating shareholders.

The post BitMine Leadership Honest Answered After Contentious Shareholder Assembly looked first on BeInCrypto.